Why does Wall Street rate this Fintech play a “strong buy”?

Leading fintech stock Paypal (NASDAQ:PYPL), like several other growth stocks, has fallen significantly this year due to bearish sentiment in the broader market amid rising interest rates. Investors are also concerned that soaring inflation and a potential recession could slow down consumer spending and affect Paypal’s growth in the short term. However, most Wall Street analysts are bullish on Paypal stock based on the growing use of digital payments and the increase in e-commerce penetration in the long term.

Paypal shares fell 6.3% on Oct. 10 amid heavy criticism of the company’s policy change that would impose a $2,500 fee on users for “misinformation.” However, the company rolled back its policy update to exclude the misinformation section and clarified that it would not implement such a fine. Including yesterday’s decline, PYPL shares have fallen 55.2% so far this year.

Robust growth prospects

Paypal’s growth rate has moderated in recent quarters, with e-commerce sales slowing following the reopening of the economy. That said, the company’s second-quarter results beat analysts’ expectations.

Total payment volume (TPV) increased 9% year over year to $339.8 billion in the second quarter. The TPV processed by Venmo, Paypal’s peer-to-peer payment platform, increased 6% to $61.4 billion. The company ended the quarter with 429 million active accounts, reflecting a 6% increase. Overall, Paypal generated operating cash flow of $1.5 billion in Q2, up 12% year over year.

Looking ahead, Paypal is focused on strengthening its namesake and Venmo digital wallets, the core business of Checkout, the Braintree payments platform, and expanding in growth areas such as buy now, pay later. The company is also cutting expenses in a tough business environment. Paypal expects its productivity initiatives to generate $900 million in cost savings in 2022 and at least $1.3 billion in 2023.

What is the target price for Paypal shares?

Recently, Canaccord Genuity analyst Joseph Vafi reiterated a buy rating and a $160 price target on Paypal stock, highlighting a potential positive catalyst with Pay with Venmo expected to launch on Amazon (AMZN) in the fourth quarter.

Vafi stated, “With nearly 40% e-commerce market share in the US, Amazon remains the clear untapped greenfield for PayPal domestically.” Based on his analysis, Vafi estimates that the Venmo launch on Amazon could generate incremental growth of 0.3% to 2.7% in revenue and 0.9% to 6.7% in EPS, respectively, on a full run rate, annualized basis .

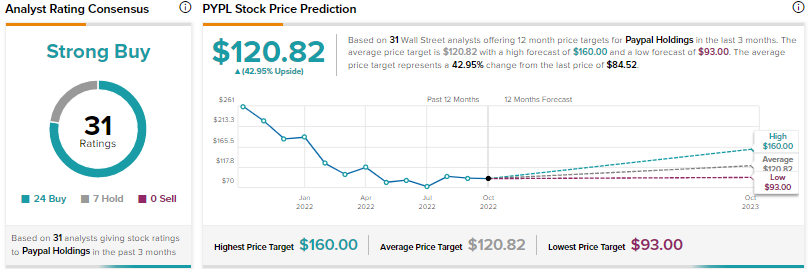

Overall, analyst consensus is a strong buy based on 24 buys versus seven holds. The average Paypal stock price target of $120.82 implies nearly 43% upside potential from current levels.

Conclusion – Paypal is a strong Fintech play for the long term

Rising interest rates and a potential recession may continue to affect Paypal’s performance in the short term. That said, despite increasing competition in the fintech space, Paypal is well positioned to capture further market share driven by its extensive customer base, innovative solutions and the rapid adoption of digital payments.

Also, activist investor Elliott Management’s interest in Paypal would help the company focus on improving profitability.

Mediation