Wrapped Bitcoin Locked on MakerDAO Drops to 2022 Low After Nexo Extracts Huge Amount of WBTC: Santiment

Blockchain research firm Santiment says crypto lender Nexo has pulled a large chunk of Wrapped Bitcoin (WBTC) from decentralized finance (DeFi) platform MakerDAO following the firm’s legal troubles with several government regulators.

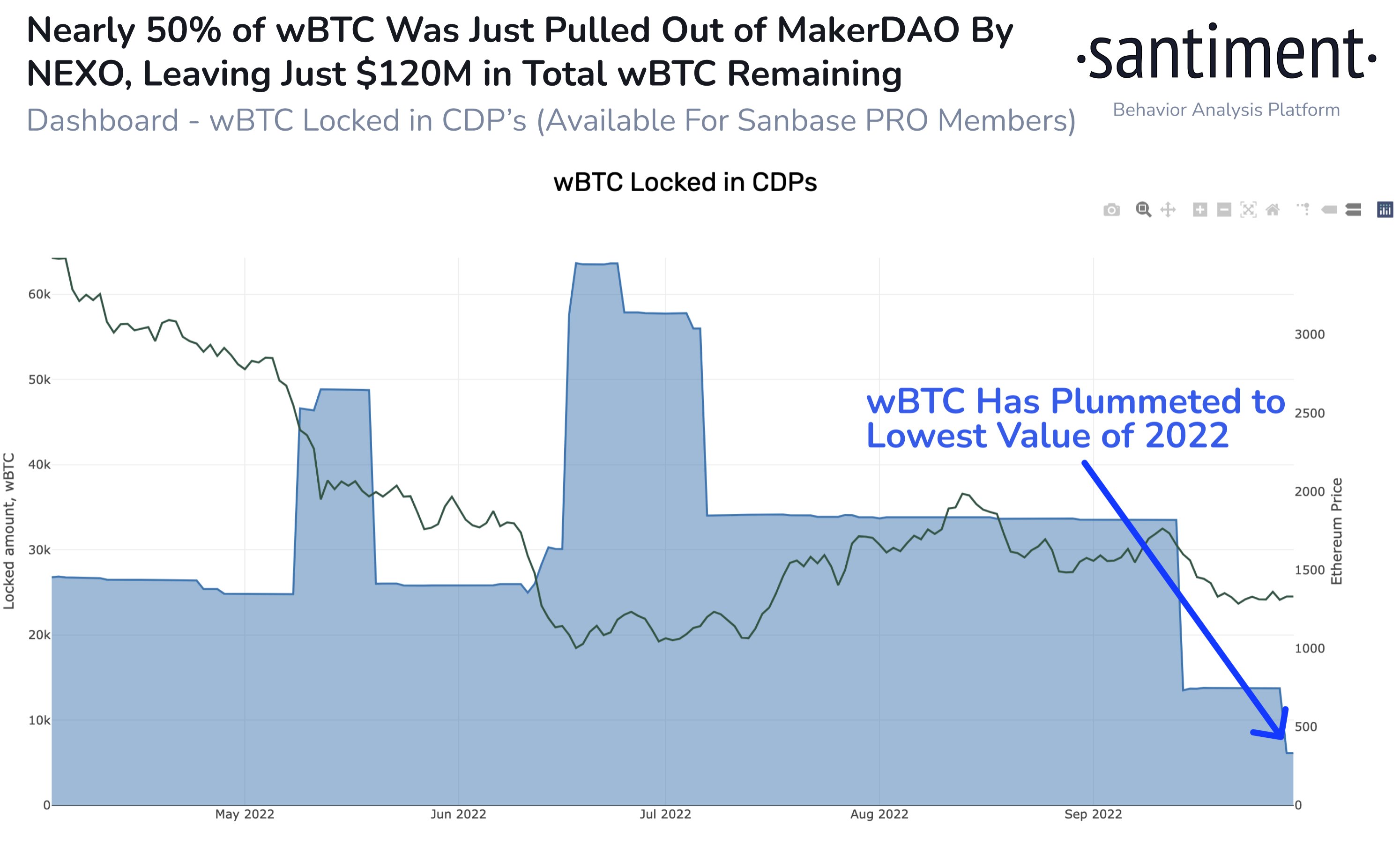

Santiment says that Nexo’s big withdrawal from MakerDAO has taken almost half of all WBTC from the platform, and that more “big moves” are likely to come.

WBTC is an ERC-20 token pegged to the price of Bitcoin (BTC) that allows users to participate in DeFi activities with a Bitcoin-based asset on Ethereum (ETH).

“Nexo has made a big move, and likely plans to earn more after withdrawing almost 50% of WBTC held in MakerDao. This has left $120 million in WBTC to remain locked in CDPs (collateralized debt position). We will monitor for signs of what Nexo plans to do with their free assets.”

Last week, state regulators in California, New York, Washington, Kentucky, Vermont, South Carolina, Maryland and Oklahoma made allegations that Nexo violated securities laws with its Earn Interest Product (EIP).

Nexo said it had been working with regulators on the issue and that it no longer accommodates US accounts and balances for EIPs since the US Securities and Exchange Commission (SEC) ruled on crypto lending platforms’ interest-bearing accounts.

“We have worked with US federal and state regulators and understand their urge, given the current market turmoil and bankruptcies of companies offering similar products, to fulfill their investor protection mandates by investigating the past conduct of providers of accrual products.”

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/artshock