Why Bitcoin, Ethereum market activity reveals looming threat of maximum pain scenario

- Bitcoin and Ethereum prices witnessed a rebound following oversold conditions, but activity on the chain and demand for the assets is slowing.

- Ethereum miners generated $571 million in revenue in July 2022, and analysts believe that this ETH will be put back into the market.

- Analysts believe that the rise was relief in the bear market, the Ethereum price may reach a new low before a trend reversal.

Analysts in Glassnode and former Goldman Sachs managers believe that Ethereum holders may witness maximum pain before a recovery in the altcoin. Bitcoin price may also witness a drop in price before the crypto bear market is over.

Also read: Is Ethereum price at risk of falling with falling NFT volume?

Bitcoin, Ethereum witness short burst of market activity

Analysts at Glassnode have assessed whether the recent rise in Bitcoin and Ethereum prices is a bear market rally or a sustained bullish impulse. A decline in chain activity in the two assets suggests weak demand and that the downtrend is still not over despite the recent recovery from extremely oversold conditions.

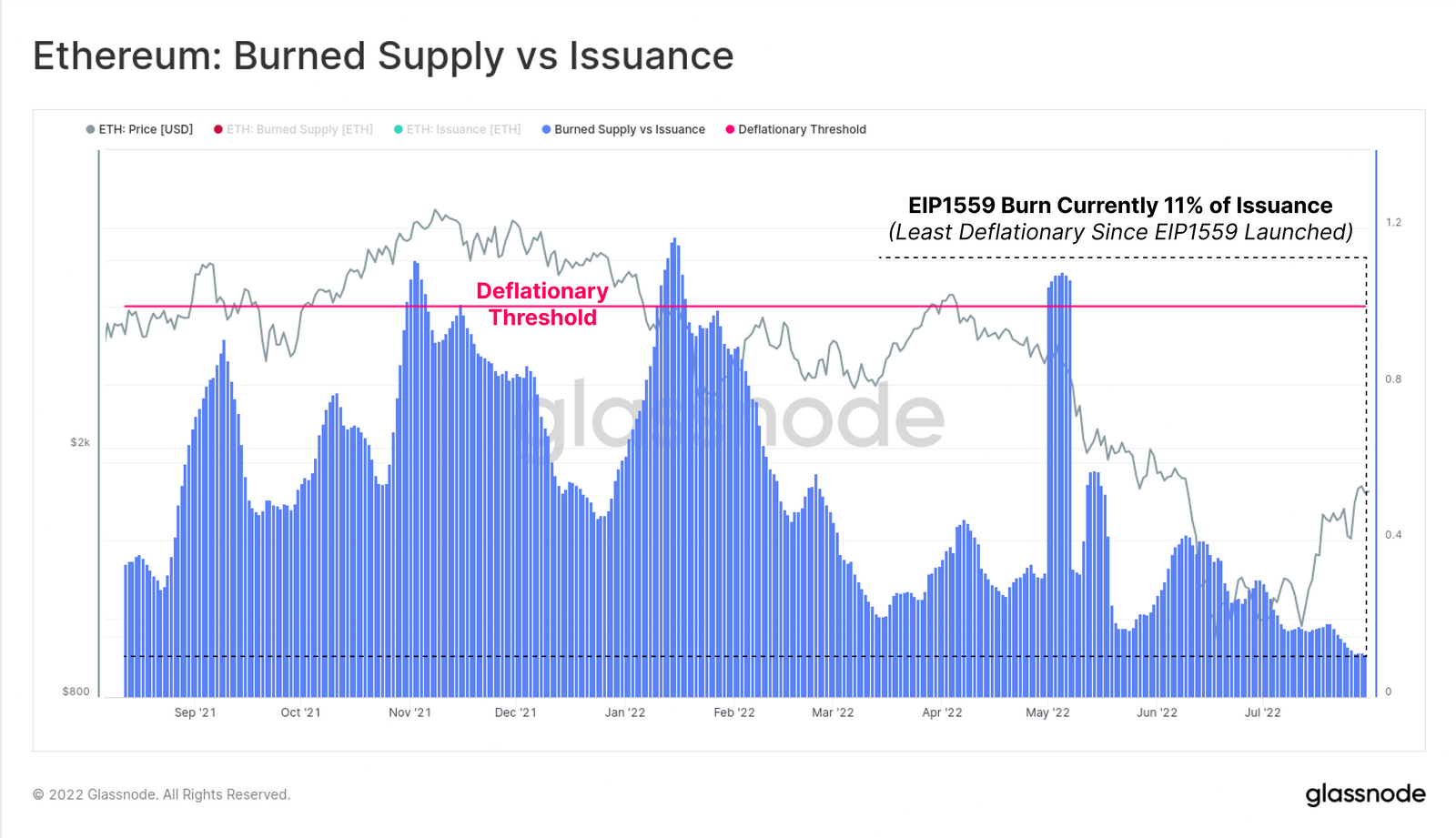

Their conclusion is that the recovery is not convincing enough if it comes against a background of low demand. Bitcoin blocks are partially empty, Ethereum gas prices have hit multi-year lows, and the EIP-1559 burn rate has hit an all-time low. The Bitcoin network continues to be dominated by HODLers (those who buy and hold indefinitely), without any significant increase in new demand, therefore the BTC price outlook remains bearish when viewed through the lens of on-chain activity.

The Ethereum burn rate has dropped, hitting an all-time low. The total Ethereum burned stands at 11% of the total issuance of the altcoin. This means that a large volume of Ethereum is still in circulation, despite the implementation of EIP-1559.

Ethereum: Brent Supply vs Issuance

Ethereum May Face $571 Million in Selling Pressure

Ethereum miners generated $571 million in revenue in July 2022. Adriano Feria, a market analyst and software developer claims that most of the mined ETH values of $571 million will be put back into the market. The resulting selling pressure may push the Ethereum price lower, but the altcoin is set to recover once the merger goes live.

As miners cover their operating costs by selling earned ETH, there is a likelihood that a portion of the $571 million will hit exchanges. However, Feria is confident that the Ethereum price will recover from the setback once the transition to proof-of-stake is complete.

Most of that $571 million $ETH is put on the market again. There is selling pressure driving the price down, but that will disappear once the merger goes live.

— Adriano FΞRIA (@AdrianoFeria) 1 August 2022

Maximum pain scenario for Bitcoin and Ethereum holders

Raoul Pal, CEO of Real Vision arguing that there is a “general feeling” that macro conditions are so bad that ETH could fall to retest the recent low. The former Goldman Sachs CEO claims that Ethereum is likely to move against public sentiment,

But my hunch is that the path to MAX PAIN is higher … $2200 to $2300 is key for me … a breach of that happens either pre-merge or post-merge. Once everyone gets back in, the market can correct sharply before rising again based on the macro.

Analysts at FXStreet are exploring the possibility of ETH price drop to $300

Amid the bear market woes, analysts at FXStreet are examining the possibility of a continuation of Ethereum’s downtrend. This could result in a drop to $300, according to analysts’ predictions. For more information, check out the video below: