Why has ETH’s supply increased since the merger?

Important takeaways

- The total supply of Ethereum has increased since the merger.

- The merger reduced ETH emissions by 89.4%, but validators are still rewarded with new ETH.

- Transaction fees must reach 16 gwei or higher for Ethereum’s fee burning mechanism to fully offset ETH issuance.

Share this article

While the move to Proof-of-Stake greatly reduced Ethereum’s ETH emissions, higher transaction fees are necessary for the network’s monetary system to become deflationary.

ETH Total Supply Inflation

Ethereum’s token supply is still increasing despite the blockchain’s transition to Proof-of-Stake.

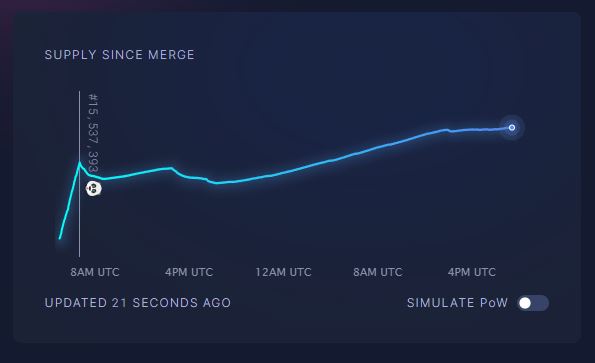

According to data from ultrasound.moneyat the time of writing, Ethereum’s token supply had grown by 418.88 ETH since the blockchain was successfully upgraded on September 15th.

Some believed that Ethereum’s transition from Proof-of-Work to Proof-of-Stake, known in the crypto space as the “Merge”, would immediately cause Ethereum’s monetary system to become deflationary. Unlike “inflationary” money, a deflationary system is characterized by a gradual reduction in the money supply over time. Although the supply of ETH fell briefly following the merger (by 248 ETH within twelve hours of the upgrade), it has now reached a new all-time high.

So did Ethereum’s Merge fail to live up to its promises? Not at all.

Ethereum’s new monetary policy

Before the merger, Ethereum distributed about. 13,000 ETH per day to miners (who ran the execution layer of the blockchain) and 1,600 ETH per day to validators (who ran the consensus layer, or Beacon Chain). At the time, Ethereum’s total supply was inflated by about 4.62% a year.

When Ethereum’s execution and consensus layers merged, the blockchain stopped distributing rewards to miners, meaning ETH emissions dropped by 89.4%. Validators still receive ETH, but they only accounted for 10.6% of the previous rewards. Consequently, ETH annual emissions fell to approximately 0.49%.

Furthermore, in August 2021, Ethereum implemented EIP-1559, which introduced an ETH burning mechanism. Ethereum users pay a base fee (denominated in gwei, or one billionth of 1 ETH) for each transaction. That treasure is automatically removed from circulation. Ultrasound.money data indicates that since the upgrade was implemented 407 days ago, a total of 2,625,258.71 ETH have been burned.

However, transaction costs vary depending on how many people (or algorithms) are using the blockchain at any given time. While gas prices are currently sitting of around 12 gwei, they routinely reached 200 gwei during the bull run – on some occasions over 100,000 gwei. According to the Ethereum Foundation, gas fees must exceed 16 gwei for the ETH burning mechanism to cancel ETH issued to validators. In other words, ETH’s total supply will increase when Ethereum transactions cost 15 gwei or less and decrease if they require 16 gwei or more.

It’s worth repeating that while Ethereum’s token supply has continued to expand in the wake of the merger, the decline in issuance is significant. Without the move to Proof-of-Stake, the supply would have already increased by more than 20,994.04 ETH – instead of just 418.88 ETH.

Disclaimer: At the time of writing, the author of this piece owned BTC, ETH and several other cryptocurrencies.