With FedNow, the US will monitor all your financial transactions

Bitcoin’s potential role in a world where central banks aim to control financial transactions through CBDC, or alternatives such as the US payment system FedNow.

The US central bank is launching its digital payment system, FedNow, in July. Described by Richmond Fed President Tom Barkin as “resilient, adaptable and accessible”, the system aims to facilitate faster, cheaper bill payments, money transfers and other consumer activities.

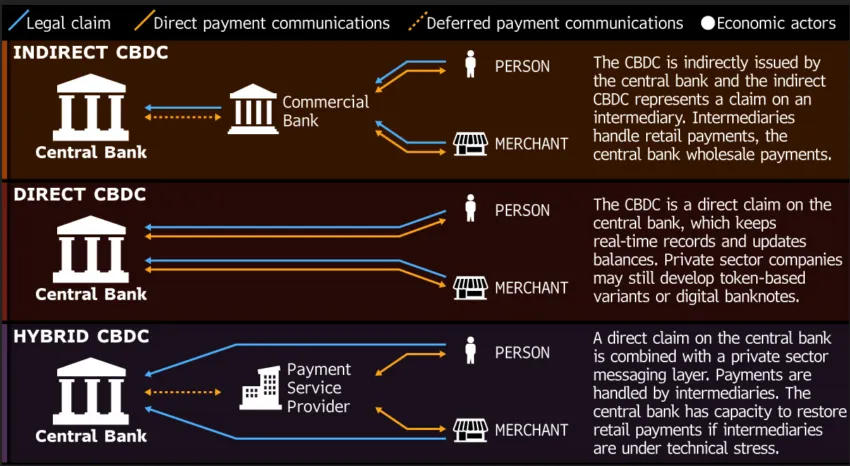

But as central banks globally pursue Central Bank Digital Currency (CBDC), concerns are arising about the potential consequences for financial freedom and privacy.

The United States must monitor all private financial affairs

FedNow’s introduction of a CBDC could potentially pave the way for increased government surveillance of private financial affairs.

According to Robert Francis Kennedy Jr., with transactional anonymity gone, central banks would have the power to enforce dollar limits on transactions and limit where and when money can be spent. A CBDC tied to digital ID and social credit scores could be even more dangerous.

Kennedy maintains that such a system could enable governments to freeze assets. They may even limit spending on approved providers for those who do not comply with specific mandates, such as vaccine requirements.

Although initially limited to interbank transactions, the launch of CBDCs is raising concerns. These relate to the potential for governments to ban or seize decentralized currencies such as Bitcoin, as was the case with gold in 1933.

Governments seem to attempt to capitalize on crises such as banking instability. For this reason, they are promoting CBDCs as safe alternatives to paper currencies and a means of protection against bank runs.

Bitcoin is the solution to preserving privacy

In light of these concerns, Bitcoin’s decentralized nature and censorship resistance are becoming increasingly important.

As a decentralized currency, Bitcoin offers an alternative to CBDCs that can empower individuals and protect their financial privacy.

- Financial sovereignty: Bitcoin allows users to maintain control over their money without relying on third parties. This independence can empower individuals to manage their finances without interference or censorship from government or financial institutions.

- Privacy: While CBDCs can enable authorities to track and scrutinize individual transactions, Bitcoin transactions are pseudonymous. Although not completely anonymous, Bitcoin provides a higher degree of privacy than traditional banking systems. It allows users to protect their financial data from unauthorized monitoring.

- Unlimited transactions: Bitcoin enables seamless cross-border transactions without the need for intermediaries or the limitations of exchange rates. This feature can facilitate international trade, remittances and global investment opportunities, promoting greater financial inclusion and economic growth.

- Resistance to inflation: Bitcoin’s fixed supply of 21 million BTC and predictable issuance rate can protect users from inflationary pressures. In contrast, CBDCs, as an extension of fiat currencies, will remain subject to central banks’ monetary policy. These include inflationary measures such as quantitative easing.

- Safety and resilience: The decentralized nature of Bitcoin’s underlying technology ensures the network’s security and resilience against cyber-attacks and system failures. This contrasts with centralized systems such as CBDCs, which can be more vulnerable to hacks or technical issues.

By bypassing centralized control and surveillance, Bitcoin can play a central role in preserving economic freedom and autonomy in a future dominated by CBDCs.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.