Why the IRS plans to add a 28% tax on NFT collectibles

The Internal Revenue Service and the Treasury Department in the United States have sought feedback on plans to treat NFTs in the same way as traditional collectibles as works of art for tax purposes.

Should new rules be introduced, they could see non-fungible token holders paying as much as 28% in taxes on their holdings.

The tax authorities want to tax NFTs

For collectors of NFTs, this would mean that they should consider their tokens similar to their more tangible counterparts, such as art, collectibles, stamps, gems and vintage wines.

In addition, the IRS statement also signaled its intention to define non-fungible tokens as collectibles before receiving further guidance on the matter.

To further complicate matters, NFTs that certify ownership of a physical object or property will be taxed accordingly after a “look-through” analysis has been performed on the token. This may mean that the tax authorities will identify the non-fungible token as an analogue for the asset it represents. However, this also means that NFT will be liable for similar tax measures if its underlying asset is also considered a collectible.

While these potential new rules and regulations may be difficult for investors to keep up with, what do they really mean for NFT holders?

How does the taxation of collectibles work?

So, how does taxation on traditional collectibles work in the first place? In the case of fixed assets that have been held for more than a year, they may be subject to relatively mild tax rates depending on the holder’s tax profile. Generally speaking, these can amount to 0%, 15% or 20%.

Despite this, if the capital gain is linked to a collectible, the maximum long-term capital gain can be as high as 28%. In the eyes of the IRS, a collectible can be any work of art, antiques, gems, stamps, metals, musical instruments, or just about any other physical property that is considered collectible in the nature of the IRS.

How will collectibles tax apply to NFTs?

