What is the Head and Shoulders Pattern in Crypto Trading?

Candlestick patterns have been an important source of market information for many years. They provide detailed information that includes the market’s current price, opening price, closing price and much more information that traders need to make informed trading decisions. One of the most common patterns is the head and shoulders pattern, which makes it easy to detect directional changes in the market.

What is the head and shoulders candlestick pattern?

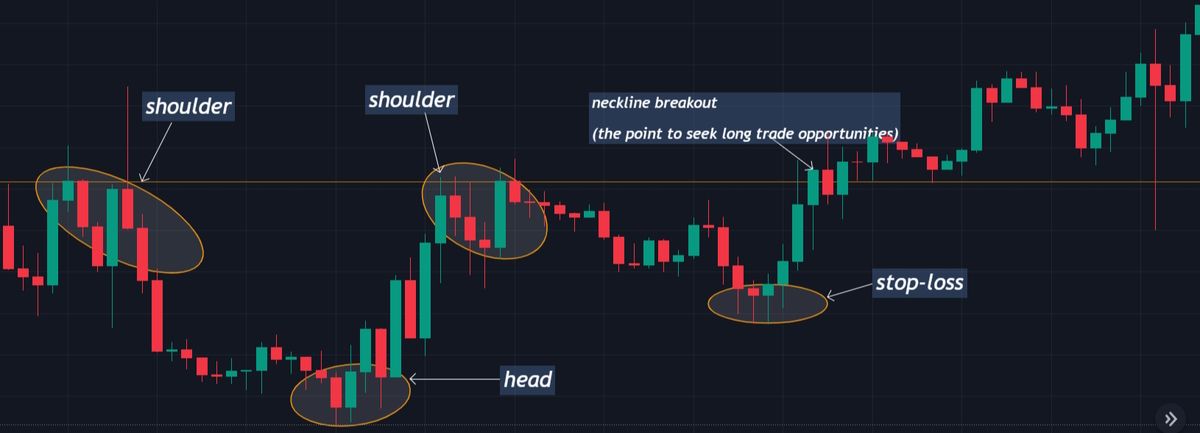

Traders check the head and shoulders candlestick pattern to detect a possible change in market direction. When the pattern forms, an ongoing bullish trend is likely to turn bearish. The pattern consists of three peaks: the head and the two shoulders (left and right).

How the head and shoulders pattern is interpreted

The head and shoulder pattern resembles the human head and shoulder structure. The structure has three peaks, with the head as the middle and highest peak. The shoulders are lower than the head.

Left shoulder

The left shoulder is the first part of the structure, and it is formed by an upward price movement, followed by a minor price correction.

The head

The middle structure is the head, which is created when the price retraces to a point higher than the previous high made by the shoulder before the price falls again.

Right shoulder

The right shoulder is the third and last peak of the structure. It is formed by another upward price movement that is not as high as the head; the final price drop also follows this.

Neckline

The neck edge acts as a support that supports the entire structure. You can also see it as a robust support or resistance to price. Therefore, when the price breaks below the neckline, it is expected to form a price support, while a break above the neckline is expected to form a price resistance.

How to Use the Head and Shoulders Pattern in Crypto Trading

Now you know what the head and shoulders pattern looks like, how can you use it for crypto trading?

It is not always a perfect structure

The head and shoulders pattern will not always form a perfect head and shoulders structure. It comes in different varieties and if you are not careful to spot it, you can miss out on many trading opportunities. However, it becomes easier to notice as you use the pattern more often.

Waiting for a broken neck

You can trade with different methods when using the head and shoulders pattern. One of the most popular ways is to wait for the carving of the neck before selling. Then, after the bearish breakout, traders look for more confirmations for trade entry.

Set Stop Loss

Traders also have varied approaches to determining their stop-loss levels. However, if you are using the head and shoulders pattern, the best place to place your stop-loss is above the neck. It is recommended to set the stop loss at a level you do not expect the price to reach.

The inverted head and shoulders pattern

The reverse head and shoulders pattern is the opposite of the head and shoulders pattern. It is also known as the inverse head and shoulders pattern. It has three valleys, with the middle (head) being the lowest and the left and right valleys at a higher price. The inverted head and shoulders pattern usually shows that a bullish reversal is about to occur.

In this case, the neckline forms a price resistance, and a price breakout above the resistance is seen as an opportunity to buy, and the stop loss is placed below the neckline.

5 advantages of the head and shoulders pattern

The following are some of the advantages of the head and shoulders pattern.

- Easy to spot: The head and shoulders candlestick pattern is easy to spot and interpret. In addition, it is beginner-friendly, making it easily accessible to traders of all levels of experience.

- Provides clear entry and exit positions: The neck breakout becomes a crucial level of resistance that triggers a seller’s market and you can also place a stop loss above it to close the trade in case it doesn’t go in your favor.

- Helps identify key price levels: The head and shoulders pattern provides clear support and resistance areas for price. The neckline can act as resistance when the price breaks below it and as support when it rises above it. With this, traders easily identify different key levels on the chart.

- Useful across different time frames: It is useful both for scalpers, day traders, swing traders and position traders. Its adaptability makes it easy to integrate it into your trading strategy.

- Provides a good basis for trading trend reversal: You can use the head and shoulders pattern to trade trend reversals in the market. It gives a clear signal to sell cryptocurrencies, which can help you find the best time to sell your cryptocurrency in a bullish market.

3 Disadvantages of the head and shoulders pattern

Here are some downsides to the head and shoulders candlestick pattern:

- May be ineffective in a fluctuating market: The head and shoulders pattern may not be effective when the market is range. In such a market there can be many false breakouts. Since traders may not know when a consolidating market ends, the strategy can be ineffective and give various false signals.

- Possible false signals: Like any other technical analysis tool, the head and shoulders pattern can give false signals and it is better to use it with other tools or at least manage your risks effectively when using it.

- It can be confusing: While the Head and Shoulders pattern is considered a reliable reversal pattern, as mentioned earlier, it can come in different structures, making it challenging for a beginner to notice. The neck edge, for example, cannot form a horizontal line, making it difficult to know when it is broken.

Always use a rounded approach in your analysis

When trading the head and shoulders pattern or any other trading strategy, you should always remember that there is no strategy that always guarantees success. It is best to use a rounded approach in trading using technical, fundamental and sentiment analysis for best results.

The information on this website does not constitute financial advice, investment advice or trading advice and should not be considered as such. MakeUseOf does not provide advice on any trading or investment matters and does not recommend that any particular cryptocurrency should be bought or sold. Always perform your own due diligence and consult a licensed financial advisor for investment advice.