What is SudoSwap and its AMM approach to NFT trading?

Until now, NFT marketplaces Trader A has put his assets up for sale at a certain price. When Trader B is willing to pay this price, the trade takes place. The marketplace is more or less the intermediary between Trader A and Trader B. Its job is to make the process seamless for them. It handles the payment, collects its fees and creator’s royalties (when applicable), and transfers the asset to the buyer’s account to match users’ buy and sell orders in record time.

This model is heavily dependent on a price agreement between both parties. If it doesn’t happen, there is no trade. When an asset class does not have many trades, we say it has low liquidity. This is something that happens with the NFT market in general. But, Sudoswap want to change this by using an AMM model on NFT Trading.

An automated market maker (AMM) is the technology that powers a decentralized exchange (DEX). It makes it possible to trade assets using crypto-liquidity pools as counterparties. A liquidity pool is a smart contract where you usually have two assets on it: the trading pair. When interacting with a liquidity pool, a user can trade (exchange) one asset for another or be a liquidity provider (LP). To be an LP, the user must deliver both assets to the trading pair. In the context of NFTs, for example, an LP provides the NFTs and ETH.

And why would anyone want to become an LP? The LP collects the trading fees of the liquidity pool where he deposited his assets. In NFT trading this means he would get a fee on this transaction and not the collection’s creator.

In this article we will cover:

- What is Sudoswap

- Why is it different from OpenSea or X2Y2

- Metrics (number of users, daily transactions)

What is Sudoswap

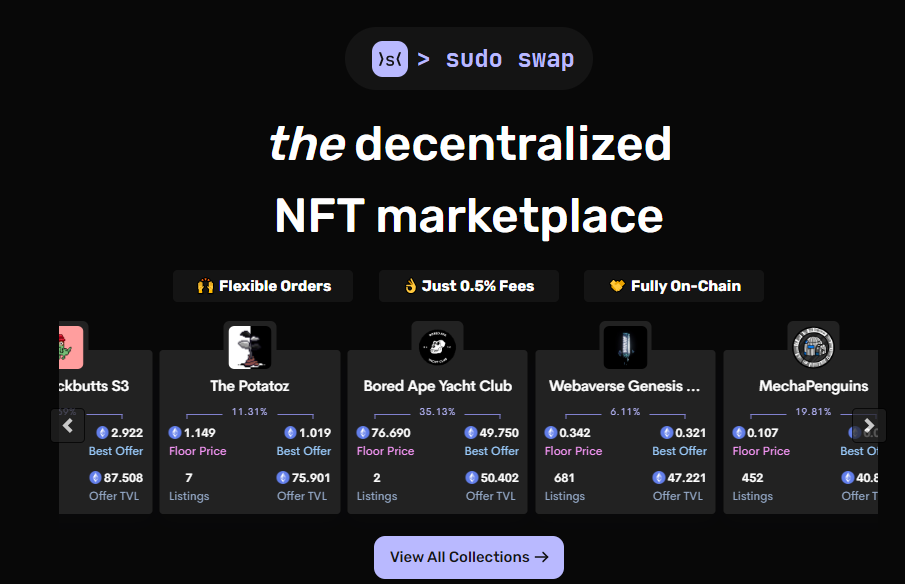

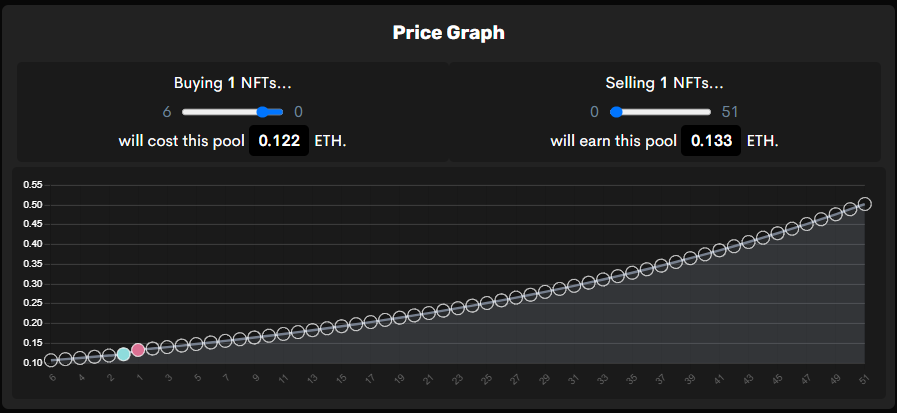

Sudoswap is a decentralized, on-chain NFT exchange that uses an AMM model. This gives the NFT market the same trading conditions as DeFi, by improving the liquidity of the NFT collection traded there. But for a user interacting with the protocol, it has the same functions as a regular NFT Marketplace. The user can select an NFT from a collection he likes and buy it. Another user can take their NFT and sell it for the price. These interactions are done on the page below.

