Will the FOMC meeting minutes affect BTC and ETH this week?

Bitcoin (BTC) and Ethereum (ETH), the two largest cryptocurrencies in the world, continue to hold above $24,000 and $1,600 respectively. However, they experienced a slight decline this morning, with Bitcoin falling from $25,000 to $24,000.

As the crypto market continues to fluctuate, investors are keeping a close eye on the upcoming Federal Open Market Committee (FOMC) meeting minutes, which are set to be released this week.

The recent downward trend in cryptocurrency prices may be linked to positive economic data coming out of the United States. This has strengthened the belief that the Federal Reserve will continue with its plan to tighten monetary policy for a longer period than previously expected.

Additionally, traders appear wary of making large investments ahead of the release of Coinbase’s results and Hong Kong’s new VASP licensing scheme, both of which are expected to have a significant impact on the market in the coming weeks.

How could the release of FOMC meeting minutes on Wednesday affect crypto prices?

The release of the minutes of the Federal Open Market Committee (FOMC) on Wednesday could have an impact on the price of Bitcoin. As the FOMC sets monetary policy in the United States, any hint of a shift in that policy could affect financial markets, including the cryptocurrency market.

In a recent speech at the Economic Club of Washington, Federal Reserve Chairman Jerome Powell discussed the ongoing disinflation process and expressed confidence in the Fed’s ability to lower inflation to its 2% target rate.

While Powell’s response to the strong January jobs report did not indicate a change in the central bank’s approach to future rate hikes, he warned that continued strong jobs data could lead to a higher terminal level in Fed funds.

At its February 2023 meeting, the Federal Reserve raised the target range for the Fed Funds rate by 25 basis points, now from 4.5% to 4.75%. This is the second meeting in a row where the size of the increase has been reduced, even though borrowing costs are now at their highest since 2007.

Bitcoin traders and investors will be watching the FOMC minutes closely for any indication of inflation concerns or changes in interest rates, which could potentially affect the price of Bitcoin.

Explore mild falls in the cryptocurrency market

The global cryptocurrency market has performed well in recent days, but experienced a slight decline in the last 24-hour period. At the time of writing, the market’s total value was $1.11 trillion, representing a fall in value of 0.68 percent.

The market’s inactivity may be related to the US celebrating President’s Day, which may cause traders to be cautious about placing significant bids. As a result, Bitcoin has also seen a slight drop in value compared to the previous day.

Meanwhile, Ether has also experienced a decline over the past 24 hours, probably for the same reason. As a result, other well-known cryptocurrencies such as Dogecoin (DOGE), Litecoin (LTC) and Ripple (XRP) have also suffered small losses.

Can a Strong US Dollar Undermine Cryptocurrency? Analyze the relationship between USD and digital assets

The US dollar has seen significant gains and is showing strength across the board, driven by positive US economic data that has pushed back predictions of an extended period of monetary policy tightening by the Federal Reserve.

The market expects interest rates to rise due to recent statistics coming out of the world’s largest economy, which indicate a tight labor market, persistent inflation, robust retail sales growth and increased monthly producer prices.

Market forecasts indicate that the Fed Funds rate is expected to peak at just below 5.3% by July. The US dollar has been strengthened by the hawkish views of Fed members, who believe that higher interest rates will be necessary to successfully fight inflation.

Therefore, the strong US dollar has been considered a major factor contributing to the decline in cryptocurrency values, including Bitcoin (BTC) and Ethereum (ETH).

Bitcoin price

Looking at Bitcoin from a technical point of view, it has been trading sideways, maintaining a narrow range between $23,700 and $25,200. The immediate resistance level for the BTC/USD pair is currently at $25,200, and if the price breaks out above this level, the it potentially reaching the $26,000 mark.

However, the leading technical indicators, including RSI and MACD, are showing divergence. The RSI is currently above 50 in a buy zone, while the MACD forms histograms below 0 in a sell zone. This type of divergence often indicates indecision among investors.

If Bitcoin’s price falls below the current support level of $23,750, the next support level will be at $22,850, which is determined by the 50% Fibonacci retracement mark.

In the coming week, the focus will be on the FOMC meeting minutes, which are scheduled to be released on Wednesday. These minutes could potentially affect the price action of Bitcoin.

