Why the Bitcoin Drawdown Might Still Not Be Painful Enough for the Bottom Line

The Bitcoin inflow in profit measurement may suggest that the current bear market has not been painful enough yet for the cyclical bottom to form.

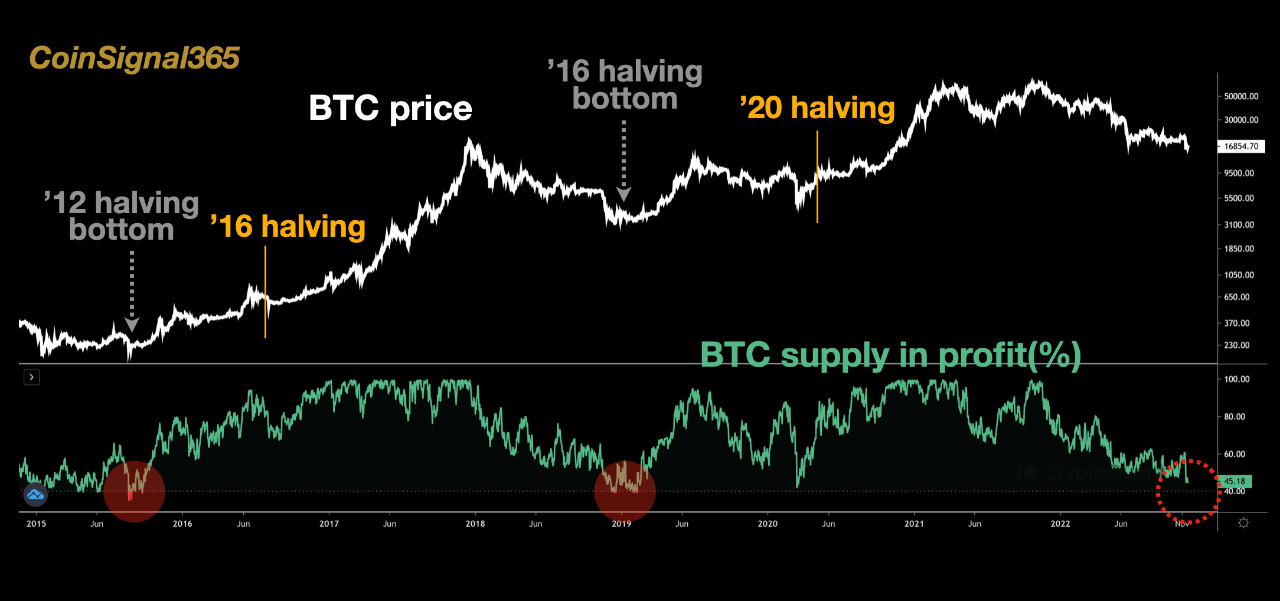

Bitcoin supply in profit has fallen to 45% after crash

As pointed out by an analyst in a CryptoQuant post, all of the historical lows occurred when the profit in the offering fell below 40%.

“Supply in profit” is an indicator that measures the percentage of the total Bitcoin circulating supply that is currently making some profit.

This calculation works by going through the chain of each coin to see what price it was last moved to. If this previous price for a coin was less than the value of BTC right now, then that particular coin has some profit at the moment.

The indicator takes the sum of such coins and then gives the percentage based on the total number of coins in circulating supply. The opposite calculation is “supply in loss”, and it is calculated simply by subtracting supply in profit from 100.

Related reading: Despite Huobi Token’s 24% decline in the past week, whales and sharks keep buying

Now, here is a chart showing the trend of Bitcoin supply in profit over the last few years:

The value of the metric seems to have sharply dropped in recent days | Source: CryptoQuant

As you can see in the graph above, the percentage of Bitcoin supply in profit has dropped recently due to the crash started by the collapse of the FTX crypto exchange.

After this plunge, the indicator now has a value of only 45%. This means that more than half of the total supply has now gone into a state of loss.

The chart also highlights the values of the metric that were observed during the troughs of the previous two halving cycles.

It appears that less than 40% of the Bitcoin supply had some unrealized profit in both of these lowest bear markets.

If the same pattern forms this time as well, it will mean that the supply in profit will still need to fall by more than 5 units to reach the historical lows.

Such a shift in profitability can only take place after more decline in price, meaning the pain is not quite over for Bitcoin investors just yet.

BTC price

At the time of writing, Bitcoin’s price is hovering around $16.6k, down 6% in the last week. Over the past month, the crypto has accumulated 14% in losses.

Looks like the price of the coin is still continuing its sideways movement | Source: BTCUSD on TradingView

Featured image from Hans-Jurgen Mager on Unsplash.com, charts from TradingView.com, CryptoQuant.com