Why I Think Bitcoin’s Collapse Is Imminent (BTC-USD)

Vertigo3d

So far, 2022 has not proven to be a particularly good year for Bitcoin (BTC-USD). Although, to be fair, that doesn’t seem to bode well for most cryptocurrencies or investments in general. However, unlike most investment opportunities, Bitcoin is excellent of the fact that at the end of the day I think it is destined to see the price plummet. For years, cryptocurrency in general has been hyped up. In addition to the general enthusiasm common with new and fast-growing technologies, Bitcoin has benefited from an environment of low interest rates and almost non-existent regulatory oversight. However, with rising interest rates, worsening economic conditions, and significant pain caused by a lax regulatory environment now making headlines, I truly believe that the best days for Bitcoin and cryptocurrency in general are in the past.

Not completely worthless… but not far off

While this article can be applied to cryptocurrency in general, I realize that there is a huge amount of variation between cryptocurrencies that doesn’t make them exactly comparable to each other. So instead of having this content target all cryptocurrencies in what ultimately won’t account for the huge variety that exists in the market, my overall focus will be primarily on Bitcoin.

For a long time I thought of Bitcoin as more or less worthless. That is not to say that it has no value. It is obviously a financial advantage to be able to transfer money from one part of the world to another in an instant and with limited costs. What the specific amount should be is up to the market to decide. But I think the notion that there would be significant value behind Bitcoin in general that would justify prices in the tens of thousands of dollars is absurd. While I don’t believe that Bitcoin is completely worthless, I do believe that its overall value is severely limited compared to what the current market has judged it to be. After all, it is the valuable blockchain technology, not the cryptocurrency itself, that transfers the money from one point to another.

I have no doubt that those who are bullish on cryptocurrency will disagree with my view. There are a number of arguments that can be made in favor of Bitcoin or cryptocurrency in particular. A common refrain is that it behaves like a store of value. But what is the value at the end of the day? In the case of stocks, the current value is not the ticker symbol you purchased. Instead, it is the share of ownership over the assets of the enterprise, with the final value theoretically determined by all the company’s future cash flows, discounted to today.

Instead of comparing Bitcoin to stocks, and more common way to justify its value is by comparing the cryptocurrency to precious metals such as gold or silver. After all, they have a lot in common. Like gold and silver, Bitcoin can be exchanged for cash. It has an active market that allows prices to be determined from moment to moment. Furthermore, just like gold and silver, Bitcoin has a limited limit to it. But when you really dig down, these points either don’t matter or the comparison is completely wrong.

Take, for example, the idea of an active market with moment-to-moment prices. Every item has the same. But at the end of the day, you don’t see pork prices or wheat prices deriving their value from the fact that they are consistent to the point that they are easily priced. Instead, it is their ultimate utility, as well as the balance between supply and demand, that matters. And when it comes to the final argument, while Bitcoin itself may be limited, the total number of cryptocurrencies is increasing rapidly. Today, there are well over 20,000 cryptocurrencies globally, with over 12,000 not in regular circulation.

Some might argue that gold and silver act as a store of value simply because we have chosen them to be so. By this logic, anything, even digital currency, can be created the same way if enough people adopt it to be. I would counter this with the argument that the fact that gold and silver are perceived as stores of value is of secondary importance. Using 2019 data for the United States, only about 8% of all gold was used for the production of official coins. A full 50% went to jewellery, while 37% was used in electronics. It gave another 5% to other miscellaneous purposes. When it comes to silver, the most common use is electronics. An impressive 35% of the silver goes to that space. 25% goes to a combination of coins and medals. 24% goes to other miscellaneous categories, while 10% can be attributed to photography and 6% is dedicated to jewelry and silverware. So yes, both of these precious metals can be used as stores of value. But at the end of the day, their value is primarily derived from their utility. When you can wear a Bitcoin around your neck that your great-grandparent bought or mined, or use it to make your camera work or your computer, the picture may change.

When trying to market Bitcoin and other cryptocurrencies, some people will point to the US dollar and other fiat currencies. But there are a couple of problems here when it comes to comparison as well. Bitcoin is marketed as a store of value, which the dollar is not. Over time, the dollar gradually loses its value due to its nature. And second, any value baked into the dollar is driven by a number of forces that cryptocurrency cannot replicate. Sure, there are always market forces that determine the exchange rate from one currency to another. But at the end of the day, the dollar’s value is supported by the US government’s ability to tax individuals and organizations, as well as by a massive military complex. It certainly helps that much of global trade, including the vast majority of international petroleum transactions, uses dollars.