Swap Interface – Source: Sudoswap

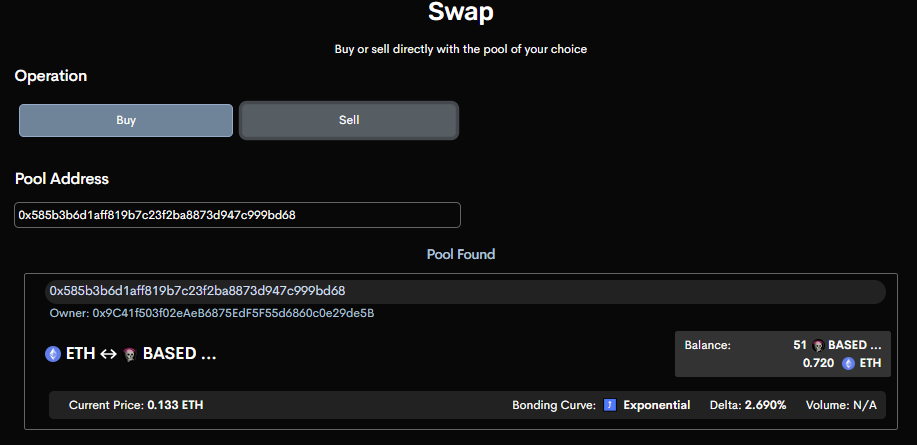

However, the main feature of Sudoswap is that it allows the NFT owner to become a liquidity provider by creating a trading pool. It is useful for collectors or traders who own many pieces of the same collection and want to set a floor price for it. LP has control over the behavior of the price changes in his pool.

Pool Overview – Source: Sudoswap

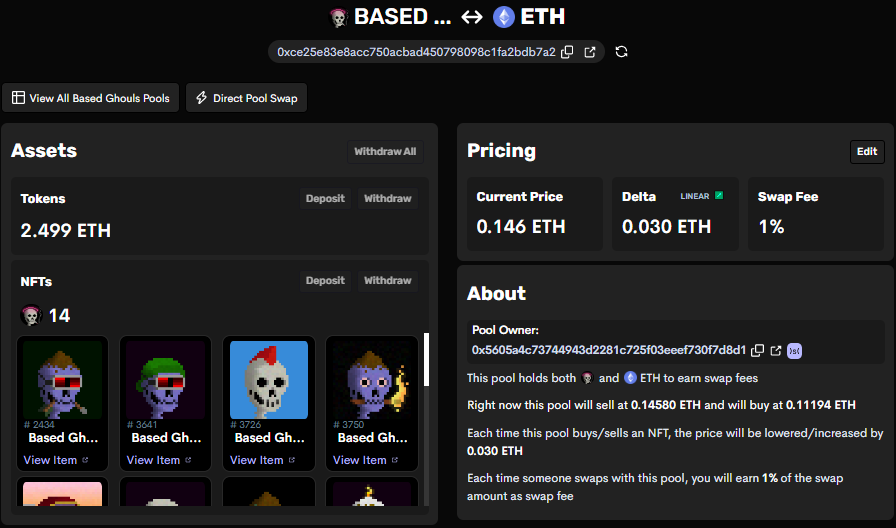

While an LP, the user can set the price changes after a buy or sell in the pool (this is called the “binding curve”). This configuration lets the LP know how many ETH we will have if all NFTs are sold, or how many NFTs he will have if all ETH in the pool is used to buy NFTs.

Price Action Chart – Source: Sudoswap

How is Sudoswap different from the other NFT marketplaces?

While retaining the basic functions of a regular NFT marketplace, Sudoswap’s approach to the NFT market is to give control to the NFT holders. They can set the trading conditions, prices and earn fees on trades that take place in the pool where they are a liquidity provider.

