What’s next for ApeCoin after Bored Ape Yacht Club dethrones NFT collections to rank first

- ApeCoin price makes double-digit gains over the past two weeks, as Bored Ape Yacht Club dethrones blue-chip NFT collections.

- Bored Ape Yacht Club closed 2022 as the NFT collection with the highest market cap despite a 38% decline.

- APE is at risk of downside as technical indicators show that the NFT token is currently overbought.

ApeCoin, an Ethereum-based NFT token, gave almost 10% gain for holders in the last 14 days. APE is the original symbol of the Bored Ape Yacht Club (BAYC) ecosystem. BAYC reached another milestone in 2022, dethroning other blue-chip NFTs such as CryptoPunks to rank first in terms of market capitalization.

Also read: Ethereum Whales Scoop Up Shiba Inu Tokens; Here’s what you can expect

ApeCoin outlook turns positive as Bored Ape Yacht Club reaches new milestone

ApeCoin is the original token of the Bored Ape Yacht Club universe. BAYC is an NFT collection that contains 10,000 digital artworks and competes with blue-chip collectibles in the ecosystem.

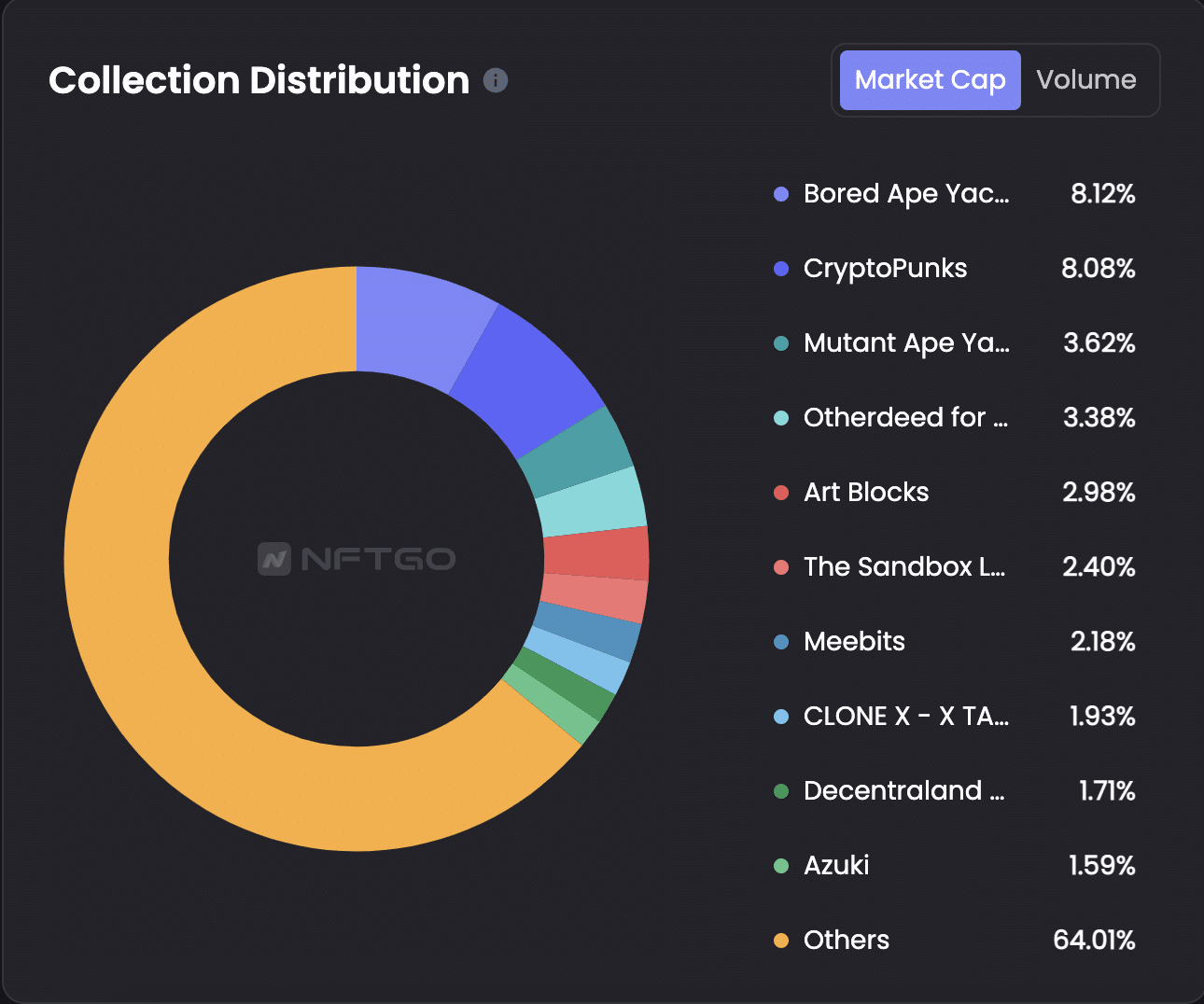

Based on data from NFTGo, CryptoPunks, a collection of 10,000 algorithmically generated pixel NFTs ranked first in terms of market capitalization at the start of 2022, when the pixelated collectibles held 10% of all NFTs market capitalization. This changed in the second half of the year with Bored Ape Yacht Club taking the lead.

BAYC ended 2022 with a market capitalization of $830 million. This makes the collection of 10,000 monkeys the highest earner in the ecosystem. Despite a steady decline in value through 2022, BAYC replaced CryptoPunks as number one, with 8.12% of the NFT ecosystem, versus CryptoPunks 8.08%.

NFT collection distribution at the end of 2022

Since the beginning of 2023, BAYC has recorded 17 sales and sales volume is up 51% in the last 24 hours. Sales totaled $1.37 million, and the Ape Collection’s earnings came in second behind Otherdeed.

While BAYC is doing well, the ApeCoin token is struggling to recoup its losses. ApeCoin has offered its owners almost 10% gains in the last two weeks, in contrast to mainstream cryptocurrencies such as Bitcoin and Ethereum.

The NFT token is currently in an uptrend, but technical indicators show that ApeCoin is overbought and thus ready for a pullback or reversal.

ApeCoin is overbought, APE price risks falling

The Relative Strength Index, a momentum indicator used to determine whether a token is overbought or oversold, indicating trend reversals is 81.44 for ApeCoin. A reading above 70 means that the asset is overbought and there is a likelihood of a correction in price.

The ApeCoin price is therefore at risk of a decline as shown in the chart below. The signal for traders to open short positions is traditionally given when the RSI exists overbought after entering the area.

APE/USDT exchange rate chart

Interestingly, the 50-day exponential moving average (EMA) recently crossed below the 200-day EMA, in a “death cross”. The death cross is a chart pattern that signals weakness in the asset’s price. These technical indicators suggest that ApeCoin price may drop to support at the 200-day EMA at $3,723.