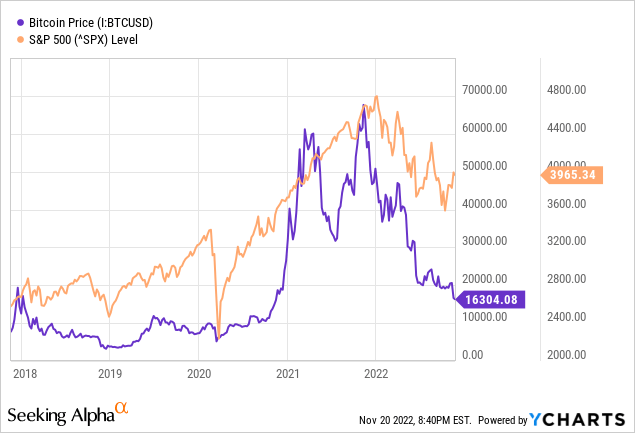

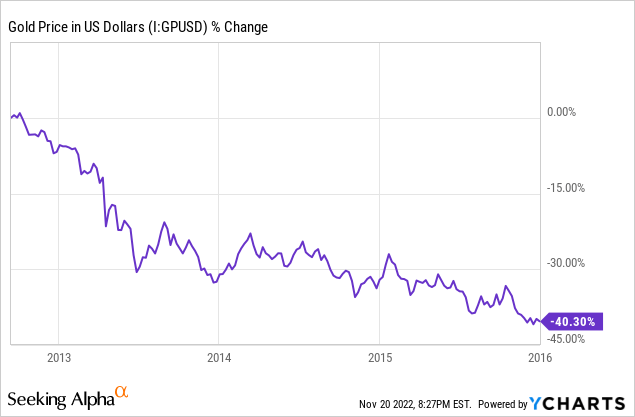

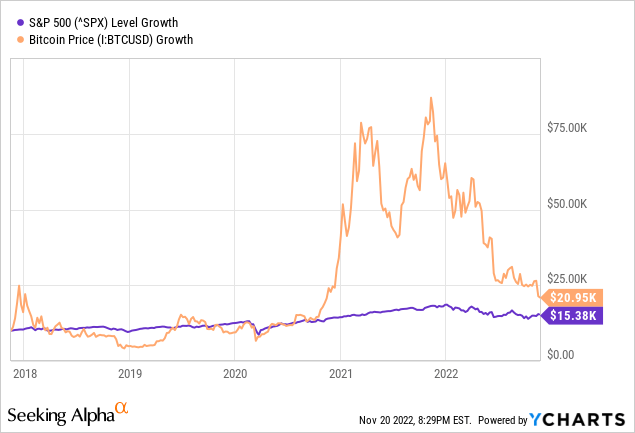

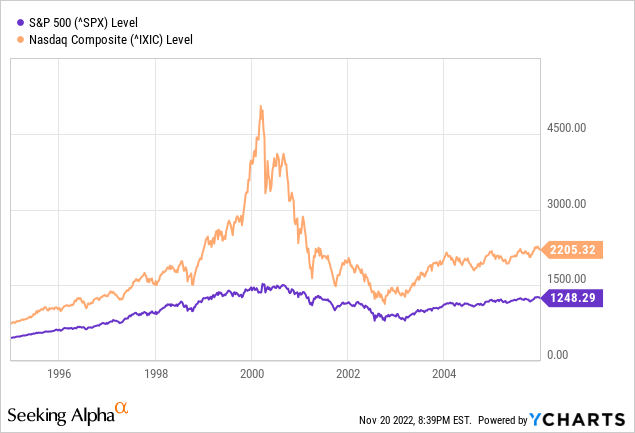

Bitcoin also lacks the kind of stability you would expect from a true store of value. Any asset can experience some volatility. But consider what gold has been like over the years. During the precious metal’s worst slump in recent memory, prices fell by 40.3%. This was between the beginning of September 2012 and January 1, 2016. But for the most part, gold has experienced a steady increase in price over the years. Looking at a chart that includes $10,000 invested in Bitcoin compared to $10,000 invested in the S&P 500, you will see that Bitcoin has behaved much more like a speculative bubble. Not just a speculative bubble, but one that is about to burst. This year alone, while the S&P 500 is down 16.8%, Bitcoin has plunged 64.1%. From its high, the cryptocurrency has fallen 72.3%.

