Why Bitcoin [BTC] may have one last dance at $12,800 before critical moment

- Bitcoin risked a further price decline due to the indications of Delta ceilings and relations to the 2015 and 2018 trend

- Price action showed that a breakout was not imminent, even as investor confidence fell

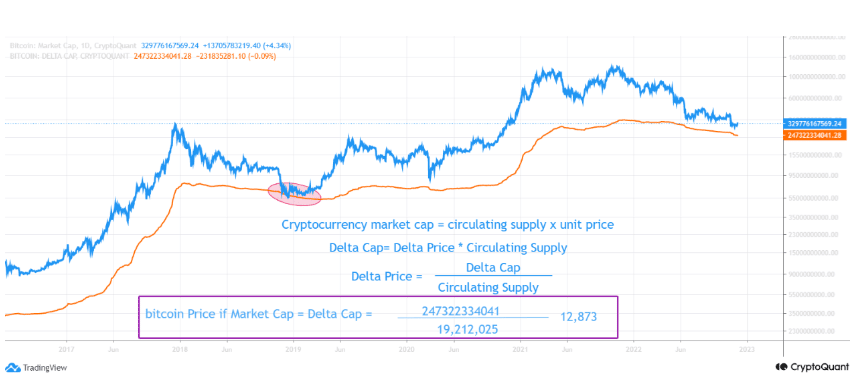

Delta price on Bitcoin [BTC] may indicate that the worst was far from over, said Ghoddusifar, a CryptoQuant analyst. According to himBitcoin’s current Delta price was $12,800.

Read Bitcoins [BTC] Price prediction 2023-2024

The delta price acts as the possible price resulting from the difference between the realized ceiling and the average market value. This conclusion also formed Ghoddusifar’s analysis, thus suggesting that BTC could fall further, as shown in the image below.

Source: CryptoQuant

Look back before the turning point

The analyst not only focused on the recent BTC trend, but also provided evidence of past events. He addressed the fact that the previous cycles in 2015 and 2018 were similar to the current circumstances.

This led to a BTC price drop before there was a “tipping point.” For Ghoddusifar, the current state of bearishness had stuck over, making the price drop inevitable.

He said,

“Based on the amount of bitcoin that fell from the top in previous cycles, as well as the Onchain oscillators, although they show that bitcoin is close to the turning point, the possibility of more falls is also confirmed.”

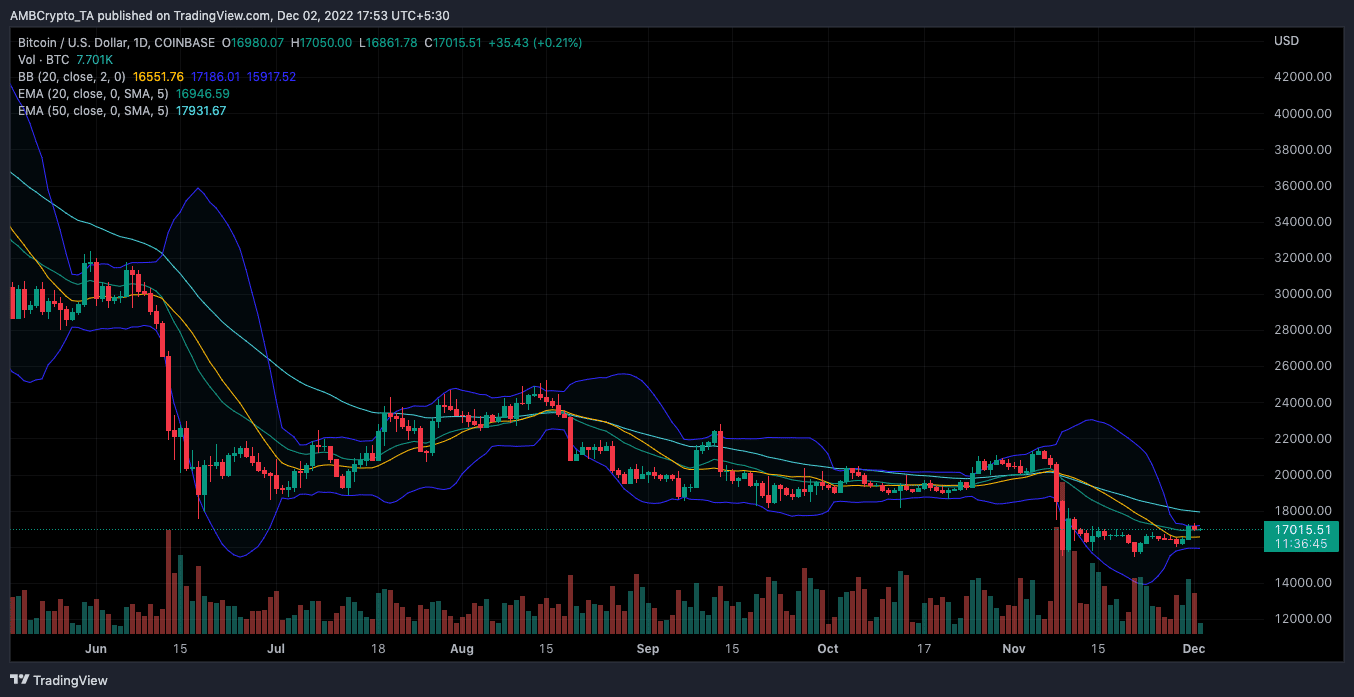

Technically, there seemed to be some valid calls from the analyst. Bollinger Bands on BTC’s daily chart revealed that the coin’s volatility was extremely low.

Since BTC had not broken the lower BB level, it was unlikely to expect a strong bounce to the upside. Additionally, the price, at $17,015, had failed in its attempt to move out of the bands. Consequently, the proposed uptrend was nullified.

Source: TradingView

Also, the exponential moving average (EMA) indicated a possible price drop. This was because the 20 EMA (green) could not overlap the 50 EMA (cyan). In this case, a bearish move was the likely option.

No risk, no reward for Bitcoin

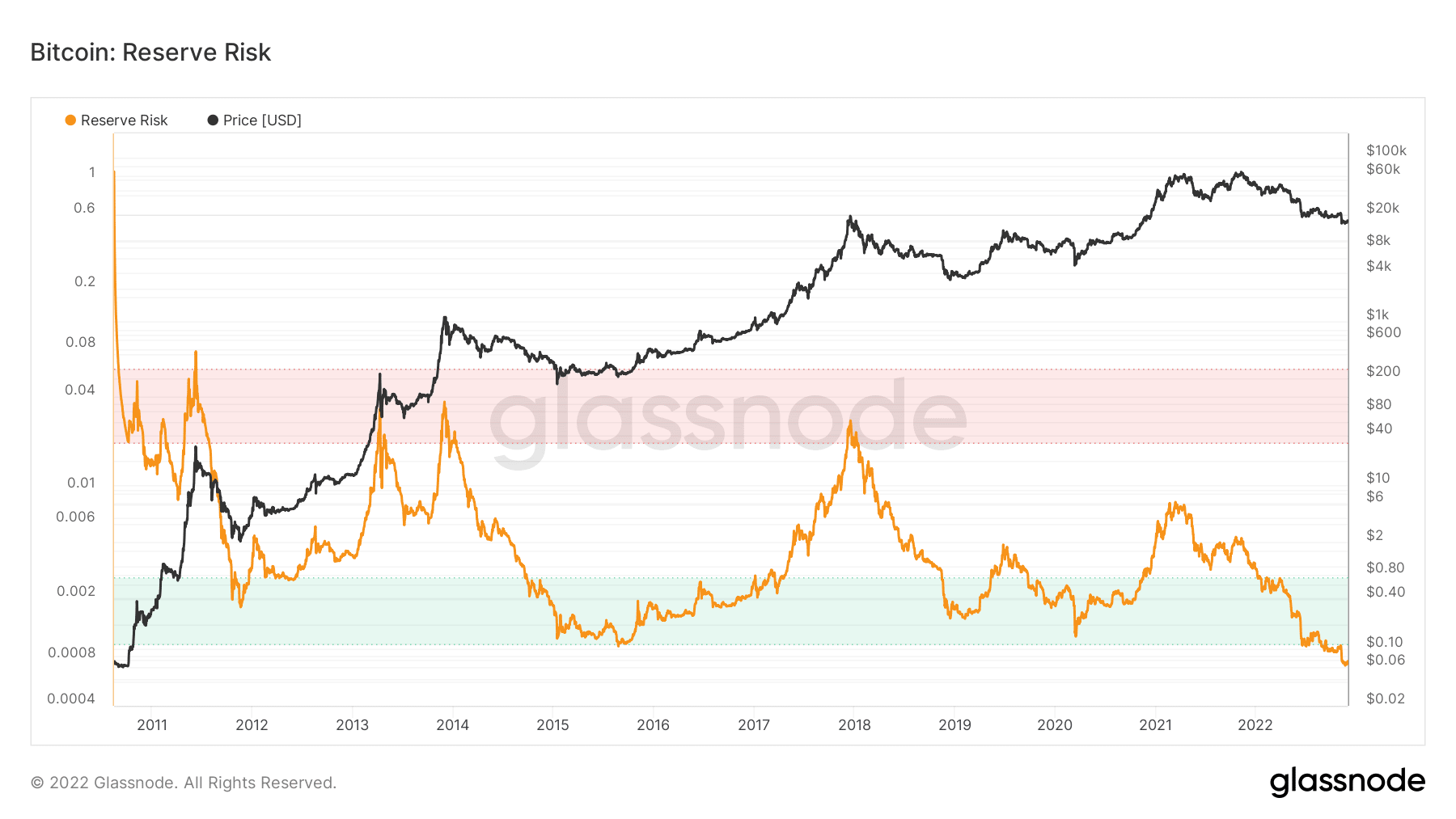

The trend above, which suggested a BTC wash, appeared to have extended in the direction of investors. In accordance Glass nodewas Bitcoin Reserve Risk at 0.00076.

This point was considered low and reflected that long-term owner confidence was not at its peak. In a case where the reserve risk was high and the price was low, it could signal another point accumulate,

However, that was not the case, as it further suggested that the previous drop below $16,000 was not the lowest BTC could hit.

Source: Glassnode