Which Way Will Bitcoin Break?

Three Reasons Luke Lango Expects More Bullishness for Bitcoin … Banking Chaos, a Dovish Fed and Growing Risk-On Appetite … PacWest Falls Again … Year-To-Date Performance for Top Cryptos

As I write early Thursday afternoon, regional bank PacWest is down 26% on news that deposits fell 9.5% during the week of May 5.

We’ll come back to this in a moment, but let’s move on to a topic that may seem unrelated at first…

Bitcoin.

As you can see below, the grandaddy crypt has been space bound since mid-March.

Source: StockCharts.com

The question now is “will it erupt to the north or south?”

Well, yesterday Bitcoin climbed after the CPI report showed continued progress on inflation. Today is slightly down as PacWest bank news has investors on edge.

While headlines will certainly push Bitcoin’s price around in the short term, what we want to know is where it’s headed in the long term. Fortunately, the influences dictating this view are becoming increasingly bullish.

So what are they?

In his last Crypto Investor Network update, our crypto expert Luke Lango identified three:

One, the continuing regional banking crisis.

Two, a dovish trend in Fed policy toward a pause.

Three, a general return to risk sentiment in financial markets.

Put them all together, and here’s Luke’s bottom line:

Importantly, we expect all three tailwinds to persist for the remainder of the year, and thus we believe cryptos will remain in “rally mode.”

Let’s look at each one.

Watch out for more bank contagion, which brings us back to PacWest

Before we get into the details, for recent Digest readers, Luke is the analyst behind it Crypto Investor Network. While this newsletter focuses on cutting-edge altcoins, Bitcoin remains the barometer of the crypto sector. In general, the trend sets the direction of momentum for the wider altcoin world. So to get a sense of where the sector is headed, Bitcoin gets the spotlight.

Now, Bitcoin is off to a fantastic start this year. That’s up about 10 times the return of the S&P (about 66% compared to about 6%). But if Luke is right, there are still many more wins to come.

As to why, let’s address his first highlighted tailwind – banking mayhem. Remember, Luke wrote this before this morning’s PacWest fireworks:

It has become abundantly clear that the regional banking crisis is not over and that dozens of regional banks could fail when all is said and done.

[Last] week, we saw near misses in two more regions – First Republic and PacWest. In the past two months, four major regional banks have now either failed or nearly failed.

Cryptos were invented as a replacement for banks. Theoretically, when banks fail and consumer confidence in the US banking system declines, it should boost cryptos. We are seeing it happen right now.

As mentioned earlier, PacWest shares are down heavily as investors fear yet another bank will fail due to a run on deposits.

Now, PacWest management reports that it has the liquidity to meet these withdrawal requests. But if the fear of snowballing results in even more requests, will it be able to meet these additional requests?

This is the classic “bank run” that can topple an institution, except there’s a twist…

While a depositor had to stand in a long queue to receive their bank savings in earlier years, a few clicks can do the job today. This only adds to the potential damage as fears of a bank failure spread.

Beyond just PacWest, we share Luke’s broad concern for the banking sector

This spring Tuesday Digestwe analyzed the weakness, and concluded that it is far too early to declare that the crisis is behind us.

As a broad summary, here is New York Times:

Yes, you should be worried about a potential banking crisis…

Our nation’s banking system is at a critical juncture. The recent fragility and collapse of several high-profile banks is most likely not an isolated phenomenon.

In the short term, a damaging combination of rapidly rising interest rates, major changes in work patterns and the potential for a recession could lead to a credit crunch not seen since the financial crisis of 2008.

By the way, on Tuesday, legendary investor Louis Navellier gave an urgent briefing to explain this escalating weakness in the banking sector, why the problems are not over, and how you can protect both your savings and your investments. Remember, Louis is a former banking regulator, so he has a unique insight into this growing toxicity. To watch a free replay of the event, just click here.

Back to Luke, here’s how he sums up this point about banking:

We believe many more regional banks will collapse before this saga is over. Therefore, we believe cryptos will continue to benefit from the regional banking crisis in the coming months.

The Federal Reserve’s continued evolution toward competence

Last week, the Fed held its May FOMC meeting and indicated that it will not raise interest rates in June.

Here is Luke with these details:

We learned [last] week that the Fed will pause its rate hike campaign in June.

Of course, they didn’t say that explicitly on Wednesday. They can’t. But they did anything but say it explicitly.

They coughed, blinked and nudged, with all their rhetoric and communication strongly suggesting that Wednesday was their last rate hike of this cycle.

“Fed Pause” is here.

Wall Street traders agree. We can see this by looking at CME Group’s FedWatch tool, which surveys traders about their expectations for upcoming interest rate levels. As I write on Thursday, the probability of a break in June is a whopping 99.1%.