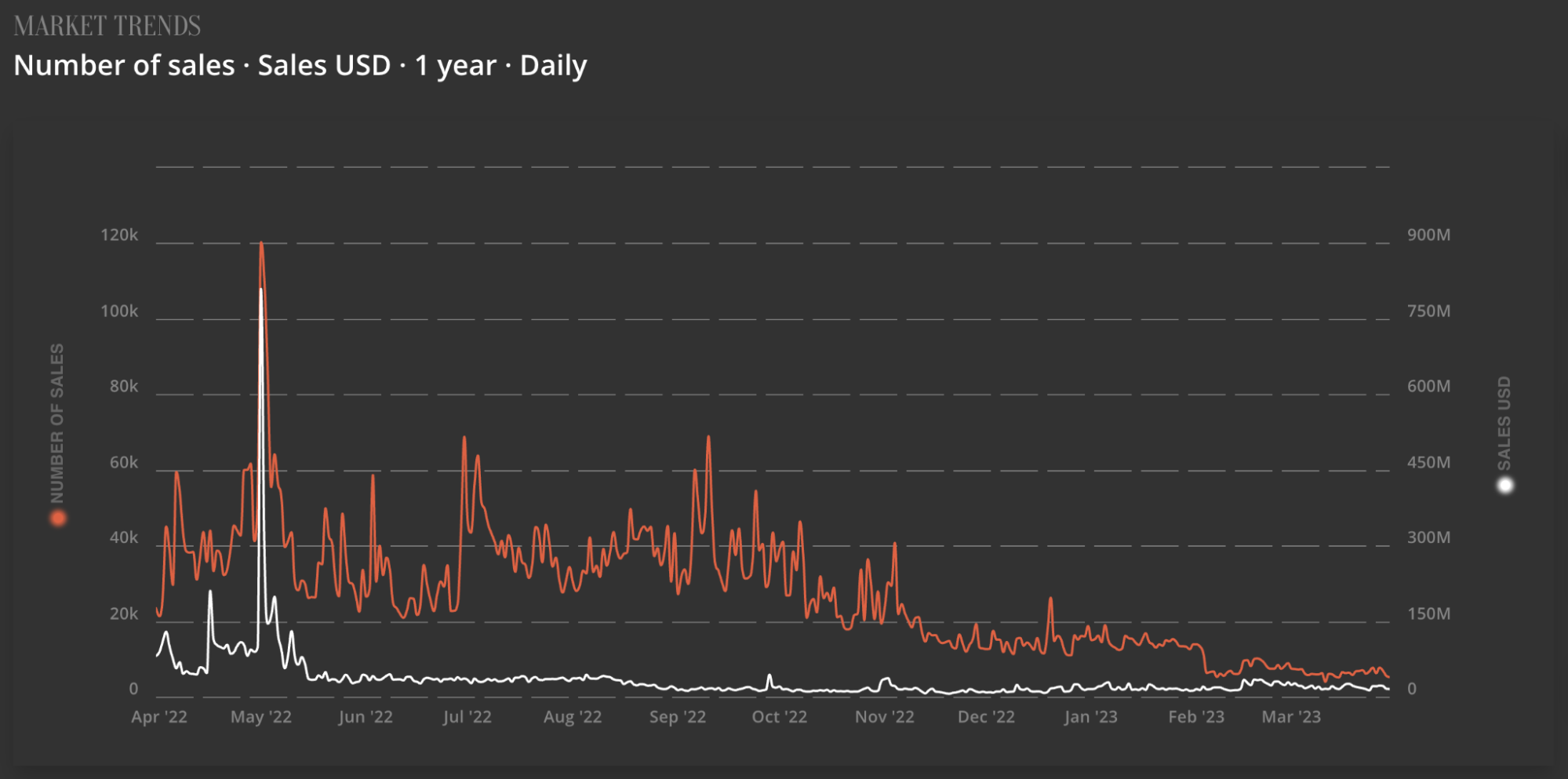

The NFT market experienced a drop in volume following large trading volumes recorded in 2021 and early 2022.

Due to declining market sentiment, NFT trading volume fell 77% to $1.7 billion in Q3 2022 as opposed to Q2 2022 which was valued at $7.4 billion. As the chart below shows, these volumes have continued to decline in 2023, with NFT sales volume falling below 6,000 in March 2023 despite a brief 2022 peak reaching 120,000 in volume.

While such a waiver is of concern to collectors, it could help holders avoid capital gains tax when selling their NFTs through processes such as crypto tax loss harvesting.

However, for investors who remain optimistic about the long-term prospects of NFTs, buying at this time may incur higher tax costs on the profits from buying at the bottom of the market to sell on at a profit. Although at the same time these costs may boil down to how we and the tax authorities define our NFTs.

The introduction of a “review analysis” to determine whether an NFT is a collectible may also open the door to new interpretations of the NFT’s purpose.

According to section 408(m) of the Internal Revenue Code, a collectible is tangible personal property such as a work of art, rug, antique, metal or gem, stamp or coin, or alcoholic beverage. This means that if a transparency analysis for an NFT certifies the ownership of a physical asset such as a gem, it will be considered a collectible. However, if the NFT certifies the right to land, this will not be considered a collectible.

To further clarify (or convolute) this, virtual land, such as metaverse property, is not considered a collectible, according to the IRS. This means that some tool symbols may be immune to scrutiny. Which begs the question, what do you own when you buy an NFT?

First look at the future of NFT taxation

Although the plans of the tax authorities are still subject to feedback, these new plans represent an important step in giving NFT owners an insight into what the future of taxation may look like for their assets.

Individuals buying and trading cryptocurrency and NFTs should be aware of the tax implications, and crypto and NFT exchanges need to start promoting tax literacy education programs to help collectors avoid problems down the line.

With the prospect of a 28% capital gains tax replacing the old 15% capital gains tax that applies to many other forms of assets, the news is likely to pose more challenges to an NFT ecosystem that has struggled to maintain trading volume over the past year. Nevertheless, these plans for more extensive tax measures will help to reduce the uncertainty hanging over the market.

Although calls for a legal challenge to challenge these measures have been made, it is worth repeating that these are preliminary guidance measures and may change many times in the future. With major consequences of the NFT market depending on the whims of the tax authorities, the eventual decision on these plans will have considerable weight.