Why Bitcoin is better than gold

hocus-focus/iStock Unreleased via Getty Images

Summary of the assignment

Bitcoin (BTC-USD) is often referred to as digital gold. In fact, the world’s premier cryptocurrency was designed for this purpose. Bitcoin and gold (GLD) share many similarities, but there are also some key differences that, in my opinion, make Bitcoin a superior form of money to gold.

Standing on the shoulders of a giant

Bitcoin was created to mimic gold because it is designed as a store of value, and over the course of human history, gold has risen as the best store of value and money available.

Gold has always been sought after by humans across the globe, even though it has no significant “industrial” use, which makes it such a good form of money. It is readily available because humans have stored it since the dawn of time, but it is also difficult to obtain. Moreover, it is malleable and easily divisible.

All these factors make gold not only a good store of value, but also good to use in trade. Gold is relatively abundant, which makes it easy for a society to define its prices in gold, but it is also difficult to obtain/mine, which means it has value and, more importantly, a stable value.

In an imperfect world, gold is as close as we have to perfecting money.

For this reason, Bitcoin was created to mimic gold, at least in two important ways. First, the supply is limited to 21 million Bitcoin. Meanwhile, estimates suggest that around 201,296 tonnes of gold have been mined, with around 53,000 tonnes remaining in identified reserves. There is of course a possibility that new reserves will be found, but this is unlikely to have any impact on the overall supply. After all, we’ve been looking for gold for years.

Perhaps the more important similarity that Bitcoin has with gold, however, is the cost of mining, which now separates it from the second largest cryptocurrency, Ethereum (ETH-USD).

Mining Bitcoin requires expensive hardware and consumes huge amounts of energy, and every four years Bitcoin is programmed to halve the reward for mining a Bitcoin block. This is similar to gold, which becomes harder to mine as you dig deeper into the earth’s surface. All the easily mined or surface level gold has already been obtained and so has all the easily available Bitcoin. (Back in 2012, one could mine a significant amount of Bitcoin with a standard laptop).

What is most important to understand, however, is that the costly mining method grounds Bitcoin’s real-world value, just as it did for gold. Proof-of-Work is proof of value.

Therefore, Bitcoin shares many of the virtues of gold; it is convenient and available, but with a limited number. It is stable in value because it has no practical use and its supply cannot suddenly increase.

But Bitcoin is even better than gold in at least three key areas.

Practical

While gold is a malleable metal, it may be an exaggeration to say that it is easily divisible and countable. In reality, gold was not a practical tool of trade until it began to be minted into standardized coins. However, this throws a big wrench into the gold bull. Minting and “standardisation” only became possible when large power structures were in place. Great governments such as those of the Roman Empire and long-standing Chinese dynasties were among the first to create coins that were so easily recognizable and reliable that they could change hands anywhere on the planet.

One of the advantages of gold is its ability to act as a neutral and censorship-free form of money, but to actually be practical it was necessary to establish a centralized entity that could mint coins. Of course, we all know how often the Romans ended up devaluing their currency.

Beyond coins, gold certificates have also been used as a convenient way to trade gold, but these are not without problems. While it is much easier for independent banks to do this, eliminating the need for a centralized entity, we now face another dilemma; gold certificates are not equivalent to gold.

Even if the bank issuing the certificate has a coverage ratio of 100%, the certificate is ultimately a promise to pay gold, not gold. This introduces counterparty risk into the equation. All fiat currencies today are a counterparty to sovereign debt, exposing the entire economy to counterparty risk. What happens if the US government defaults? Complete economic collapse.

The appeal of physical gold is that it has no counterparty risk, but it is not convenient to trade. On the other hand, Bitcoin can be traded in its purest form, unadulterated Bitcoin sent between market participants, without the need for an intermediary. This is even more relevant in today’s digital world.

Neutrality

Neutrality is another important reason why gold has always been touted as a superior form of money. It is not controlled by anyone. It knows no borders or political affiliations. Anyone can buy it and everyone will accept it. There are some caveats, of course.

Although gold can be bought freely in most countries, it is also true that most gold production in the world comes from a few countries. Bitcoin is more democratic in the sense that literally anyone can mine it. Even if you don’t have dedicated hardware, you can join a mining pool.

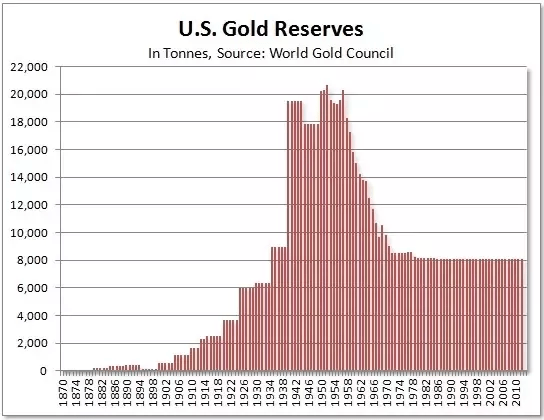

The other big problem is that gold, because of its medical nature, has to be secured, which also gives the custodian a lot of power. We can see in the chart below how the US accumulated gold reserves during World War I and World War II.

US gold reserves (World Gold Council)

Many Allied countries sent their gold reserves to the United States, not because they particularly wanted to, but because they were afraid that the Nazi troops would seize the gold upon invasion, which is exactly what they did.

This put the US in a very powerful position, which of course led to abuse. Bretton Woods created a dollar-centric system, where currencies could be redeemed for dollars, and only dollars could be redeemed for gold. However, it only took a couple of decades for the United States to abandon its promise when Nixon “closed the gold window” in 1971.

This happened because gold has certain limitations. This would not have happened with Bitcoin. Digital currency is much easier to store and secure. This protects it against theft, fraud and unnecessary accumulation.

Censorship

Finally, I would argue that once again, thanks to its digital properties, Bitcoin is more resistant to censorship than gold.

All over the world, gold has been the victim of censorship precisely because it is such a powerful form of money. Politically motivated fiat systems cannot compete head-to-head with gold, which is why there have been many gold bans worldwide.

In 1934, the Gold Reserve Act banned private ownership of gold ahead of a massive dollar devaluation. In China, right now, retail traders are limited in precious metal ownership. And meanwhile the central banks are making gold like they haven’t done in over 50 years.

This hardly seems fair; there is another limitation that gold has and Bitcoin does not. Bitcoin can move freely and anonymously. A law could be passed to ban Bitcoin ownership, but how would it even be enforced? Besides torturing citizens for their private keys, there is little the government can do to seize Bitcoin. And in addition, financial trading can still occur despite a Bitcoin ban. Peer-to-peer transactions in Bitcoin cannot be stopped by decree.

Once again, Bitcoin excels where gold fails.

Final thoughts

In conclusion, there are clear advantages to Bitcoin as a store of value over gold. This is not to say that gold ownership does not have its place. Furthermore, it is important to enter one point for the yellow metal. Gold has a very long history of acting as a store of value, which makes it even more reliable as a store of value. Bitcoin is barely 13 years old, so it still has some history to make.