Another difference is that Sudoswap does not pay royalties to the collection creators. This is a function that the marketplaces have on their smart contracts. It does not appear on the smart contract that was used to stamp the collection. Therefore, this is a decision that each marketplace makes, as we saw in X2Y2 decision to provide flexibility on it. For that reason, there is more incentive for the NFT owners to trade on Sudoswap.

The price action on Sudoswap is also different from a normal marketplace. Large pools have enough NFTs and ETH in them to make the price follow the binding curve. This dampens price fluctuations.

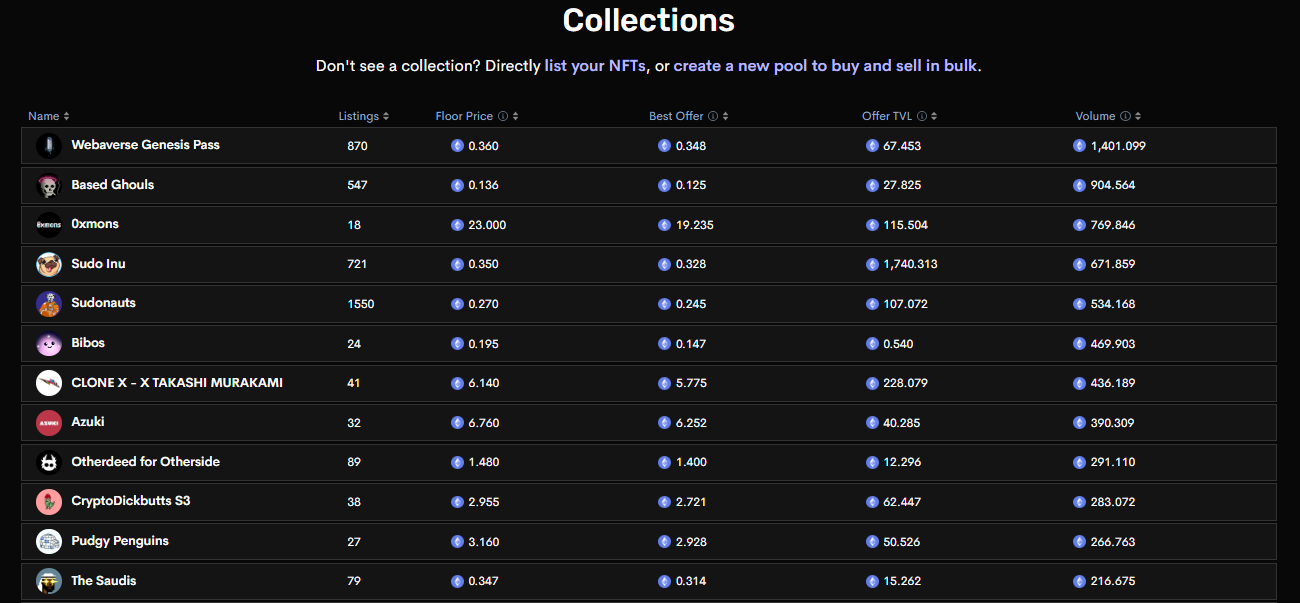

Collections Leaderboard – Source: Sudoswap

NFT owners of different collections are experimenting with this new concept as we can see some familiar collections already available for trading there, such as Azuki, Otherdeed and Pudgy Penguins.

NFT projects can also benefit from this model, as they can create their “official pools” of items in their possession to start their trading activity. Examples of that on SudoSwap are “Based on Ghouls” and “Lobster DAO.”

