What makes an NFT valuable?

The digital asset industry has grown exponentially in recent years, and along with the rise of cryptocurrencies has come the consistent presence of Non-Fungible tokens, or NFTs. Also, these assets exist in a very unique class and can be confusing to some. So let’s delve further into answering what makes an NFT valuable.

There are a number of reasons why something may have value. Indeed, whether it is art, a tool, or fiat currency, the idea of value is a very interesting concept to uncover and discuss. So, what makes ownership of these assets so valuable?

What is an NFT

First, let’s delve into what an NFT actually is. Specifically, these assets are unique digital objects that are stored on the blockchain. However, unlike blockchain assets such as cryptocurrency, NFTs are non-fungible. Essentially, it just means that they are not interchangeable due to their uniqueness.

NFTs are used to represent ownership over a particular digital content. This can vary from artwork to music to videos. In fact, ownership over these digital assets is where monetization comes in.

So these assets are essentially defined by a few different properties. These characteristics allow them to make money from the person responsible for their creation. Conversely, investors seek out these assets for a variety of reasons, all of which influence why the market considers them valuable.

Why are they valuable?

As we’ve said before, there isn’t one thing that makes NFTs a worthwhile investment. Also, they act like all assets, meaning they boast individual characteristics that enhance their value. Nevertheless, let’s delve into some qualities inherent in most NFTs that will make them valuable.

Limited number

One aspect that will affect the value of an NFT’s value is the number of the specific asset in existence. Specifically, valuable digital art is often unique, and scarcity positively affects its overall market value.

Exclusivity and rarity are facets of any form of value, and they apply to digital content and NFTs. When someone buys an NFT, they want to look for limited edition creations. Then, if one artist makes a supply of 1,000 copies, and another produces 100 copies, the latter will become increasingly valuable.

Unique and authentic

Another aspect that will increase the value of an NFT is its uniqueness and authenticity. Indeed, these assets are created to be inherently unique, with their verifiability being a huge aspect of ownership and value. Also, as with all things in the art world, uniqueness and authenticity go hand in hand when establishing value.

Blockchain technology is essential when discussing this area of the industry. Specifically, the blockchain is used to observe the digital file and ensure that it is both authentic and unique. Moreover, this technology can often inform the value of the asset, because it is very secure and cannot be changed.

The rare factor

When discussing assets, from Da Vinci paintings to baseball cards, rarity is incredibly important. Likewise, NFTs require rarity to increase their value on the open market. Also, collectors are often willing to pay a higher price for something that is more rare than competing digital assets.

A good example of this is the sale of the first ever tweet. Specifically, the tweet sent by the platform’s former CEO, Jack Dorsey, sold for millions. This was primarily because ownership of the historic asset was incredibly rare. Thus establishing its value.

Reputation and culture

An NFT may also see the increase in value based on the reputation of the asset or creator, and the potential significance of the asset culturally. First, if the creator of the asset is a notable, it is likely to increase its value. Alternatively, if the asset has a reputation in the community, it can also significantly increase its value.

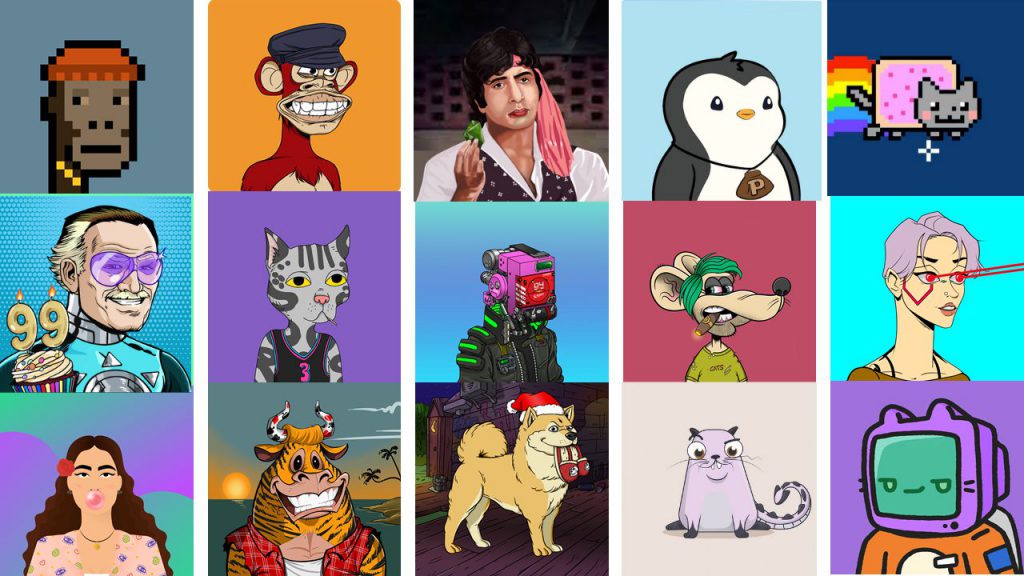

Alternatively, cultural relevance will always affect the value of any asset class. Something like Bored Ape Yacht Club is a good example of both of these. The asset has gained a reputation in the NFT community, but it has also developed a sense of cultural significance. These things may only be digital assets, but their status exists in the real world.

Conclusion

NFTs are among the most unique asset classes on the planet. They don’t quite maintain the utility of some cryptocurrencies, but their digital nature puts them in the same class. Also, the community continues to grow. As the market and creator base for the class evolves, so should the value of the creations.