What’s in store for the coming week?

Bitcoin (BTC) and Ethereum (ETH) continue to suffer losses, with both cryptocurrencies showing bearish signals at the start of the new week. The broader cryptocurrency market is also struggling, with Bitcoin and ETH each experiencing declines of over 6% in recent days.

Other notable cryptocurrencies, including Litecoin (LTC) and Dogecoin (DOGE), are also showing negative sentiment.

The subsequent release of strong US economic data has increased the likelihood of the Federal Reserve’s hawkish stance, which is one of the primary factors negatively impacting the cryptocurrency market, including Bitcoin.

Furthermore, the Silvergate incident has exacerbated the market’s losses. Meanwhile, Binance’s management expressed concerns about regulatory issues related to their association with Binance US.

It’s worth noting that Binance believes the US government will see them as a single entity, which could lead to regulatory hurdles, potentially leading to further Bitcoin losses.

Looking ahead, traders and investors are anxiously awaiting positive economic data from China, which is expected to be released this week and could help the cryptocurrency market regain its strength.

What’s in store for the coming week?

Investors will keep an eye on two key economic events later today. First, at 07:30, the release of Switzerland’s CPI month-on-month figures will be closely watched. The market expects an increase of 0.6%, compared to last month’s 0.5%.

Second, at 3pm, the release of Canada’s Ivey Purchasing Managers’ Index (PMI) will also be closely watched. Last month’s reading was 60.1, and the market forecast for this month is 55.9.

On Friday, there are several key economic events to watch, including the release of employment data for Canada and the United States. This includes CAD employment change and unemployment rate, as well as average hourly wages in USD m/m, change in non-farm employment and unemployment rate.

These data points are closely watched by investors and traders as they can have a significant impact on financial markets, including currencies and stocks.

Risk-off sentiment in the crypto market

The global cryptocurrency market continued its downward trend over the weekend as market participants struggled to process the Silvergate situation. Bitcoin’s value fluctuated between $22,500 and $22,600 in the last 24 hours, representing a 1% drop.

Ethereum’s value also fell by 1% and is now below $1,600, mimicking the behavior of BTC. If the impact of Silvergate does not spread, we could see a gradual recovery in digital assets across the board.

The good news, however, is that the entire crypto market cap remains above $1 trillion, providing some reassurance to crypto traders.

In addition, Binance’s management expressed concern about regulatory issues related to their association with Binance US, which is their subsidiary located in the United States.

Binance is concerned that US regulators may view the two entities as one, resulting in potential regulatory issues. This comes as regulatory oversight of Binance and the broader cryptocurrency industry tightens.

Sluggish US dollar confounds traders

Investors have been waiting for Federal Reserve Chairman Jerome Powell’s testimony and the release of February employment data, which could potentially affect the US central bank’s aggressiveness, resulting in mixed signals from the broad-based US dollar.

The dollar has been range-bound around 104.560, and the dollar index, which measures the currency against six major peers, was down 0.057% to 104.560. However, the index remained close to its seven-week high of 105.36, reached last week.

The small drops in the value of the US dollar could potentially provide some relief to the cryptocurrency market by helping to reduce losses.

Bitcoin price

The current price of Bitcoin stands at $22,357.71, with a 24-hour trading volume of $18,546,058,671. In the last 24 hours, Bitcoin has experienced a decrease of 0.26%.

Based on technical analysis, the BTC/USD pair is currently consolidating within a narrow trading range of $22,000 to $22,500. A breach of this area has the potential to drive further price action in the Bitcoin market.

If the price breaks above the $22,500 level, there is a possibility of a bullish breakout, which could expose BTC to the $22,800 or even $23,250 levels. However, if the support continues to hold around $22,000 or $21,750, there is a chance for a rebound.

Buy BTC now

Ethereum price

The current value of Ethereum is $1,570, with a trading volume of $6.7 billion in the last 24 hours. In the last 24 hours, Ethereum has experienced a decrease in value of 0.15%.

From a technical point of view, the ETH/USD pair is currently trading within a narrow range between the $1550 and $1580 levels.

If the price of Ethereum falls below the $1,560 level, it may face support at the $1,500 mark. However, it should be noted that there is significant resistance at $1,620 or $1,680 levels, which could limit any further price declines.

Buy ETH now

Top 15 Cryptocurrencies to Watch in 2023

Check out Cryptonews’ Industry Talk team’s curated list of the top 15 altcoins to watch in 2023. The list is updated frequently with new ICO projects and altcoins, so be sure to visit often for the latest updates.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

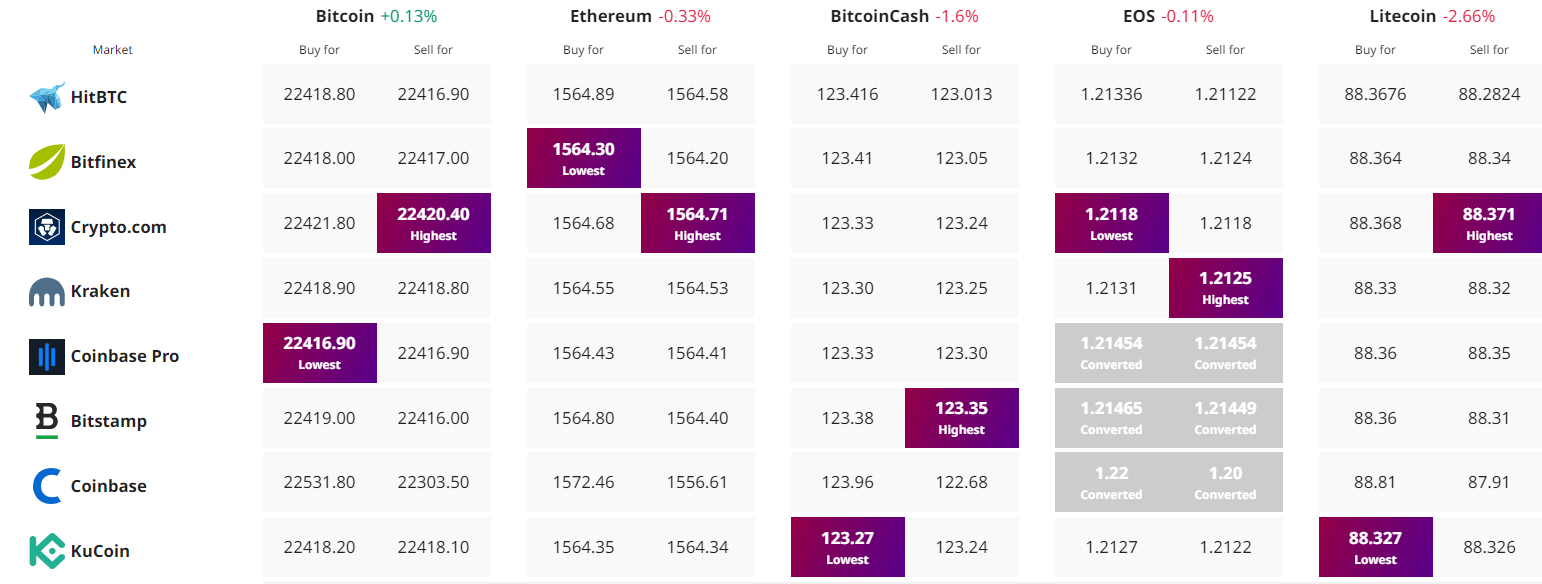

Find the best price to buy/sell cryptocurrency