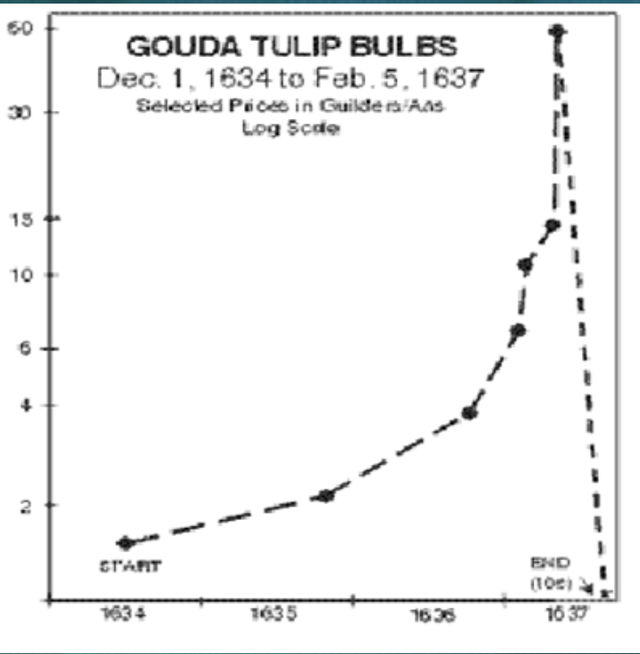

In the past, there have been other speculative bubbles. These are sometimes defined as periods where an asset or assets are pushed up in price well above their intrinsic value, only to eventually collapse. The oldest example on record is often referred to as Tulipmania. In the 16th century, tulips first began to appear across Europe, arriving via the spice trade routes that had been established not long before. Beginning with the wealthy, tulips were seen as high-class goods, and demand for them grew as the middle class sought to emulate the wealthier members of society.

Wall Street Club

Starting in 1634, a tulip craze swept through Holland. Specific accounts of exactly how bad the bubble was have rightly been questioned. Some economic historians believe that some of the stories that were told have been embellished or made up entirely. But by some accounts, the rarest variety of tulip bulbs rose in price to the point of reaching upwards of $1 million in today’s money. This was not a bubble that would disappear quickly. It was not until 1637 that the bubble burst, a full three years after it started. Some individuals may be inclined to ridicule those who fell victim to the mania. But in some ways, that crisis was more understandable than the current cryptocurrency bubble is today. After all, at least the buyers of tulips got something tangible that had some intrinsic value as opposed to a few lines of code.

Wikimedia Commons

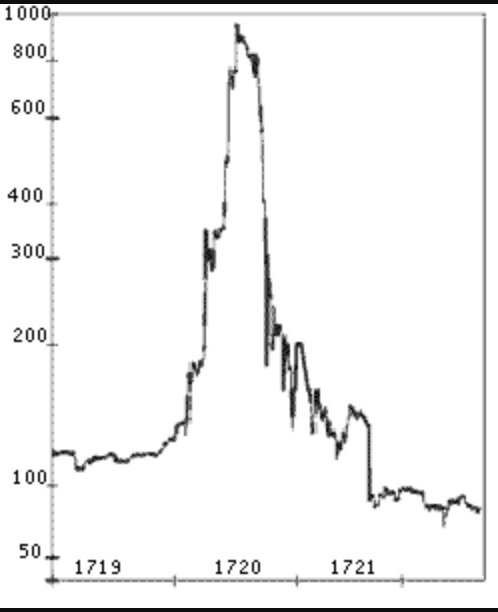

Another example that I would like to point to is the South Sea bubble. Some of the most brilliant minds of the time fell victim to the crisis, including the highly revered Sir Isaac Newton. Originally founded in 1711, the South Sea Company was structured as a way for the British Crown to cover debts it incurred as part of fighting two separate wars, the most notable being the War of the Spanish Succession. Holders of approximately £9 million were forced to relinquish their debt to the new company in exchange for shares entitling them to a stake. A lower interest rate on that debt was then arranged and paid to the company, and those amounts were paid to the shareholders in return. In order to create some value in the enterprise, the South Sea Company was also given a monopoly on the slave trade with South America which would eventually provide some economic benefit. For the sake of brevity, I will not cover all the details of that crisis. But in short, widespread speculation led to the implied value of the South Sea Company being higher than all the assets of Great Britain before the bubble finally burst. As the chart below illustrates, the Dot-Com bubble (as measured by the NASDAQ) saw a similar pattern.

In many cases, it takes a major event before a speculative bubble finally collapses. The big event for Bitcoin may very well end up being the collapse of FTX. Already, there are concerns about the financial stability of other cryptocurrency platforms such as crypto.com and BlockFi. After the housing collapse in the early 2000s, we saw exactly what happens when a place is poorly regulated. And what is clear in this case is that the cryptocurrency market is far worse off from a regulatory perspective than the housing market was back then. You also have other factors that come into play. Higher interest rates, for example, will ultimately lead to less appetite for riskier assets. And perhaps nothing has higher risk right now than cryptocurrency. While it is true that these particular problems may be overcome by the industry, along with the fact that there is no significant value to Bitcoin, it is more likely than not that this is part of a perfect storm that will sink Bitcoin for good .

Remove

Truth be told, I don’t expect this article to change the minds of anyone who is bullish on cryptocurrency. However, I hope that it can serve as a warning to those who decide to try their hand at the market or those who are thinking of doing so. At the end of the day, there is some marginal value in Bitcoin. But that value is only tied to the underlying ability of the blockchain to instantly facilitate financial transactions across the globe. Fundamentally, I believe that the market for Bitcoin and, more generally, cryptocurrency, should never have grown to what it is today. Already, there has been considerable pain caused by the decline. More likely than not, this pain will continue. Of course, it is possible that Bitcoin and other cryptocurrencies will eventually bounce back and soar past their previous highs. But I believe such reprieve will prove to be only temporary as it cannot escape the truth of its nature.