Where will the Bitcoin price bottom? – Bitcoin Magazine

Below is an excerpt from a recent issue of Bitcoin Magazine Pro, Bitcoin Magazine premium market’s newsletter. To be among the first to receive this insight and other market analysis on the bitcoin chain straight to your inbox, Subscribe now.

CPI volatility does not disappoint

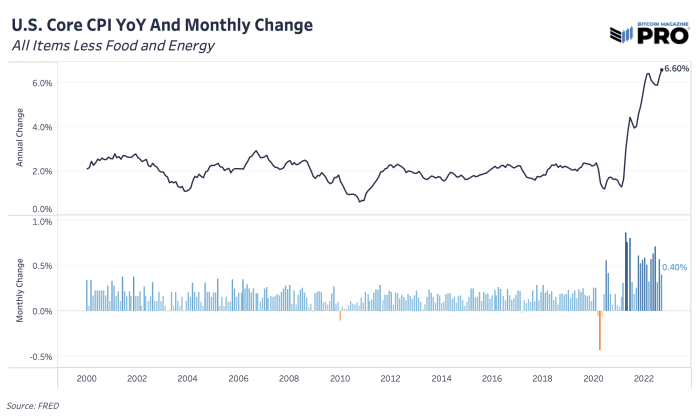

In the last article, we highlighted a potential for CPI to surprise on the upside and bring more volatility – and that’s exactly what we got and more. We won’t cover the components that created the surprise in detail since we’ve already highlighted a lot of it, but most importantly, the core CPI came in hotter than expected at 6.6% year-on-year and 0.4% month-on-month -month with shelter (rent, housing components, etc.) and medical services as key drivers. This is the fastest rate of change in annual overall core CPI since 1982. To compare the various components over the past three months, check out this diagram.

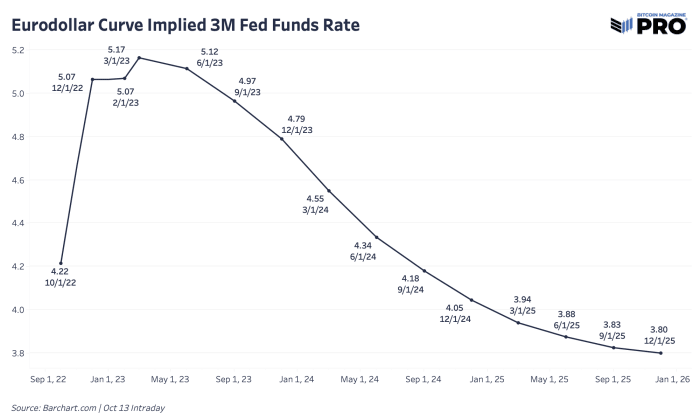

As for rates, the latest implied federal funds rate from the Eurodollar market shows a peak just above 5% in March 2023 before any rate cuts happen at the end of the year.

Where is the Bitcoin price low?

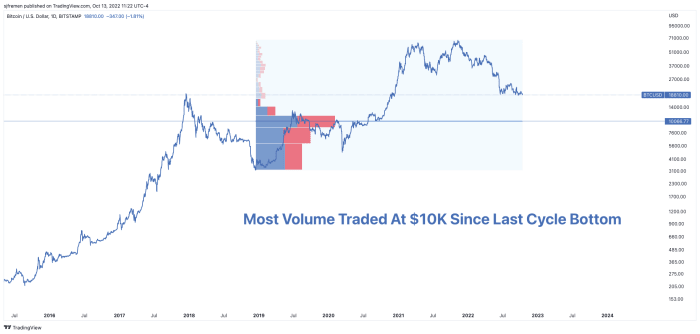

With a drop to $18,000 looming and bitcoin facing the risk of new year-to-date lows, it’s worth taking a look at some key floor price levels to gauge where the price could end up. First, let’s look at the profile of the fixed volume range of bitcoin since the bottom of December 2018 in the last cycle. The overwhelming majority of traded volume in the market occurred right around $10,000, also an important psychological level. In a strong down move, $10,000 is a place where many in the market have their spot cost basis and can start to feel some real pain or lack of conviction.

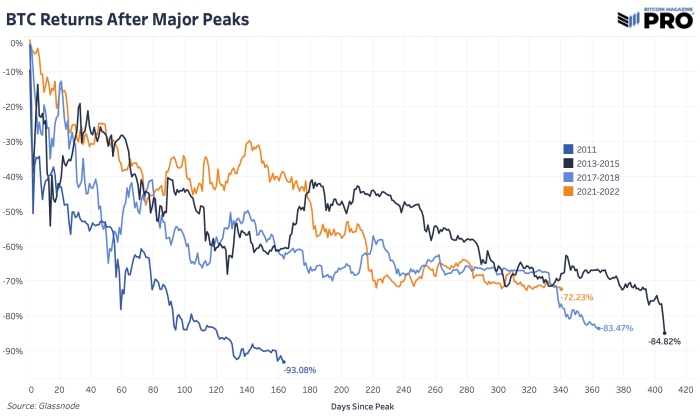

Regarding bear market and cycle duration, let’s look back at the cyclical drawdown chart for bitcoin in current and previous cycles. Currently, we’re right around a 72.23% move from a record high close of $67,589. If we’re going to see a max cycle decline come in less than the last two cycles – say around 80% – then we’re looking at a price around $13,500. If we assume this cycle and the bounce in valuations will be much worse, let’s say around 85%, then we’re looking at a price around $10,100. The point is that we have found a durable bottom at $18,000 and we will not see the maximum drawdown now beyond 73%.

From an on-chain perspective, one of the more interesting realized price ranges is the realized price held by the group of addresses that hold 10-100 BTC. Remember that realized price is an estimate of the average cost basis based on the price when UTXOs last moved. This particular group accounts for around 22.6% of all circulating supply. This group will certainly reflect a decent portion of long-term owners, and there’s a case to be made that in a deep, prolonged bear market, long-term owners have yet to feel the pain or capitulation that we’ve seen in the past.

Relevant previous articles: