Why Hedera could make a surprise comeback in 2023’s NFT market

- Hedera made some significant developments in 2022, paving the way to become an NFT power plant.

- A price pivot may be on the way, as HBAR was shy of oversold conditions despite the downside.

Now that 2022 is over, it’s time to recap the performance of some of the top tier 1s. Hedera [HBAR] rose to prominence over the past year, as it saw some significant developments that could lay the foundation for strong growth going forward.

Read Hederas [HBAR] Price estimate for 2023-24

There were notable developments and partnerships in 2022 that underlined Hedera’s potential for more growth in the NFT market. These included the network’s collaboration with LG Art Lab, a partnership aimed at facilitating the distribution of NFT.

In a tweet on December 27, LG Art Lab reiterated its commitment to building on the Hedera network despite the challenges the market faced in 2022.

As markets continue to figure out the inner details of FTX’s collapse, HBAR has seen volatile moves as projects continue to build on top of Hedera.

In a recent interview with HBAR Foundation’s Chief Legal Officer, he had stated that Hedera has already issued grants to… pic.twitter.com/3qXaOs1Zt9

— LG Art Lab (@LGArtLab) 27 December 2022

The LG Art Lab update also confirmed that it has already built over 150 projects on the Hedera network, thus contributing to healthy network adoption despite unfavorable external market conditions.

Such partnerships and developments will allow Hedera to play a greater role in the mass adoption of NFTs.

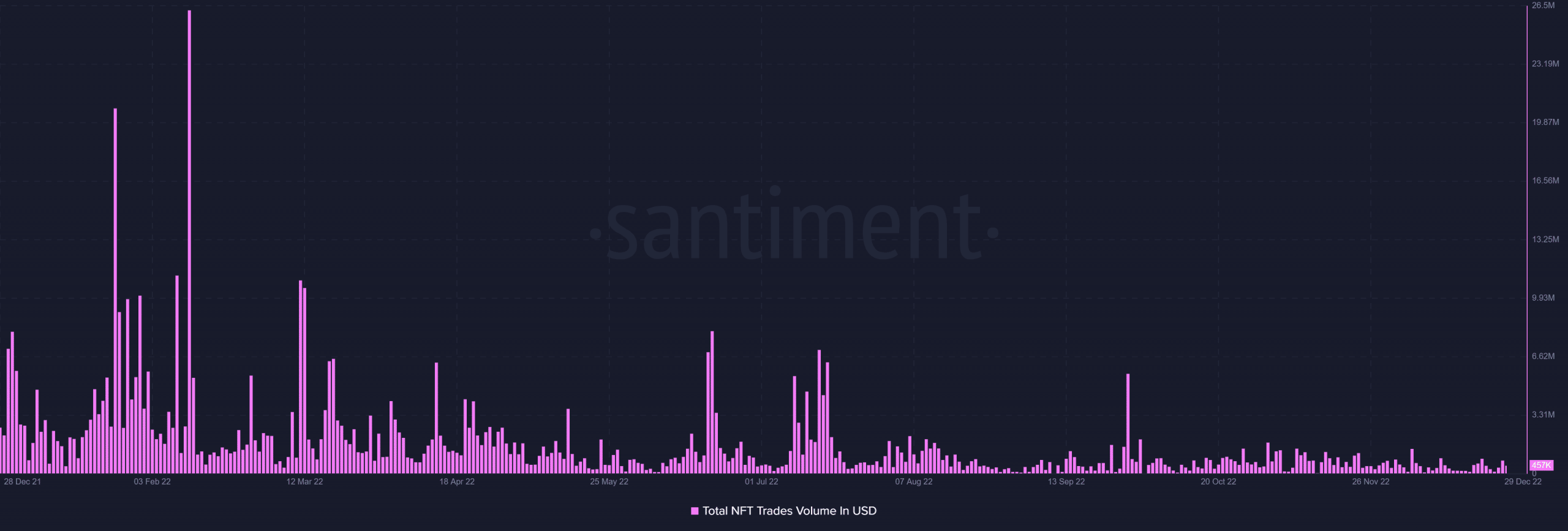

2022 was not exactly the best year for Hedera’s NFTs. Although it started with healthy NFT trading volumes at the beginning of the year, demand slowed as the market faced external economic pressures.

Source: Sentiment

The collaboration with LG Art Lab can enable faster use of digital art, which can be displayed via LG screens. This will promote support not only in the NFT market, but also in the art industry. But what does all this mean for HBAR’s performance?

Could Hedera’s NFT activity revive HBAR demand?

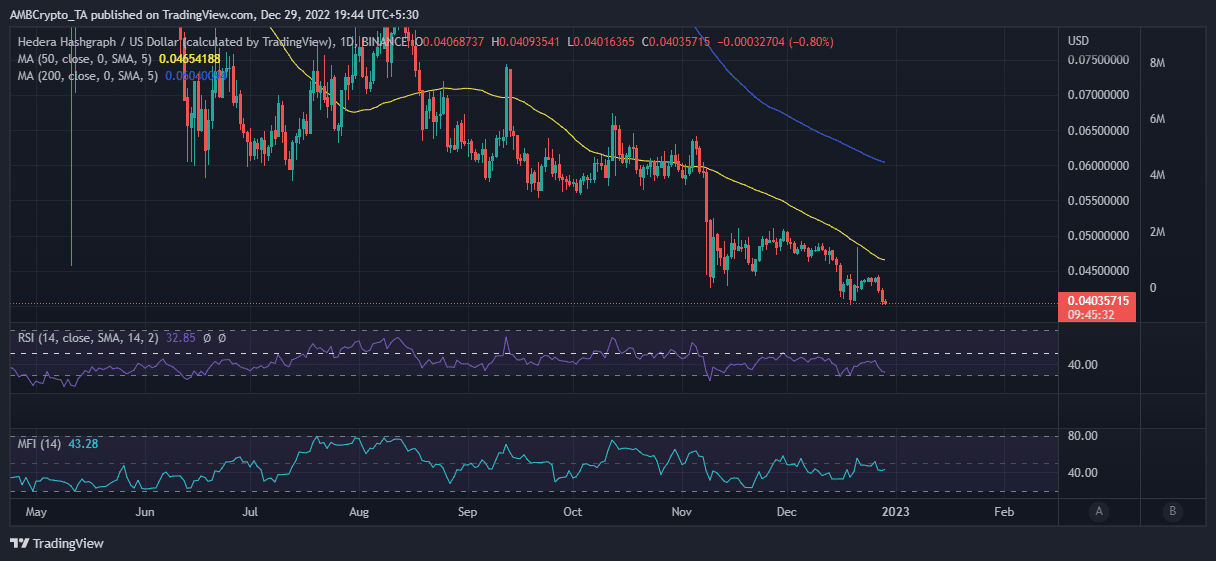

Hedera’s market impact was reflected in HBAR’s price action, which was heavily discounted in 2022. The press time price of $0.040 is the same price it traded at in January 2021.

Source: TradingView

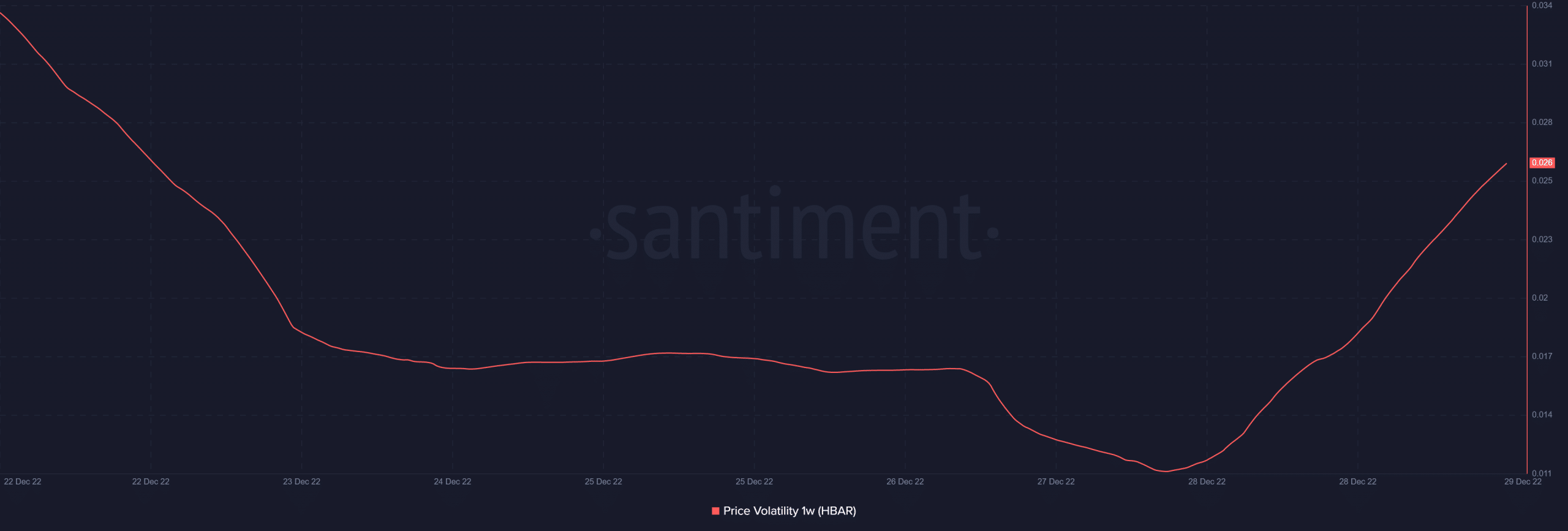

Is a pivot in the works? HBAR is still a bit shy of oversold conditions despite the downside. The RSI indicated positivity after retesting the bottom area for the second time in the last four weeks. Its weekly volatility calculation also reversed over the past two days, indicating higher incoming volatility.

Source: Sentiment

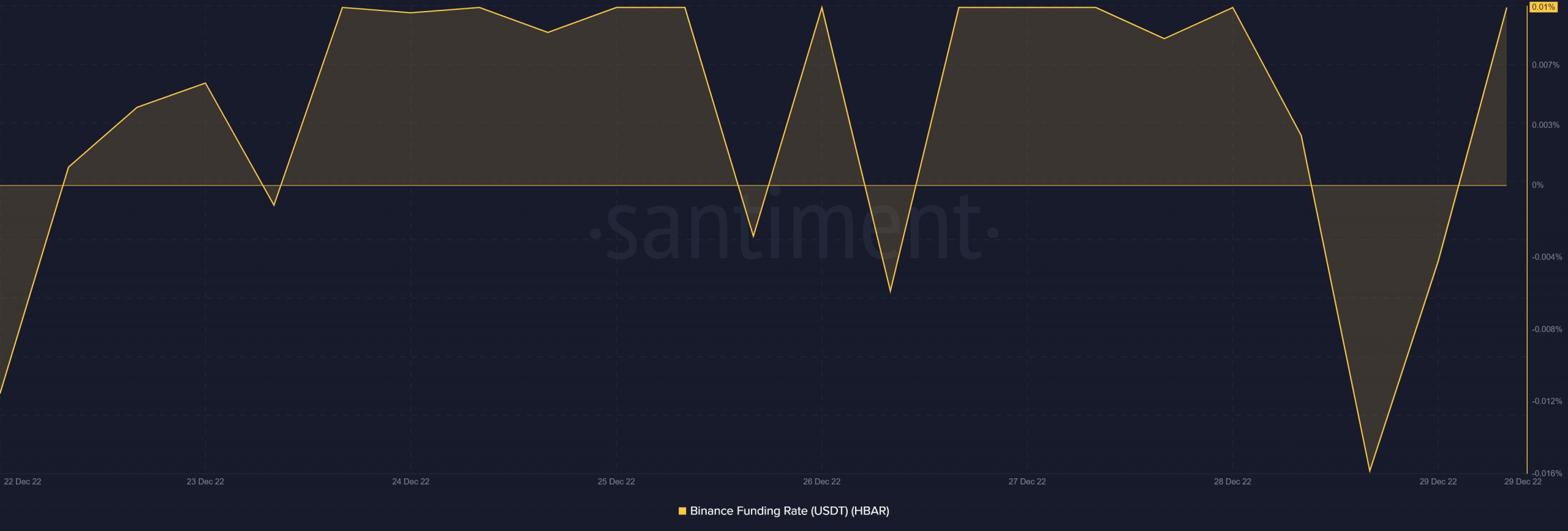

The increase in volatility has also been accompanied by an increase in Hedera’s Binance Funding rate, suggesting that there was some demand stimulation for HBAR in the derivatives market at press time. This was particularly interesting because a resurgence in demand for derivatives often precedes demand in the spot market.

Source: Sentiment

Is your HBAR inventory flashing green? Check the profit calculator

The above analysis meant that HBAR bulls could flex their muscles in the next few days. The price drop could also be a great opportunity for long-term owners looking for a heavily discounted entry point.