Buy BTC now

Ethereum price

The ETH/USD pair has seen an increase in bullish momentum after finding support near the $1,650 level. On the 2-hour time frame, Ethereum has formed a symmetrical triangle pattern, which suggests indecision in the market and has kept the price of ETH within a choppy range.

If Ethereum experiences a bullish bounce-off above the $1,650 level, it could potentially reach the $1,720 mark. Additionally, a bullish breakout above the $1,720 level and the symmetrical triangle pattern could drive further bullish price action. In both scenarios, the price levels of $1,760 and $1,800 are likely to act as resistance levels.

On the downside, Ethereum has support levels around $1,650 or $1,625. RSI and MACD show divergence, which can be compared to the analysis of Bitcoin’s price.

This indicates that investors may wait for an important news event, such as the release of the FOMC meeting minutes, to determine the next market trends.

Buy ETH now

Bitcoin and Ethereum alternatives

In addition to Bitcoin (BTC) and Ethereum (ETH), there are several other altcoins in the cryptocurrency market that show significant potential. The CryptoNews Industry Talk team has conducted an analysis and created a list of the top 15 cryptocurrencies to watch in 2023.

This list is regularly updated with new altcoins and ICO projects, so it is recommended to check back often for the latest additions.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

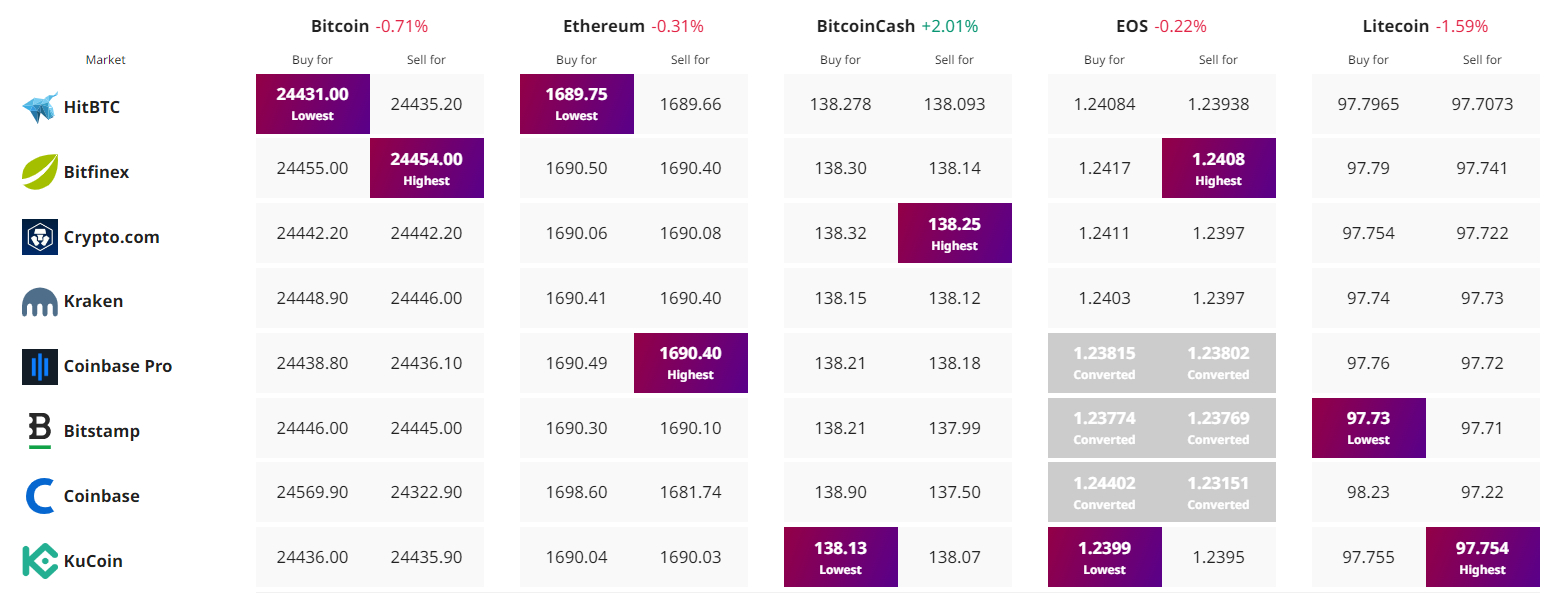

Find the best price to buy/sell cryptocurrency