Why you should be concerned

As the crypto market continues to evolve, the health and performance of the Bitcoin (BTC) network remains of paramount importance to investors and market participants. However, recent trends suggest a potential slowdown in Bitcoin network activity.

Key metrics such as trade volume, daily active addresses, circulation and Network Value to Transactions (NVT) solve the puzzle behind this decline.

Bitcoin Trading Volume: Meaning and Implications

Trading volume refers to the total number of BTC traded on various exchanges within a specific period. It is a crucial metric for assessing market liquidity and investor interest.

A high trading volume indicates a vibrant market with a large number of transactions. Conversely, a low trading volume indicates reduced interest and limited market activity.

In the context of the slowdown in the Bitcoin network, the sharp drop in trading volume after an initial price spike highlights the potential weakness in the market. This sudden decline could mean that investors are either taking a wait-and-see approach or shifting their capital to other cryptocurrencies or investment opportunities.

If trading volume remains low, it could hamper Bitcoin’s ability to maintain or further increase its price.

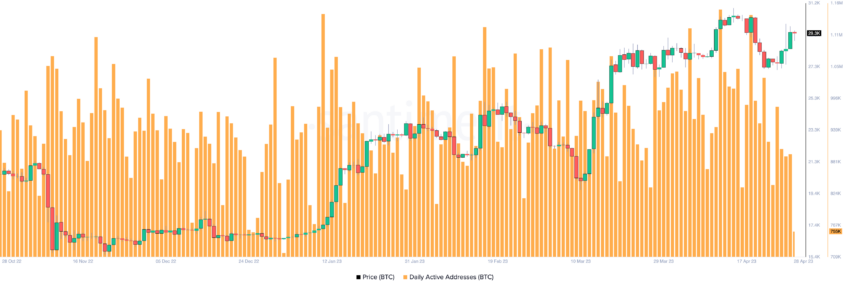

Daily active addresses: Assessing network engagement

Daily Active Addresses represent the number of unique addresses that participate in transactions on the Bitcoin network each day. This metric provides insight into network engagement, adoption and overall activity.

An increasing number of active addresses means that more users join the network. Meanwhile, a declining or stagnant number may indicate waning interest or reduced usage.

Despite the recent price increase, the slow growth of daily active addresses suggests that Bitcoin network activity is not keeping pace with the price gains.

This may signal a divergence between the market value and the actual use of Bitcoin. Consequently, it can undermine the long-term sustainability of price growth.

Circulation: Understanding BTC Movement

Circulation refers to the number of individual tokens that are moved between addresses on the Bitcoin network per day. This metric provides valuable information about the flow of capital in the ecosystem and the propensity of users to trade with Bitcoin.

An increase in circulation indicates an active market with more tokens being transferred. Conversely, a decrease indicates reduced transaction activity.

Despite a rising price, the current reduction in Bitcoin circulation means that fewer tokens are being transferred across the network. This could be due to users holding on to their coins in anticipation of future price increases or shifting their focus to other cryptos.

In either case, reduced circulation may indicate a weakening of the Bitcoin network’s transaction tools. This may have a negative impact on long-term growth prospects.

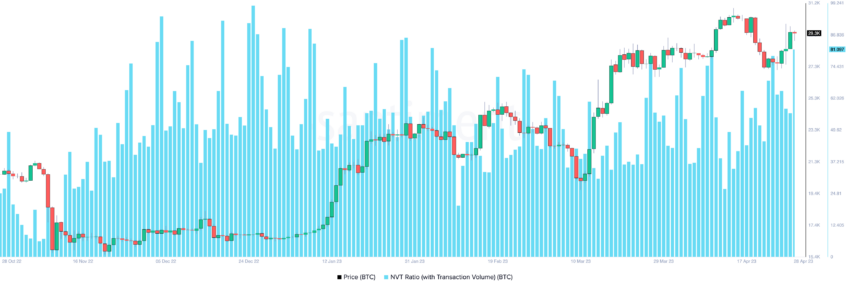

NVT Divergence: Examines network value relative to transactions

The Network Value to Transactions (NVT) ratio is a measure that compares the market value of Bitcoin to the volume of transactions occurring on the network. A high NVT ratio suggests that the network is overvalued relative to transaction volume. Meanwhile, a low NVT ratio indicates that the network is undervalued.

A rising NVT ratio, rising prices and falling unique tokens moved signal a bearish divergence, which could be a warning sign of an impending market correction.

The observed NVT divergence in the Bitcoin network highlights the link between market capitalization and actual transaction activity. This divergence raises concerns about the sustainability of the network and could contribute to increased market volatility if not addressed through improvements in the chain.

Bitcoin price prediction: a warning for bulls

While predicting the exact trajectory of the Bitcoin price is challenging, the decline in network activity suggests a cautious outlook. The discrepancy between the key figure and the rising price may indicate an overvaluation of the asset. This could potentially lead to a market correction in the short to medium term.

Nevertheless, it is important to recognize that the crypto market is inherently volatile and subject to various external factors. These include regulatory changes, macroeconomic developments and technological advances. These factors could affect the Bitcoin price and network activity, either reducing or exacerbating the current decline.

It is worth noting that if the Bitcoin network activity can improve, it can regain momentum and strengthen its position. In addition, positive developments in the broader crypto market, such as increased institutional investment, may also contribute to a more optimistic outlook for the Bitcoin price.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, objective reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions.