Why UP Fintech (TIGR) Stock Just Plunged Almost 30%

Gilnature

After falling nearly 10%, Futu Holdings (FUTU) fell another 31.0% on December 30, 2022. News that Chinese authorities will restrict UP Fintech Holding (NASDAQ:TIGR) and Futu sent the shares sharply down.

Why did the authorities ask the two firms to do so stop taking new ones ashore Chinese investors? For years, the firms operated a cross-border securities trading business without the Commission’s approval.

Having covered Fintech recently, TIGR stock’s 28.5% drop will interest readers.

Statement of the China Securities Regulatory Commission

On December 30, 2022, the China Commission said, according to Google’s translation, that UP Fintech did not have permission to conduct cross-border securities trading. This constituted an illegal activity that contravenes current laws and regulations.

A year before that, on 15 October 2021, the CSRC communicated its views on non-compliance through the media.

The following month, on 11 November 2021, the CSRC conducted regulatory interviews with the two firms. As a result, the regulator would correct the violations in two ways. Firstly, it will prohibit new account openings and the solicitation of domestic investors.

Second, it will allow existing domestic investors to continue with transactions. However, foreign institutions cannot accept incremental funds.

UP Fintech’s trade committee tested

TIGR stock had already collapsed from its record highs set in early 2021. Last year, the stock managed to form a trading range between $3.20 to around $5.00. Speculators are betting that the Chinese would ease unrelated regulatory restrictions on December 8, 2022. They concluded that once China abruptly ended its Dynamic Zero COVID policy, the government would allow UP Fintech to continue its operations.

UP Fintech said it would comply with relevant laws and regulations. It will not register new land customers. The company said the regulations will have no impact on its operations outside the mainland.

Customer acquisition in the 3rd quarter of 2022

In its conference call, Up Fintech, also known as Tiger Brokers, said the business added new quality clients. The customers in Singapore contributed an average net asset inflow of USD 11,000. Investors concluded that the increase in net assets from USD 9,000 in Q2 validated Tiger’s healthy business model.

The company reported that its continued research and development spending improved efficiency. For example, self-clearing led to a clearing cost as a percentage of the trading commission falling to 13%.

Tiger highlighted the strength of its risk control and self-clearing capabilities will benefit retail investors. Furthermore, wealth management clients will get better service from the newly launched Tiger Vault. They can diversify their portfolio while combining their cash management needs with other investment products.

More risks

As discussed above, regulatory overhang is a major risk to Tiger’s business model. These uncertainties will distract it from dealing with the downturn in securities trading. The rate hike cycle has not yet peaked. The increase in borrowing costs will weaken the insurance business. The tight liquidity will weigh on Tiger’s income potential on its existing customer base.

Tiger must stop all marketing initiatives related to recently funded account acquisitions that violate the regulations. This will severely limit the company’s expansion plans. This will give competitors a chance to take more of the large, total addressable market.

In order to sustain the growth of its business outside of mainland China, Tiger may need to increase the amount they spend per active customer.

This is an uphill battle. 20% of funded accounts in the third quarter came from mainland China.

TIGR shares fair value

TIGR stock fell 28.5%, more than 20% of the funded account growth from the mainland. Although this may indicate that the market oversold shares, bears are firmly betting against Tiger.

The short interest rate is 14.42%.

TIGR chart (Seekingalpha)

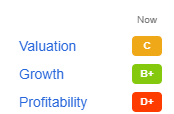

Investors can rely on Tiger’s mixed quant score to support the case for buying shares. The stock has a fair valuation score and a growth score of B+.

TIGR share score (Seekingalpha Premium)

Unfortunately, TIGR stock’s profit potential depends almost entirely on Chinese regulators. Investors should not rely on the above grades to gauge the company’s prospects.

Your takeaway

Bears is betting heavily on both Futu Holdings and UP Fintech. The short interest is 1 4.42% on the TIGR share and 16.37% on the FUTU share.

China’s harsh regulations against Tiger will hurt its revenue and profitability prospects. The company cannot invest in the business to promote customer growth. This uncertainty will hurt the stock this year.

The bear market punishes companies with any regulatory risks. As a result, investors should avoid TIGR shares.