Which has the advantage in crypto trading?

As cryptocurrencies continue to gain momentum in the global economy, Bitcoin’s long-standing dominance is facing a growing challenge from Ethereum. This second most valuable cryptocurrency has innovative features that have sparked discussions about a possible shift in precedence. Ethereum vs. Bitcoin. Is there a clear winner?

In this article, we delve into the strengths and weaknesses of both Ethereum and Bitcoin, while examining the potential for Ethereum to dethrone Bitcoin in the not-too-distant future.

Bitcoin has undeniably long reigned as the king of cryptocurrencies. However, Ethereum’s rapid progress and unique features have ignited debates about a potential escalation. Here we will analyze the strength of both and the likelihood of Ethereum surpassing Bitcoin in the near future.

Ethereum’s advantage

Ethereum’s platform has the ability to support decentralized applications (dApps) and smart contracts. These innovations have enabled a myriad of use cases, such as decentralized governance, prediction markets, and supply chain management. In contrast, Bitcoin’s architecture focuses primarily on secure and decentralized transactions, which limits potential applications.

An example of Ethereum’s versatile platform is Uniswap, a decentralized exchange (DEX) that allows users to trade tokens without a centralized intermediary. Uniswap’s success shows the potential of dApps built on Ethereum’s network.

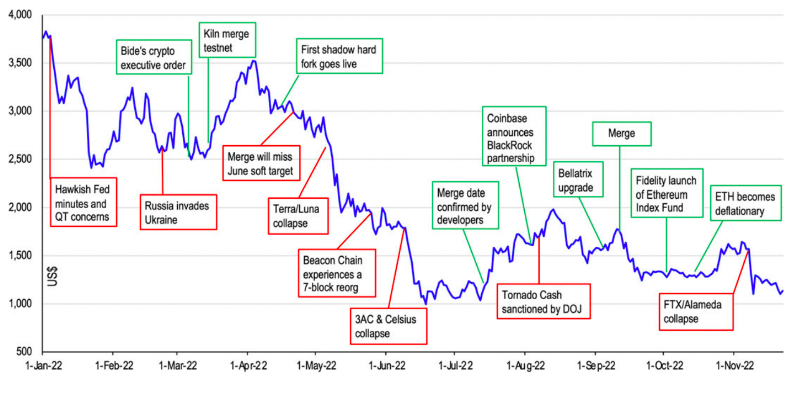

The Ethereum 2.0 upgrade and Shanghai hard fork addressed two pressing concerns: scalability and environmental sustainability. By adopting a Proof of Stake (PoS) consensus mechanism, Ethereum significantly reduced energy consumption, positioning itself as a greener alternative to Bitcoin’s energy-intensive Proof of Work (PoW) system.

The Ethereum upgrade also introduced sharding, a technique that increases transaction throughput by dividing the network into smaller, interconnected units called shards. This reduces congestion and improves overall network performance, making it more attractive for large projects.

Ethereum’s prominence in the DeFi and NFT markets increases its potential to overtake Bitcoin in market capitalization and real-world applications. With DeFi enabling lending, borrowing and asset management, and NFTs ensuring unique ownership of digital assets, Ethereum is becoming important.

Examples include Aave, an Ethereum-based DeFi lending platform, and Ethereum’s booming NFT market, with projects like CryptoPunks and Bored Ape Yacht Club.

Bitcoin’s Persistence

Bitcoin’s pioneering status and established network have secured its position as the leading digital resource. The network effect it enjoys makes it difficult for competitors to match it for recognition and adoption. Even when they introduce new features and technological advances.

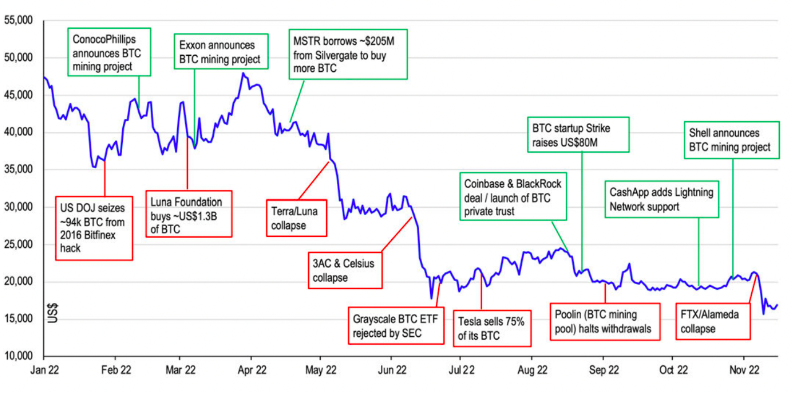

A notable example of Bitcoin’s network effect is the Lightning Network, a second-layer solution that enables faster and cheaper transactions. By leveraging Bitcoin’s established infrastructure, the Lightning Network has gained traction, further strengthening Bitcoin’s dominance.

Bitcoin’s limited supply and deflationary nature have earned it the designation of “digital gold,” establishing it as a reliable store of value. As other cryptocurrencies advance technologically, Bitcoin’s scarcity and stability continue to entice investors seeking a hedge against inflation.

Institutional investors such as MicroStrategy have invested billions of dollars in Bitcoin, exemplifying its appeal as a store of value. Moreover, countries such as El Salvador have adopted Bitcoin as legal tender, further confirming its role in the global financial landscape.

Bitcoin’s PoW consensus mechanism has stood the test of time, offering unmatched security and decentralization. Despite Ethereum’s innovations, Bitcoin remains the gold standard in terms of robustness, keeping it at the forefront.

Bitcoin’s network, operated by a number of miners worldwide, contributes to its security and decentralization. The massive computational power required to attack the network deters potential adversaries, ensuring that transactions remain secure and reliable.

Ethereum vs. Bitcoin: The Future

Ethereum’s progress and DeFi/NFT prominence suggest it may surpass Bitcoin. But Bitcoin’s first mover advantage, store of value status and strong security ensure it remains formidable.

Finally, the competition may focus on the distinct roles of Ethereum and Bitcoin in the blockchain ecosystem. As the landscape evolves, both are likely to influence and promote industry growth in complementary ways.

Ultimately, it is likely that Ethereum and Bitcoin will coexist, catering to different niches in the crypto space.

Ethereum, with its versatile platform and innovative technology, can become the backbone of decentralized applications and digital asset markets.

Bitcoin, as a secure digital gold standard, can persist as a hedge against financial uncertainty.

Whichever cryptocurrency leads, the evolving blockchain landscape will reshape finance, governance and various industries. Both Ethereum and Bitcoin will be crucial in shaping the future of the digital economy.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should verify information independently and consult with a professional before making decisions based on this content.