When does the bear market end?

Below is an excerpt from a recent issue of Bitcoin Magazine Pro, Bitcoin Magazine premium markets newsletter. To be among the first to receive this insight and other market analysis on the bitcoin chain right to your inbox, Subscribe now.

Price-based capitulation versus time-based capitulation

A look at previous bitcoin bear market cycles shows two distinct phases of capitulation:

- The first is a price-based capitulation, through a series of sharp sales and liquidations, as the asset pulls down anywhere from 70 to 90% below previous all-time high levels.

- The second phase, and the one much less often talked about, is the time-based capitulation, where the market finally begins to find a balance between supply and demand in a deep bottom.

Let’s cover both of these phases with images and data taken from the blockchain.

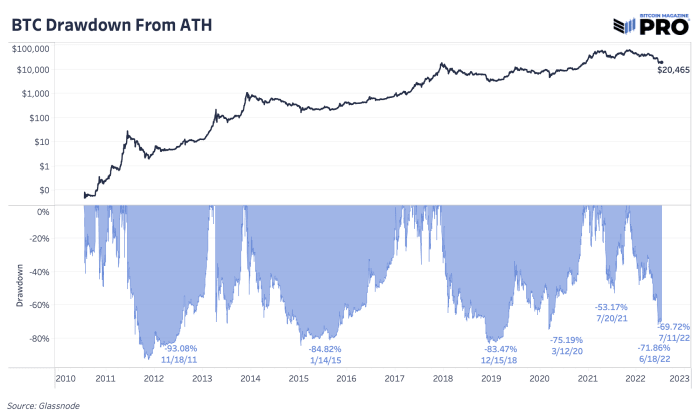

Bitcoin Drawdowns from All-Time Highs

While much has been written about the macroeconomic backdrop regarding the bitcoin market (with our analysis probably included), this bitcoin cycle ironically does not look so different from the cycles of the past.

At the time of writing, bitcoin is 69.72% below previous all-time highs, with the peak of the decline reaching 71.86% on 18 May. The bear markets with bitcoins previously saw declines of 93.08%, 84.82% and 83.47%, respectively. With this in mind, despite the fact that the absolute size of this cycle’s downsizing dwarfs previous cycles, this was relatively nothing out of the ordinary for bitcoin.

When the average owner of bitcoin is under water, despite the parabolic gains seen over longer time frames, we look at this as a classic price-based capitulation event.

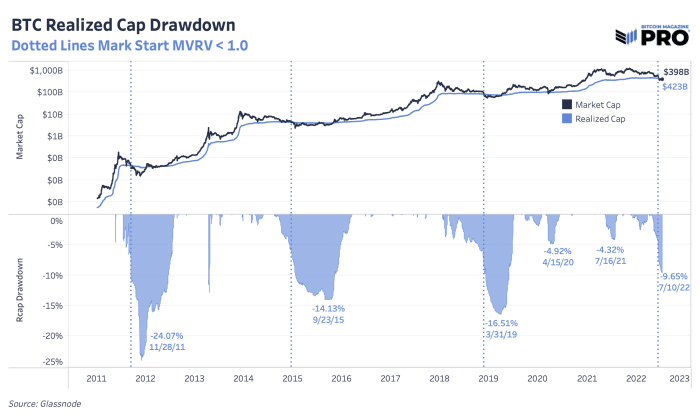

Time-based capitulation

What follows the collapse of the market below the average cost basis for the average holder is what we consider to be the time-based capitulation event. As the average owner is under water, most marginal sellers have already sold their holdings, and although further disadvantages are possible, the “pain” market participants feel is in the form of a longer period spent under water instead of rapidly falling prices that marked the start. in the bear market.

It is also worth noting that as the price falls, and market participants capitulate at a loss, the average cost base (realized price) falls. To contextualize this decline in the “fair” value of bitcoin, the history of realized price features is shown below.

Bear market cycles take time to play out and vary in length depending on how you define them.

In all likelihood, the bulk of the biggest capitulation event in bitcoin’s history has just happened. More balance contagion is definitely on the table (rather hiding under it), and the macroeconomic environment is looking increasingly ugly. Holders should restrain themselves, not only in the event of more severe market declines, but the undoubtedly more painful possibility of extended sideways action along with lower prices and much sideways chopping when coins are transferred from weak hands to strong hands, and from the impatient to the convinced.

Bitcoin is here to stay. Your job is simply to survive.