Will Uniswap and Optimism’s massive crypto rally continue? Santiment Analyzes Top Ethereum Altcoins

The analysis platform Santiment looks at two cryptoassets that register three-digit percentage increases over a relatively short period of time.

Starting with decentralized finance (DeFi) platform UniSwap (UNI), Santiment says the crypto asset has appreciated by over 150% over a period of almost two months.

“Uniswap has been on a tear for the past seven weeks, disconnecting from the rest of the altcoin pack on several occasions, jumping +153% since June 18.”

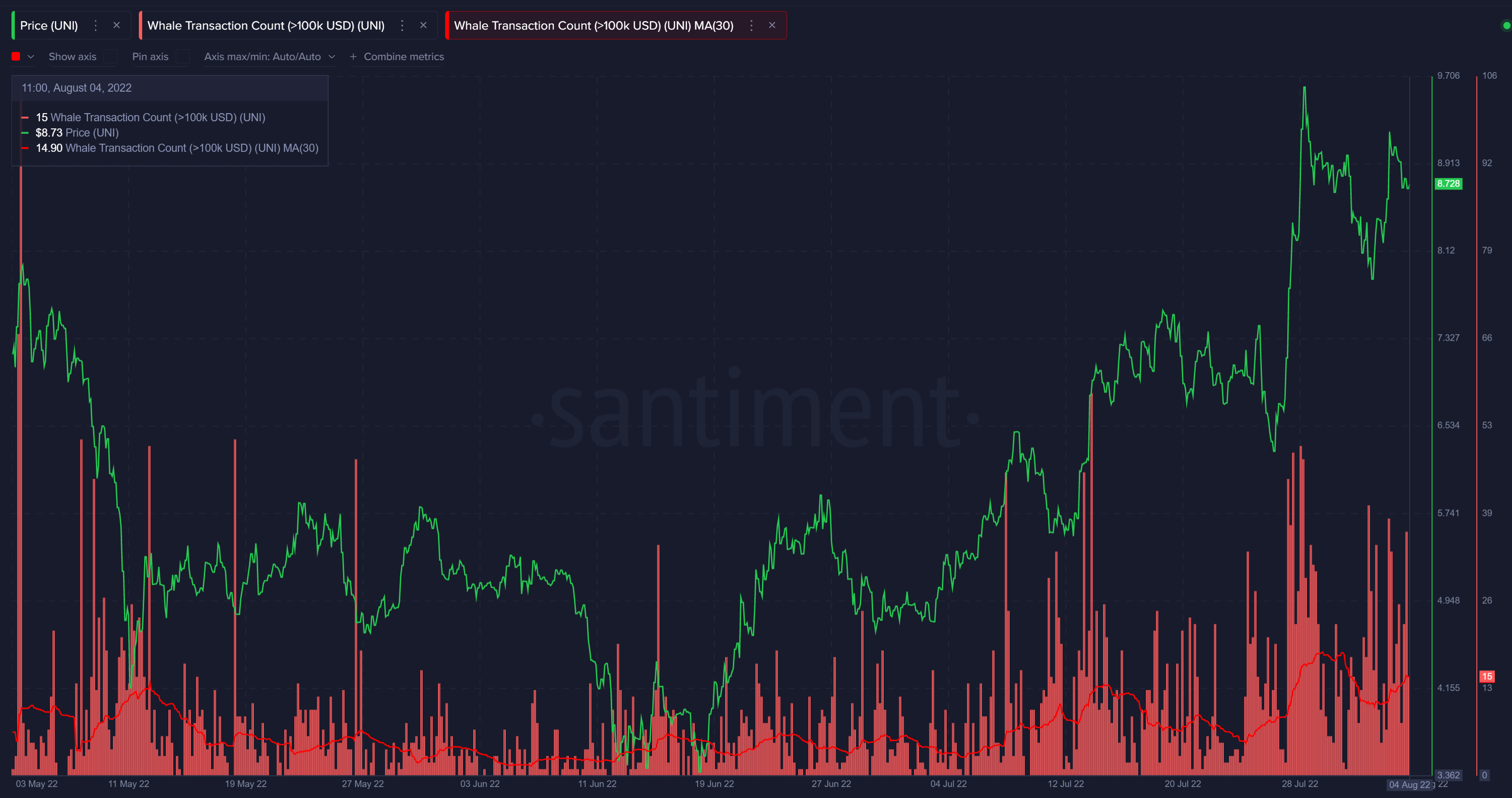

According to Santiment, the daily address activity of Uniswap has increased and large owners of cryptoassets also continue to accumulate.

“It’s also great to see that shark and whale addresses have accumulated heavier and heavier percentages of Uniswap’s total supply since May. 100k to 1m UNI addresses in particular saw a massive accumulation spike just two weeks ago. And continued price increases soon followed.”

And speaking of whales, the volume of large transactions (which we consider transactions valued at $100,000 or more) is increasing back to May levels as well. We can clearly see the big lump of big whale trades that started to form a week ago, just before the big price rally up to $9.69.”

Uniswap is trading at $8.96 at the time of writing.

The crypto analytics firm says that while those who bought Uniswap 30 days ago have double-digit profits, those who bought the crypto-asset a year ago are still at a loss.

Consequently, Santiment says that Uniswap may fall in price in the short term, but it remains undervalued in the long term.

“We can see that the 30-day market to realized value (MVRV) is currently up at +22.5%, which is well above the backtested ‘danger zone’ of +15% or more. But even with medium-term trading returns beginning to spill over, the good news is that long-term traders (in the 365-day MVRV) are still well under water, meaning that there could be a downside coming in the next week or two for UNI, but the future still looks bright to be undervalued in the long term.”

MVRV is the ratio between the current price and the average acquisition price for the asset in question. An increase in the MVRV value indicates an increase in potential profit.

Santiment then looks at Ethereum (ETH) scaling solution Optimism (OP). According to the research firm, Optimism has undergone a “classic dump and pump” move as it rallied just over 300% from a July low of $0.45 to a high of $2 in August.

Optimism is trading at $1.93 at the time of writing.

The research firm says that Optimism could undergo a correction of over 30% to a price just above $1,297 in the short term based on the Elliot Wave theory.

“Expect a correction to around the bottom of wave four soon, but no more, as five waves tend to continue after that.”

The Elliott Wave theory states that the long-term price trend of an asset moves in a five-wave pattern while corrections move in a three-wave pattern.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/Ekaterina Glazkova