Why Bitcoin Investors Are on Edge After Genesis’ Bankruptcy Announcement

- Genesis’ bankruptcy filing revived concerns about a potential Bitcoin sale.

- However, bulls broke through the FUD and passed the $22,000 price level.

Genesis reportedly filed for Chapter 11 bankruptcy after failing to secure enough funds to cover its debt. The company, which was one of the largest institutional lenders at one point, has the potential to unwind all the gains made with Bitcoin [BTC] in January 2023.

How much is 1,10,100 BTC worth today?

Genesis was in debt to several lenders as of press time, including bankruptcy exchange Gemini. Genesis reportedly entered into swaps offering GBTC shares to 3AC. The latter is the same crypto firm that collapsed in 2022, leading to losses that have pushed Genesis to its current position.

Genesis Trading filed for Chapter 11 bankruptcy this morning, according to reports @CoinDesk.

All Genesis Trading wallets appear to have stopped operations on the chain 11 hours ago.

Genesis wallets still hold $280M+ worth of crypto, with $220M+ as clean $ETH. pic.twitter.com/Jjdvm3oJy4

— Arkham (@ArkhamIntel) 20 January 2023

Genesis’ connection with Bitcoin

Unfortunately, the 3AC and FTX collapse pushed Genesis into insolvency, meaning it was unable to repay its borrowed funds. Thus, Genesis may be forced to liquidate the crypto funds in the wallet to pay off the creditors. This action could potentially trigger another massive BTC selloff.

