You are both wrong about Bitcoin; Lessons from the FTX collapse

duo eye

Summary of the assignment

Following the demise of FTX (FTT-USD), both Bitcoin (BTC-USD) naysayers and maximalists have come out of the woodwork to attack/defend Bitcoin.

On the one hand, some see the FTX collapse as proof that Bitcoin, and the broader crypto market, have become nothing but a gigantic Ponzi scheme. That despite all its advanced technology, Bitcoin is just a speculative investment

On the other hand, there are those who see further evidence of the need for Bitcoin after the FTX decline. After all, FTX was a centralized exchange, and Bitcoin aims to be a tool for decentralization.

In a sense, both camps are right, and both are wrong.

How centralized is Bitcoin?

One of the first words often used to describe Bitcoin is decentralization. The biggest draw of Bitcoin is that it is not controlled by anyone. Supply is determined by immutable code, and it is purposefully designed to make ownership available to anyone around the world with an internet connection.

But while Bitcoin is theoretically decentralized, in practice much power is concentrated in a few entities and small areas.

Let’s look at the key players in the Bitcoin ecosystem; miners, node providers and owners.

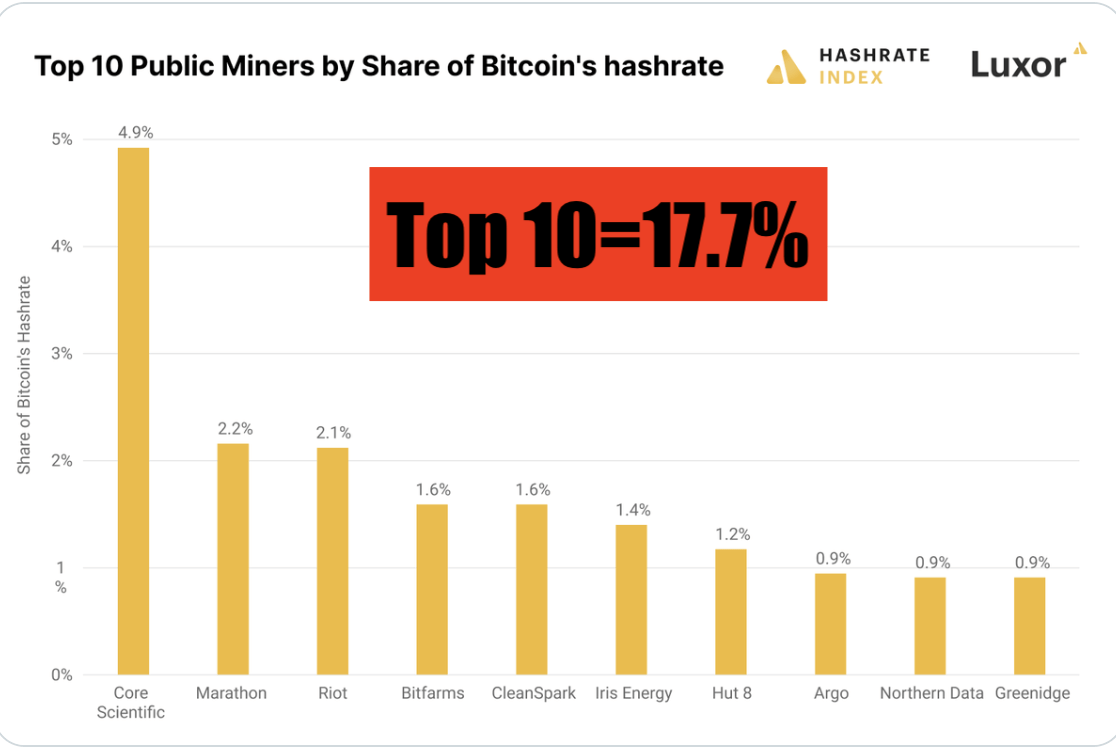

Hash rate (Author’s elaboration based on Luxor INdex)

Now, as we can see in the chart above, one could argue that mining is currently a very centralized market. The 10 listed crypto miners control 17.7% of the total Bitcoin hash rate.

