Will Ethereum be vulnerable to censorship after the merger?

Important takeaways

- The Ethereum community is debating whether major validators could end up being forced to censor transactions after the merger.

- Ethereum creator Vitalik Buterin believes transaction censorship will constitute an attack against the network.

- Some Ethereum projects have already started blacklisting sanctioned addresses.

Share this article

With the upgrade to Proof-of-Stake fast approaching, the Ethereum community is debating whether the recent sanctions against Tornado Cash could end up putting the blockchain itself at risk.

Merge Hype Overshadowed by Tornado Cash

The Ethereum community is concerned about censorship.

Only one month remains before Ethereum switches from its Proof-of-Work consensus mechanism to Proof-of-Stake. The transition, colloquially known in the crypto space as the “Merge,” is expected to reduce the network’s energy consumption by 99% and reduce token emission rates by 90%. Delayed several times lately, the highly anticipated upgrade looks set will take place next month on September 15.

However, dampening the public’s excitement came the recent decision by the US Treasury’s Office of Foreign Assets Control (OFAC) to add the popular privacy protocol Tornado Cash to its sanctions list, claiming that the app was primarily a vehicle for money laundering by cybercriminals. The move is unprecedented in that it is the first time a piece of open source code has been added to a sanctions list. Following the move, Dutch authorities arrested a Tornado Cash developer in connection with a separate investigation into the privacy protocol.

Following the news of the Tornado Cash ban, several companies such as stablecoin issuer Circle, software version control platform Github and Ethereum infrastructure provider Infura complied with the sanctions, blacklist Tornado Cash-related Ethereum addresses listed in the OFAC statement. The Tornado Cash case sets a worrying precedent, and now the crypto community has deep concerns that centralized entities running Ethereum Proof-of-Stake validators may be forced in the future to censor transactions on the Ethereum blockchain itself.

Ethereum’s Vulnerability to Censorship

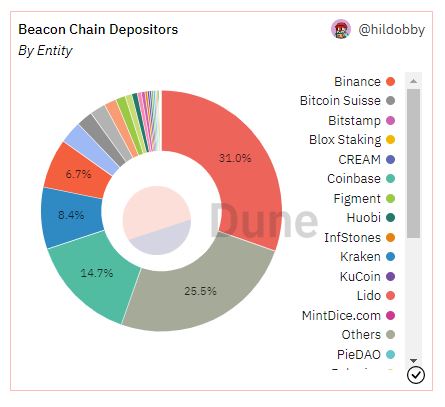

The bottom line is that when Ethereum is upgraded, it will no longer rely on Proof-of-Work miners to reach consensus, but on Proof-of-Stake validators. Instead of spending energy creating new blocks like miners do, these validators have to stake ETH tokens. While each validator needs 32 stake ETH to run, a single device can run multiple validators, increasing their influence over the network. And which noted by DXdao contributor Eylon Aviv, five of the six largest validating entities will most likely be forced to comply with OFAC regulations.

Aviv singled out crypto exchanges Coinbase and Kraken, staking services Staked and Lido, and crypto service provider Bitcoin Suisse as entities likely to be forced to censor transactions on Ethereum. “I think somehow Coinbase will find a way to ensure that it doesn’t validate a block with Tornado [transactions]”, he stated before adding:

“If 66% of validators will not sign specific blocks, block builders / relayers who propose blocks with sanctioned [transactions] are less likely to be included, which means that these block builders will lose money, which makes the inclusion of such [transactions] financially unaffordable.”

In response to these concerns, several community members pointed to the slashing system built into Ethereum’s upcoming Proof-of-Stake consensus mechanism. As Ethereum creator Vitalik Buterin explained in a 2018 tweet: “if a 51% coalition starts censoring blocks, other validators and clients can detect that this is happening, and use the 99% fault-tolerant consensus to agree that this is happening, and coordinate a minority fork.”

In other words, should the largest validators decide to censor transactions, the rest of the Ethereum validator community, even if they are in the minority, have the ability to destroy the censoring validators’ means.

OFAC compliance as censorship

The possibility of cutting major validation funds gives way to another question: should compliance with OFAC regulations be considered an attack on Ethereum itself?

Swedish Bitcoin lawyer Eric Wall seems to think so. “Ethereum cannot comply with all nations’ validator-level censorship requirements,” he tired. “Zero censorship is the only neutral option for global consensus.”

wall asked in a poll on whether the Ethereum community should fire the efforts of major validators attempting to comply with the OFAC sanctions. Of the 9,584 Twitter users who participated, 61.2% were in favor and 9.3% were against (with 29.5% asking to see results.) Vitalik Buterin also weighed in, indicates in a comment that he was among those who voted yes.

However, major validators who have already skated ETH into the beacon chain may be left with few options. After the merger, ETH will remain locked until 2023, meaning validators will not be able to withdraw their staked funds from the Ethereum network even if they wanted to avoid censoring transactions under OFAC regulations.

One option they have is to “voluntarily go out” by simply ceasing to perform its validation tasks. By doing so, they will not be able to rejoin the network or access their ETH until withdrawals are enabled. Even worse, they could potentially be hit with inactivity fees worth 50% of their stake.

Asked on Twitter whether Coinbase prefers to censor transactions or shut down its validators, CEO Brian Armstrong said black:

“It’s a hypothetical we hopefully won’t face. But if we did, we’d go with it [shutting down] I think. Must focus on the bigger picture. There may be a better alternative (C) or a legal challenge as well which may contribute to a better result.”

Still, stuck between a rock and a hard place, Coinbase and other validators may end up choosing hard to save their money, says Spacemesh developer Lane Rettig mean. This will result in two different Ethereum Proof-of-Stake chains: one OFAC compliant, the other permissionless. “It’s possible that the OFAC-compliant fork would win,” Rettig said. “It would totally change the landscape of Ethereum, as it is very likely that stablecoins, asset-backed things and many [decentralized finance protocols] would not be able to follow the non-compliant fork.”

Ethereum’s difficult path forward

Beyond the issue of Ethereum’s consensus mechanism, some crypto projects in the ecosystem have decided to ensure they are OFAC compliant. TRM Labs already has launched a wallet screening service that allows decentralized finance (DeFi) protocol interfaces to block sanctioned addresses, or those that have been the counterparty to sanctioned addresses. The decision has been met with criticism from the wider crypto community.

“Hackers don’t use the front end,” Yearn.Finance lead developer banteg tired. “You can only block legitimate users. TRM has played you for absolute fools.” Banteg later shared an article from a DeFi hack victim describes his inability to access his funds on the DeFi lending protocol Aave because a direct transfer had previously occurred between his wallet and a sanctioned wallet – the transfer was a hack in which he lost $200,000.

Flashbots, an organization that helps Ethereum reduce the disadvantages of on-chain price arbitrage, as well indicated it would be blacklisted addresses sanctioned by OFAC, ask conversations for validators to use a different relay. Flashbots responded to the criticism by making its own relay code open source.

As the merger deadline ticks closer with each block, the uncertainty surrounding the fate of the ecosystem feels heavy for some. “[Ethereum] had one job – ONE JOB: censorship resistance,” says Right. “It’s the ONE Thing that makes all the pain worth it: all the uncomfortable, slow, painful theater of decentralization. If you can’t do that one thing, then there’s no point in any of this, and we should all pack up and go home already.”

Disclosure: At the time of writing, the author of this piece owned ETH and several other cryptocurrencies.