Why and how does the Bitcoin price change?

Bitcoin has yet to be toppled from the top position in the cryptocurrency world by any altcoin. It is widely regarded as the first ever blockchain-based cryptocurrency. From 2009 until now, Bitcoin, which was supposed to be “electronic cash”, has not been widely accepted as a form of money.

When the idea of Bitcoin was launched, its creator Satoshi Nakamoto presented it as “electronic cash” and not as a speculative asset. At the time, Bitcoin was neither considered an alternative to precious metals like gold nor to listed stocks. The cryptocurrency was considered an alternative to the current dominant form of money – fiat currency. In particular, while the value of currencies such as the US dollar or AU dollar usually rise or fall by very small margins, the value of Bitcoin can change drastically over a short period of time.

Today, let’s understand why and how the price of Bitcoin or any other cryptocurrency changes.

Speculative asset, not money

The way Bitcoin works right now is contrary to how Nakamoto envisioned it. Instead of being widely accepted in the payment system, the cryptocurrency has become a globally popular and controversial speculative asset. A listed stock is an example of a speculative asset. The price variation in such assets is a product of market sentiments, particularly buy-and-sell trading activities.

Its proponents hail Bitcoin as a medium of exchange that can reduce the time and costs involved in payment transfers. The US dollar is considered a very critical player in trade and commerce, thanks to the fiat currency’s near-universal acceptance.

Demand and supply

Bitcoin trades on specialized cryptocurrency exchanges, the way listed stocks do on stock exchanges. The value of Bitcoin is a product of how many people are willing to buy and sell it. The more buyers who compete and outbid others, the higher the price can be. When demand falls, value automatically falls. By this measure, the function of Bitcoin resembles not that of fiat currencies, but that of speculative assets.

On the other hand, most other speculative assets such as gold and stocks are usually less volatile than cryptocurrencies, including Bitcoin. This is why many people also see Bitcoin as too risky and prone to very large losses. The reason is that many experts believe that Bitcoin lacks utility as a medium of exchange and that it cannot also be compared to the listed shares that represent a specific company engaged in commercial activity.

Ultra-volatility of Bitcoin

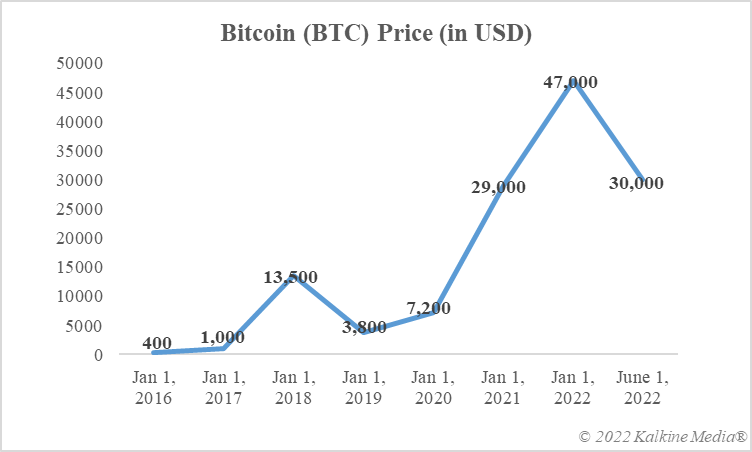

Publicly traded stocks can sometimes be volatile, but cryptocurrencies can be too volatile. The price of Bitcoin grew strongly in 2020 and 2021, but a sharp drop followed this in 2022. The speculative asset market has recently been weak due to rising interest rates, with stocks such as Microsoft enduring losses. But the loss in value of Bitcoin is relatively very large. Events such as a company declaring acceptance of Bitcoin in payments may result in a limited increase in the cryptocurrency’s value. On the other hand, a negative comment from someone like Elon Musk could also trigger a broad selloff in Bitcoin.

Stated data of CoinMarketCap.com

The bottom line

The answer to why the price of Bitcoin changes is that it acts as a speculative asset at the moment. How it changes depends on the mood of the market, with supply and demand forces determining the price at any given time. Bitcoin has not yet been considered a stable medium of exchange by the wider financial world. Even the legalization in El Salvador declaring Bitcoin as legal tender has invited criticism from various quarters, including the International Monetary Fund.

Risk Disclosure: Trading cryptocurrencies involves high risks, including the risk of losing part or all of your investment amount, and may not be suitable for all investors. The prices of cryptocurrencies are extremely volatile and may be affected by external factors such as economic, regulatory or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) are subject to change. Before deciding to trade in financial instruments or cryptocurrencies, you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience and risk appetite, and seek professional advice where necessary. Kalkine Media does not and cannot represent or warrant that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept responsibility for any loss or damage resulting from your trading or your reliance on the information shared on this website.