Back to Luke:

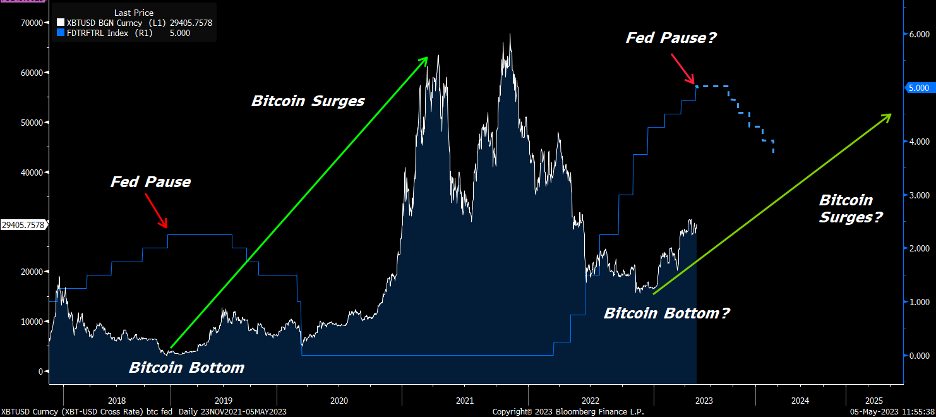

[A Fed pause] is extremely bullish on crypto. The last Fed break in early 2019 meaningfully accelerated the third Crypto Boom cycle. We believe that this mid-2022 Fed break will meaningfully accelerate the fourth Crypto Boom cycle.

Source: Bloomberg

But why is a Fed pause good for Bitcoin?

Well, first, remember that investors have many options for their investment capital. When interest rates are high, “risk-free” assets can provide returns that are very attractive to certain investors (for example, a two-year Treasury pays nearly 4%). This can lure money away from assets like Bitcoin that do not provide returns.

So when interest rates stop, it is the necessary next step towards an eventual rate cut that will reduce the attractiveness of yield-paying assets.

Additionally, many of the projects in the digital altcoin world are bootstrapped and require debt financing. When interest rates are high, there is a rapid headwind against profitability. So when interest rates stall (which in turn suggests an eventual rate cut), it promotes optimism about future economic conditions.

Since investors are always positioning their money for “what’s coming,” a rate break often acts as a starting gun for investors looking to get ahead of any rate cuts.

And this ties in with Lukas’ last point…

Investors are becoming more comfortable with risk

Back to Crypto Investor Network Update:

Finally, investors generally grow more risk-seeking in 2023.

Inflation is falling. The Fed has become more dovish. The economy is proving to be robust. These macroeconomic factors have turned investors who fear the Fed will tip the economy into recession into investors hoping for a soft landing.

Risk-on sentiments have returned to the markets.

To illustrate, Luke highlights the strong performance of technology and growth stocks here in 2023.

In fact, the tech-heavy Nasdaq is about to enter a new bull market, as defined by being up 20% from its most recent low. This is how it looks.

Source: StockCharts.com

By the way, I should note that Luke’s core portfolio in his tech-focused Innovation Investor service is up 27% year-to-date (as of yesterday). That is another indicator of this technological strength.

Back to Luke:

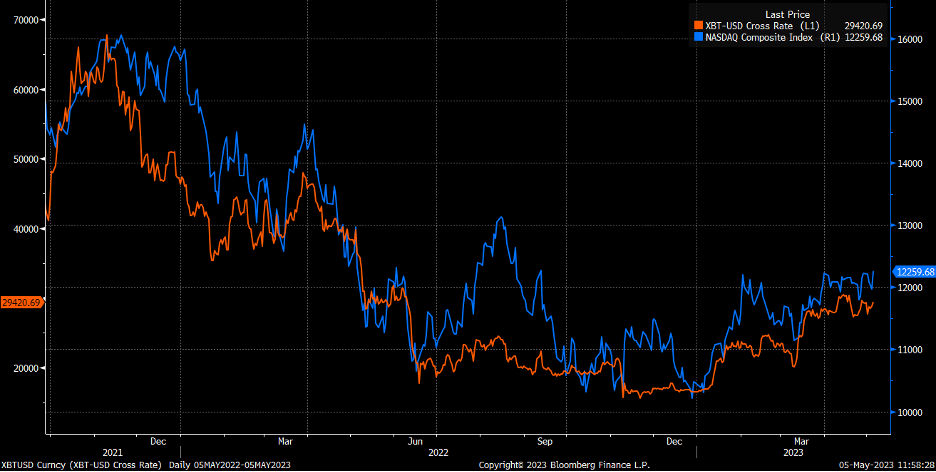

This [tech bullishness] is bullish on crypto because over the past few quarters Bitcoin has acted as a major tech stock. The price path of Nasdaq and Bitcoin mirror each other back to 2021.

Source: Bloomberg

We expect risk sentiment to improve significantly over the next few months and therefore believe we will have a “rising tide lifts all boats” situation in the financial markets.

We think the fastest rising boat in that tide will be crypto.

A snapshot of overall market strength

Before we wrap up, let’s take a look at the performance of some of the biggest/most owned cryptos here in 2023. As you can see, it’s a strong performance.

Bitcoin – 66%

Ethereum – 53.7%

GNP – 27.6%

XRP – 26.6%

Cardano – 49.6%

Solana – 110.0%

Polygon – 15%

Polka Dot – 26.6%

But if Luke is right, this is just the beginning. To learn more about joining him Crypto Investor NetworkClick here.

Here’s Luke to take us out:

Overall, we are very optimistic about the outlook for crypto.

The fundamental factors that have the greatest influence on crypto prices are improving meaningfully and will continue to improve for the foreseeable future. This supports further strength in crypto prices.

The technicals are also supporting further strength, with Bitcoin continuously showing support exactly where it needs to show support to preserve the technical uptrend in 2023.

Accordingly, we continue to emphasize a “buy-the-dip” strategy to the crypto markets in 2023, with dip-buying efforts focused on the cryptos in our portfolio.

Have a nice evening,

Jeff Remsburg