Will ADP Non-Farm Employment Data Result in a Range for BTC and ETH?

Bitcoin (BTC), potentially the most popular cryptocurrency in the world, maintained its winning run and gained significant traction towards the $28,500 mark. Meanwhile, Ethereum (ETH), the second largest cryptocurrency, extended its upward trend and hit an eight-month high of $1,900.

Bitcoin (BTC), potentially the most popular cryptocurrency in the world, maintained its winning run and gained significant traction towards the $28,500 mark. Meanwhile, Ethereum (ETH), the second largest cryptocurrency, extended its upward trend and hit an eight-month high of $1,900.

However, the continuous bullish rise in the crypto market was mainly influenced by ongoing liquidity problems in the financial sector, which has the potential to affect both traditional and digital asset markets.

Investors will look for any instability or volatility in this sector as it could affect the rest of the financial system.

On the other hand, Ethereum’s upcoming Shanghai upgrade, scheduled for April 12, was seen as another key factor leading to an overall rise in the crypto market.

Thus, many investors are analyzing Ethereum’s performance ahead of the upgrade, hoping that it will stimulate the development of the entire crypto market.

Investors seem hopeful about the cryptocurrency market in April, as historical statistics show that the month has been fruitful for cryptocurrencies such as Bitcoin and Ethereum, with recent increases and growing popularity in the crypto industry.

It is worth recalling that Bitcoin has already gained 23% in March and is up 67% so far this year. This is why investors remain bullish on the prospect of new records in the coming weeks.

Bitcoin pulled bids despite decline in US job vacancies

Bitcoin has been on the rise, experiencing a significant increase of late, even amid Tuesday’s larger-than-expected decline in US job vacancies. However, the recent decline in US job vacancies may indicate an easing in labor market conditions, potentially limiting gains in the Bitcoin price rally.

According to the monthly Job Openings and Labor Turnover Survey (JOLTS), the number of job openings in the United States fell by 632,000 to 9.9 million in February, reaching the lowest level since May 2021.

This decline in vacancies follows a reduction of 1.3 million in the first two months of 2023. Economists had previously forecast 10.4 million vacancies, signaling a larger-than-expected drop.

Accordingly, these data figures suggest a tighter labor market, which is likely to impact the broader economic outlook and investor sentiment, particularly in cryptocurrency.

Crypto market rally persists – awaiting non-farm payrolls data

The global cryptocurrency market has maintained its bullish rally, with a market cap of $1.20 trillion at the time of writing, reflecting a 1.09 percent increase over 24 hours. Consequently, Ethereum (ETH) passed the $1,900 mark, hitting an eight-month high early Wednesday.

Meanwhile, BTC has remained stable around the $28,000 level. In addition, several significant cryptocurrencies posted gains across the board, including Dogecoin (DOGE), Ripple (XRP), Litecoin (LTC), and Solana (SOL).

Since most cryptocurrencies performed well in March, investors are optimistic about the market in April, as historical data indicates that April has typically been a good month for Bitcoin (BTC) and Ethereum (ETH).

However, ongoing liquidity problems in the financial sector could affect digital asset markets, and investors will watch closely for instability or volatility. This could potentially have effects on the wider financial ecosystem.

Bitcoin Holdings by Digital Asset Managers Shows Resilience Despite Bank Failure.

BTC holdings by digital asset managers, including trusts and exchange-traded products, only fell in early March following the collapse of major banks. Afterwards, these managers added nearly 4,000 BTC to their holdings, totaling over 692,000 BTC as of April 2nd.

Therefore, this indicates that investor interest in Cryptocurrency has recovered, as these managers are increasing their holdings despite recent bank failures.

Thus, the increased BTC holdings of digital asset managers may signal greater confidence in the cryptocurrency and may influence broader market sentiment, ultimately contributing to positive price momentum for BTC.

Bitcoin price

The current Bitcoin price is $28,500, with a 24-hour trading volume of $16.6 billion. Bitcoin has experienced an increase of almost 2.5% in the last 24 hours. According to technical analysis, the BTC/USD pair is currently bullish. However, it may face resistance near the $28,950 level.

If Bitcoin succeeds in breaking through the $28,950 resistance level, its value could potentially rise to $29,250 or even $30,500.

Conversely, should a bearish trend emerge, significant support is expected at $26,500 and $25,500 levels.

Buy BTC now

Ethereum price

Currently, the current price of Ethereum stands at $1,909.55, with a 24-hour trading volume of $11.6 billion. Ethereum has seen an increase of almost 6% in the last 24 hours.

Buy ETH now

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest ICO projects and altcoins by frequently referring to the handpicked selection of the 15 most promising cryptocurrencies to monitor in 2023, which have been suggested by the specialists at Industry Talk and Cryptonews.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

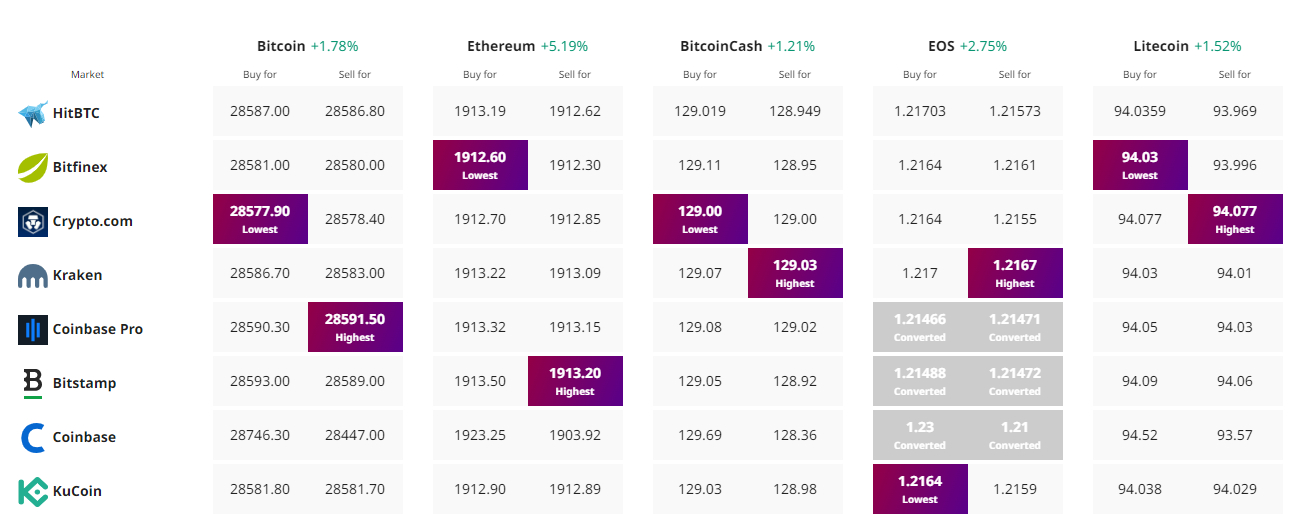

Find the best price to buy/sell cryptocurrency