Will the October 21 option expiration be a non-event?

The crypto market has been devoid of volatility lately. Over the past fortnight, the price of Bitcoin has mostly hovered around $19k. After recording a gain of just 0.4% on the daily, the largest crypto was trading at $19212.9 at press time.

Bitcoin’s upcoming options expire

In a day’s time, approximately $538 million worth of Bitcoin is set to expire. At the moment, most traders are bearish, as the puts are overshadowing the calls.

Call OI Thursday for the October 21 expiration was 12,272.4 BTC at press time. Put OI, on the other hand, stood at 15,728.8 BTC. As a result, the call/put ratio was below 1, at 0.78.

As illustrated below, most bearish bets have been placed at the strike price of 19k and below, while call bets have been placed to the upside.

For context, at $19k, the call OI stood at just 678.49 BTC, while the put OI stood at 2.11k BTC. Conversely, at $19.5k, call OI was at an elevated 1.49k BTC compared to put OI at 561.19 BTC.

What to expect?

Bitcoin has traded below all of its crucial daily averages since the beginning of this month. As analyzed in a recent article, large, small and medium-sized participants continue to increase HODLings. Nevertheless, the price remains inert.

Indicators such as the RSI also had neutral readings at press time, which showed the weak demand. So if no buying action takes place overnight, the price can be expected to remain stagnant at around $19k.

So at the time of expiry on Friday [8:00 AM UTC], if Bitcoin trades below $19k, it would be quite difficult for put traders to resist using the opportunity to sell their respective coins. If that happens, bear traders will be in the driver’s seat.

In such an event, the price of the asset could drop to $18.5k in the short term.

However, on the upside, the road to $21k looks to be challenging – given the hurdles midway and the current state of the market.

Odds of a non-event

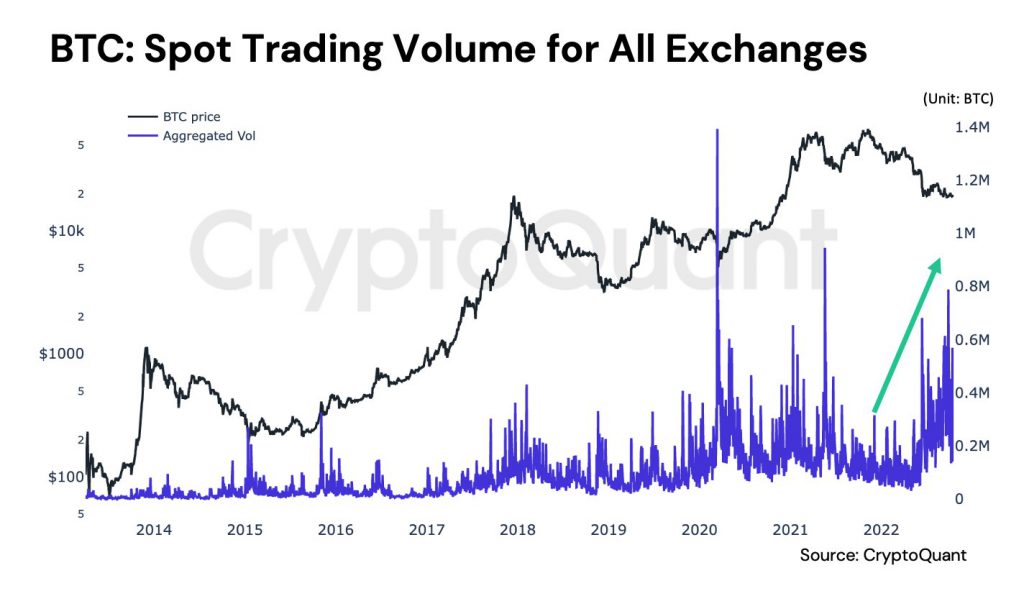

At this stage, it’s worth noting that Bitcoin’s spot market dominance has been on a slant lately. A recent tweet from CryptoQuant CEO Ki Young Ju highlighted that BTC spot trading volume for all exchanges has increased 20x over the past six months.

Options OI, on the other hand, has not seen any major rise, and perhaps tomorrow’s expiration will also act as a non-event. As in, we can’t essentially notice any massive rise/fall at the time of expiration – just like the last few times.

Read more: Bitcoin creates new ATH, but it is not price related