Which bear market? The NFT transaction volume hits ATH in the second quarter despite falling prices

Fears of a global recession have forced some investors to look for alternative markets to achieve better returns. The latest research from BestBrokers showed that NFTs can be the alternative market investors flock to, as the sector has seen its best quarter so far.

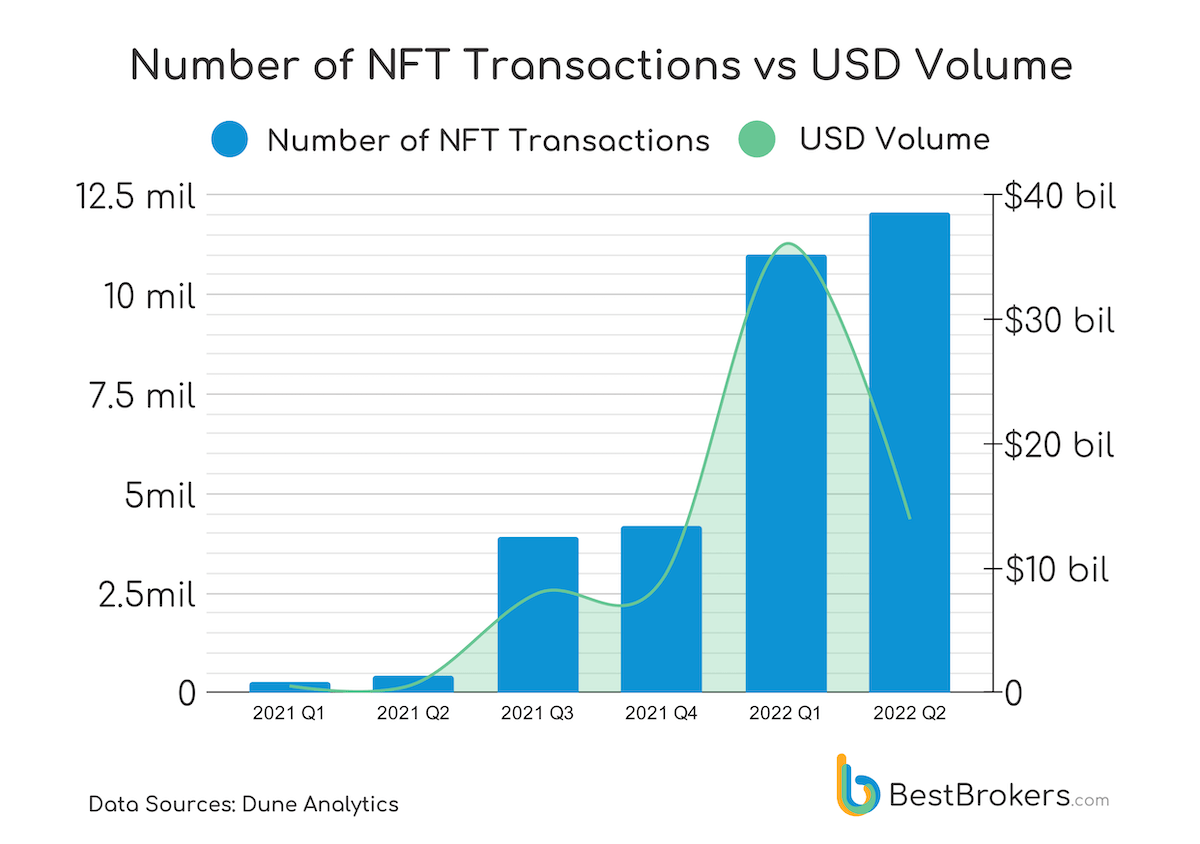

In the first and second quarters of the year, the total number of NFT transactions exceeded the 11 million mark, while the last quarter approached 12 million NFT transactions.

The increase in the number of transactions is in direct contrast to the sharp decline in the USD trading volume NFTs has seen in the last quarter. The start-up of a bear market and the intense price volatility in recent months have wiped out over $ 1.3 trillion from the crypto market. And while both spot and derivatives trading volumes suffered, it seems that NFTs are changing hands more than ever.

According to data from BestBrokers, there have been 12 million NFT transactions in the largest marketplaces, which include OpenSea, LooksRare, Rarible, SuperRare, LarvaLabs and Foundation. The volume is an increase of 9% from the 11 million transactions registered in the first quarter and an increase of 2,857% from year to year.

Since they first broke into the mainstream in 2021, NFTs have seen their popularity explode. In December 2021, the number of NFT transactions reached 1.7 million – an increase of over 9,300% in less than 12 months.

Analysts believe that the increase in NFT trading, while global markets are down, shows that bulls are looking for opportunities even under the worst market conditions.

Alan Goldberg, an analyst at BestBrokers, said that despite rapidly falling cryptocurrencies, NFTs still offer great opportunities for long- and short-term trading.

“When the entire global economy declines in 2022, we will see a huge increase in the number of NFT transactions, which means that traders will find it more attractive than the traditional assets in the current bear market.”

Goldberg explained that the fall in prices is also an excellent opportunity for traders to acquire popular non-fungible tokens at a very low USD value. And with many investors expecting a downturn in the future, trades will have to pay back.

“While many analysts are discussing cryptocurrency winter and a Bitcoin bear cycle, it is worth considering the fact that cryptocurrencies are not alone in this disorder, and they are likely to bounce back with the other markets. Traders’ interest that somehow shifts to The NFT market only proves that blockchain technology is here to stay, and it should not be depreciated, he added.