We can see that there is also a strong geographical concentration in the diagram below:

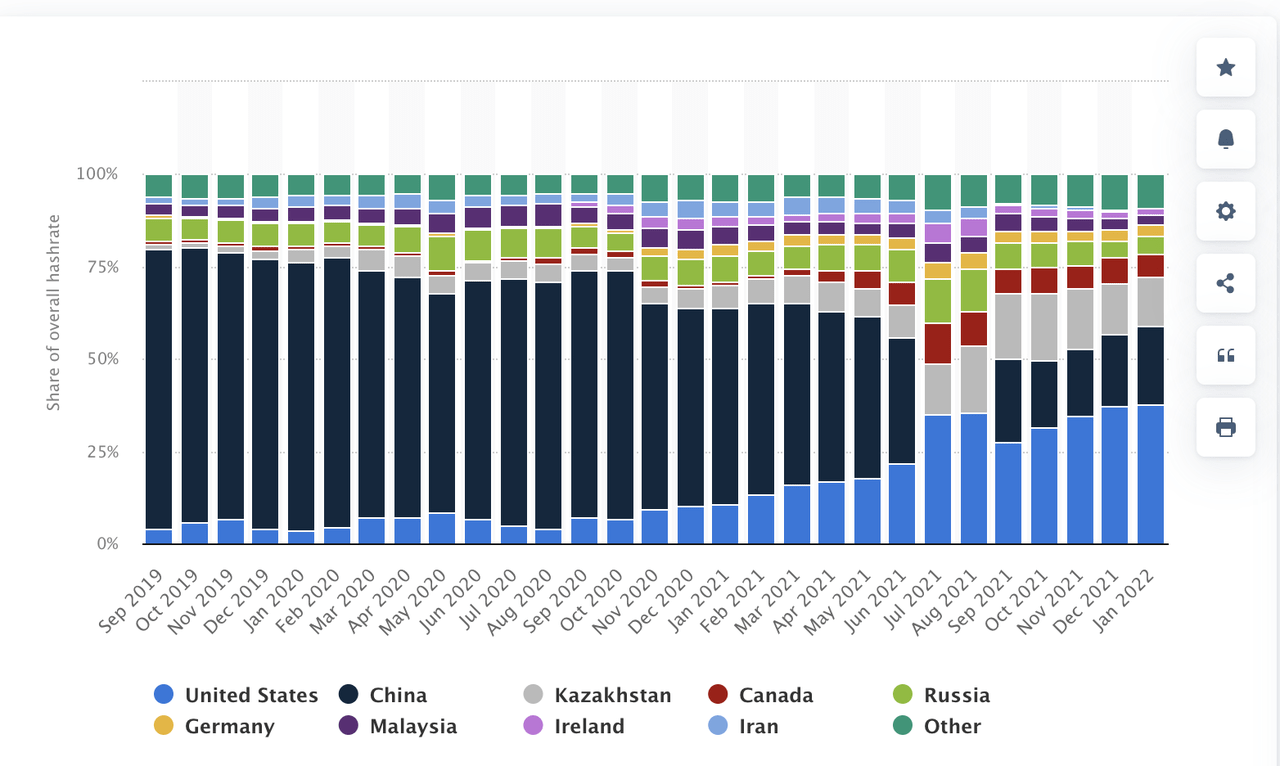

Hashrate by country (Statistics)

Here we have the Bitcoin hash rate by country, and we can see that over half of the hash rate is controlled by China and the United States combined.

Now let’s move on to Node deployment:

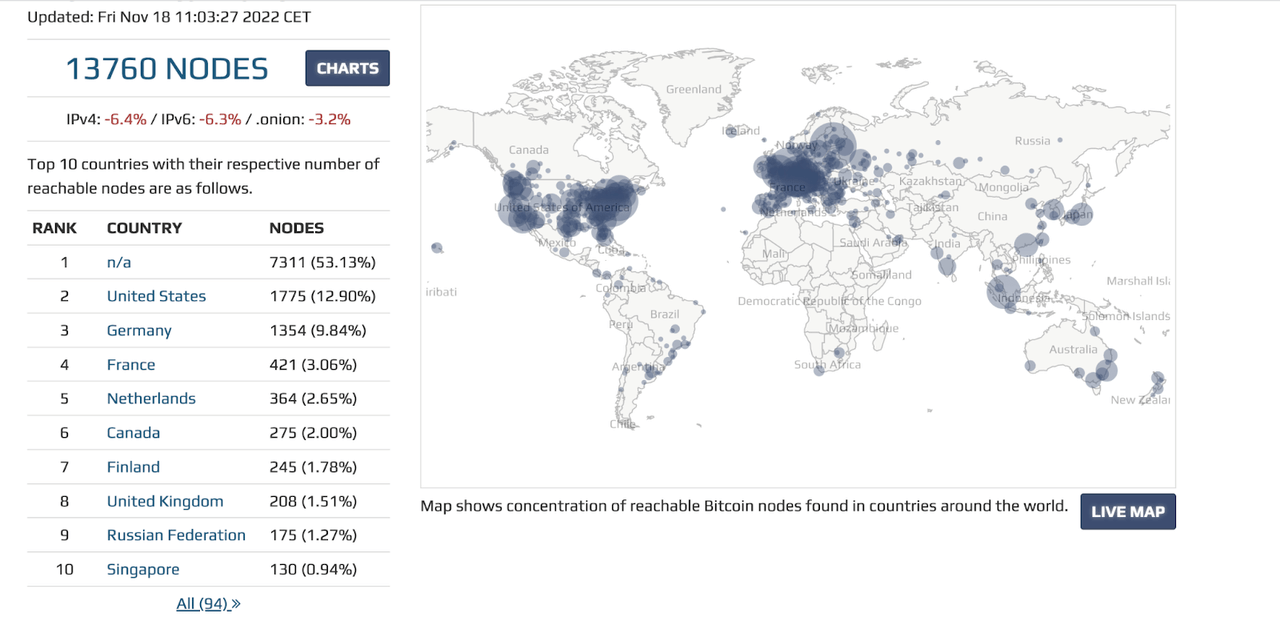

Bitcoin nodes (Bit Nodes)

Once again, we see that nodes, which are responsible for updating the Bitcoin blockchain, are mostly concentrated in the US and Europe. The chart also shows 53% of the nodes in an undetermined location, but I think it’s safe to assume that many may come from China.

Finally, we need to consider Bitcoin ownership. On-chain data can be very useful in determining how Bitcoin is distributed among holders, but it has some problems. The problem is that a single address does not correspond to a single person, and one person can have several addresses. Also, the opposite can be true, and multiple people’s funds can be stored in a single address (as is the case with exchanges).

A Bloomberg report stated that 95% of Bitcoin was controlled by only 2% of addresses. However, this was disputed by Glassnode, who provided a much more thorough analysis of Bitcoin ownership, finding that at most the top 2% of network entities control 71.5% of the supply.

Ultimately, we have seen an increase in Bitcoin concentration, which can be attributed to increased participation from institutions and large investors.

So, is Bitcoin actually decentralized? It depends on what the meaning of this word is. In practical terms, much of the Bitcoin ecosystem is dominated by a handful of people/companies, but that doesn’t mean Bitcoin is centralized. The cryptocurrency still has very low barriers to entry for those who want to mine or operate a node, and using pools is an option.

The main issue here is also that Bitcoin does not depend on centralization for its success, but rather the centralization can be seen as proof of its success. Bitcoin does not require large concentrations of wealth or effort to mine or transact, although that is the case now. This means that Bitcoin is still “anti-fragile”, as it will not be subject to the collapse of an exchange like FTX, or even a mining ban like the one China passed.

Bitcoin Tools

Now, with the demise of FTX and its token FTT, and the general weakness in crypto, extreme bears are once again coming out of the woodwork and predicting a total collapse. This is also very far from the truth. While I do indeed see lower Bitcoin prices in the near term, there is no doubt in my mind that we will retrace our all-time highs eventually.

Those without proper knowledge of Bitcoin fail to understand that Bitcoin is very different from the thousands of tokens that have been launched in the last 10 years. FTT was purposefully built to support the FTX ecosystem, so it’s not surprising that both collapsed together. In many ways, FTT tokens are just like FTX equity.

But this is not the case with Bitcoin. This cryptocurrency has no company behind it, nor does it have a famous creator behind it. It was designed to work for all intents and purposes like gold, and it is in many ways superior to gold. Bitcoin has a real use as a store of value, and this is proven by the fact that tiny nations like Nigeria are among the most crypto-curious in the world. For these people, Bitcoin actually offers utility as a store of value and a vehicle for transferring wealth. This concept may seem foreign to us now, but the dollar is also subject to the same risks as any other fiat currency.

Now, that’s not to say that most Bitcoin ownership today isn’t speculative. This is undeniable and it is supported by the charts posted above. Most people who hold Bitcoin today do so in hopes of increasing their wealth in dollars. But as with the centralization argument, one does not negate the other.

The fact that Bitcoin is being bought up by speculators does not take away from the fact that it has the necessary characteristics to be accepted as a means of payment worldwide. It does not take away from the fact that Bitcoin can replace and improve our current financial system. And it does not take away from the fact that in an increasingly divided world there is a need for a neutral form of money to arise.

Final thoughts

In conclusion, we must learn to distinguish between what Bitcoin is, or what it is perceived to be, and what Bitcoin can be. Bitcoin is a speculative investment, and its price will fluctuate wildly in the coming years. Fortunes will be made, and fortunes will be lost. The crypto space will see continued innovation, but also more cases of fraud and collapse. The path to growth is not a straight line.

But ultimately, time will show that Bitcoin has a very important role to play in our financial and monetary system.