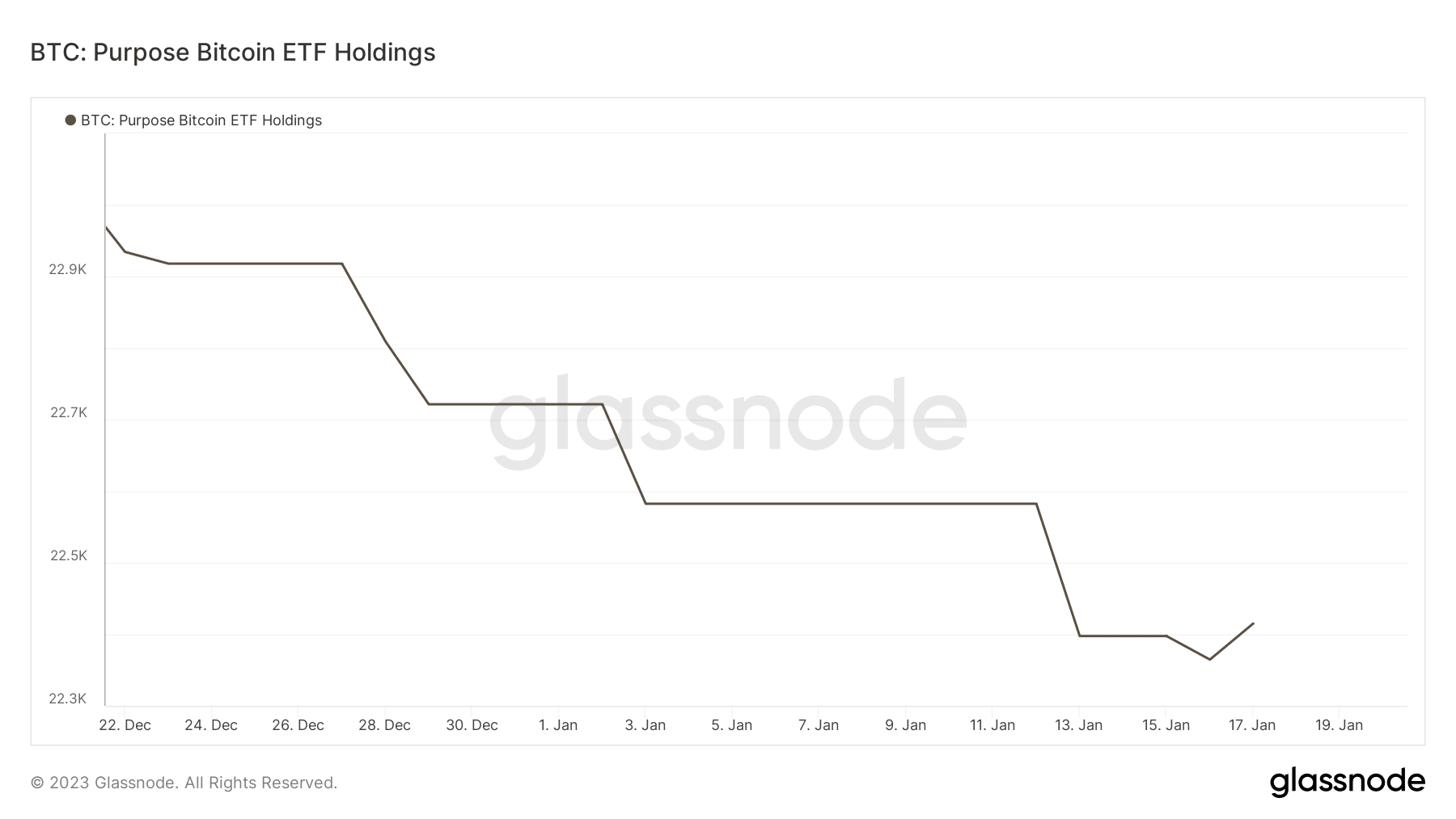

This risk highlighted above may be why BTC had not seen strong institutional demand before press time. This was especially the case with the Purpose Bitcoin ETF, which continued to fall despite the rally it witnessed in January.

Source: Glassnode

However, the same metric appeared to have started to fluctuate at the time of writing, suggesting a positive shift in Bitcoin’s favor despite the aforementioned concerns. The latest interchange flow data was in line with the potential for more downside.

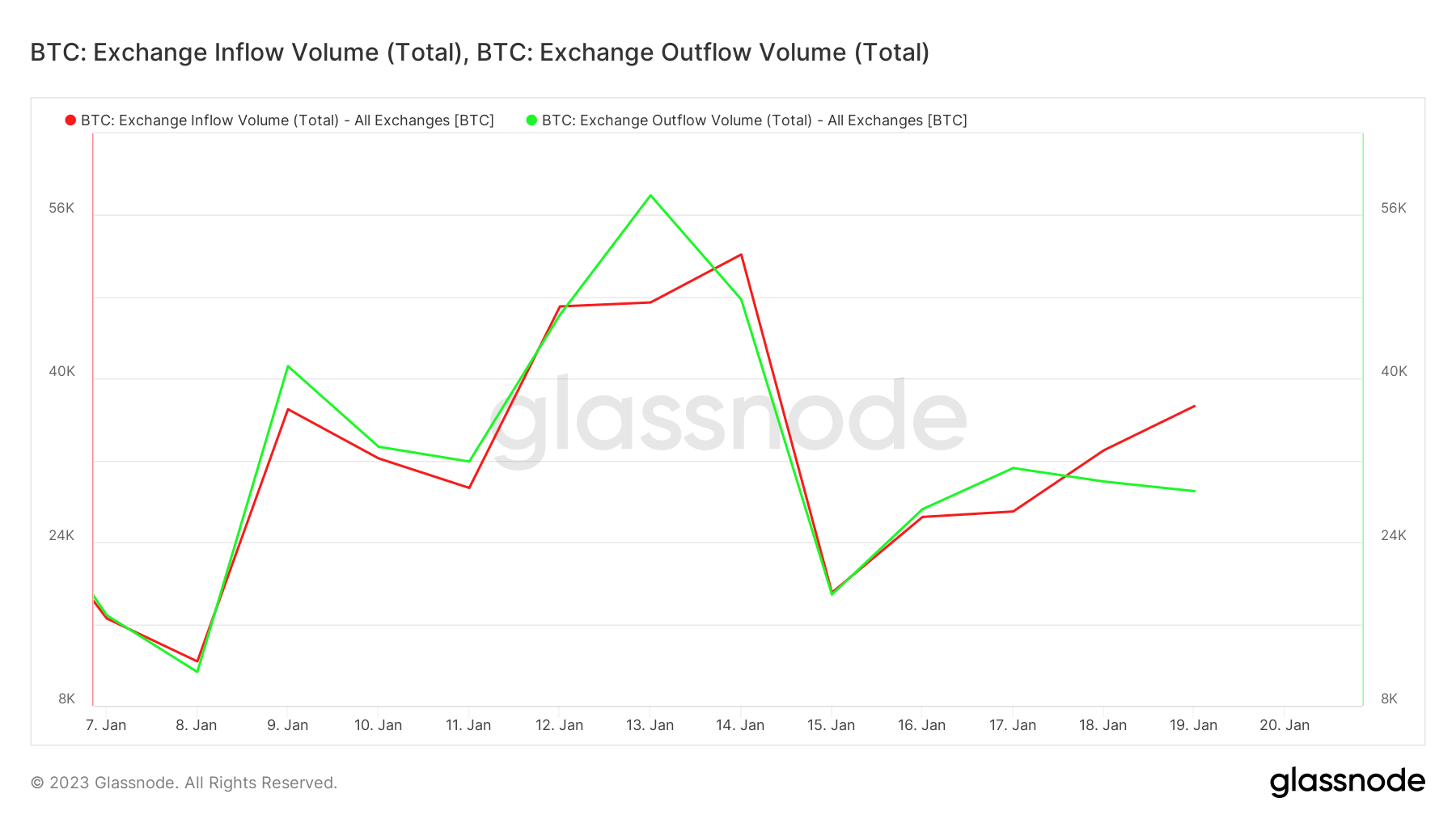

BTC’s exchange inflows offset exchange outflows since mid-week, suggesting that there may be more incoming selling pressure than buying pressure.

Source: Glassnode

Although the conclusion may be sales pressure, it does not necessarily have to be the case. Many Bitcoin holders may move BTC to exchanges in preparation for a potential sale.

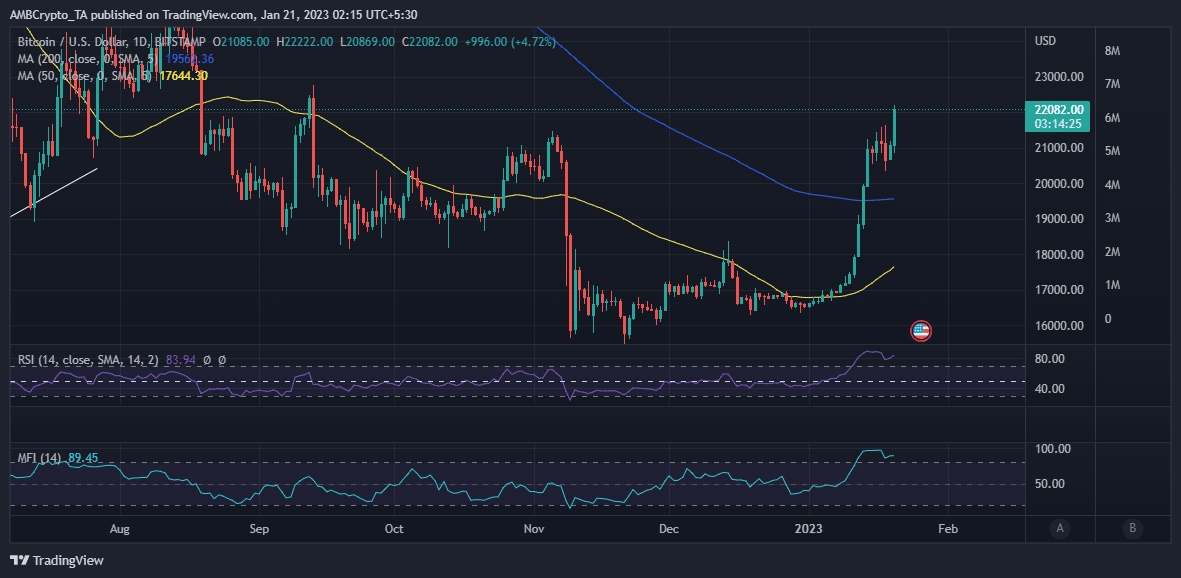

But in a spot of good news, Bitcoin’s price continued to rise despite these concerns. It had breached the $22,100 price range at press time.

Source: TradingView

Is your portfolio green? Check out the Bitcoin Profit Calculator

The press time observation was that Bitcoin bulls had turned a deaf ear to FUD and maintained their dominance. Possibly, the cryptocurrency experienced strong buying pressure during the same period.

This gave credence to the idea that Bitcoin may be in the early stages of the next bull run. Despite this, investors should not throw caution to the wind, as the tables can quickly turn.