Calculations

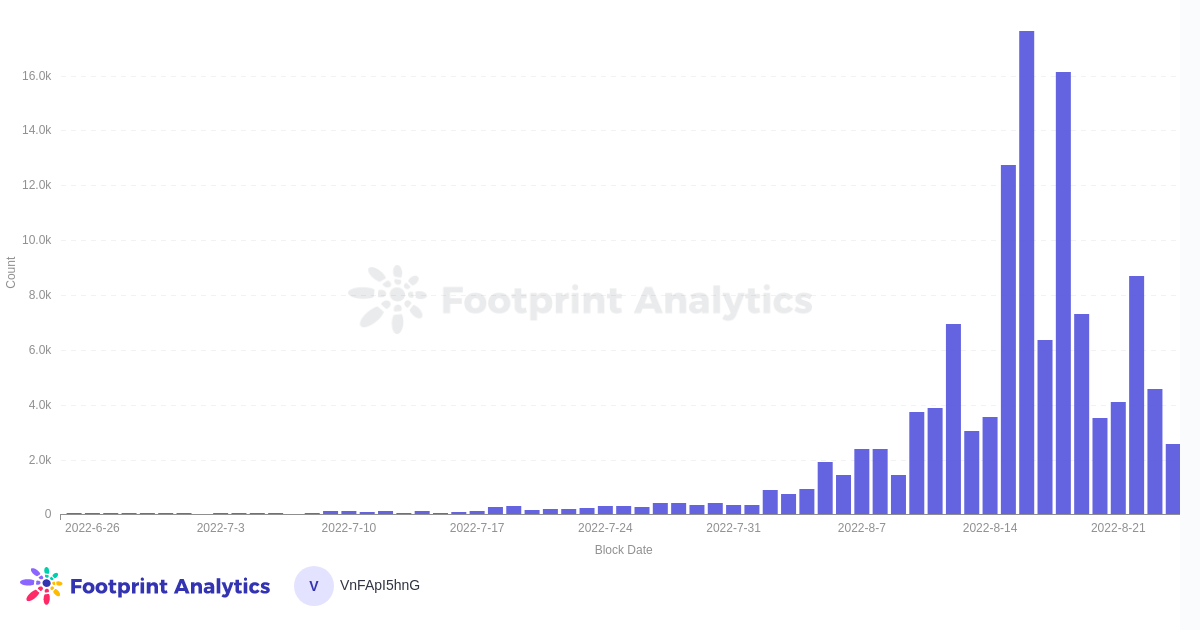

Sudoswap launched its AMM on July 7. Since then, it has already had over 100,000 NFT transactions.

Daily Transactions – Source: Footprint Analytics

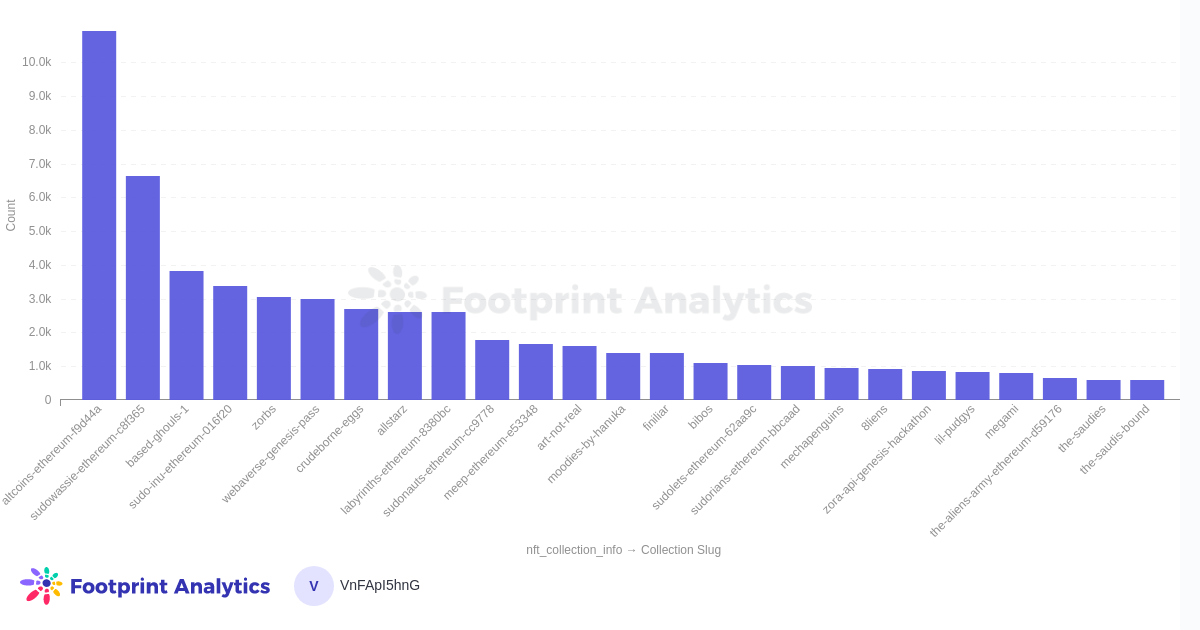

In the chart below, there are the Top25 NFT collections by number of trades, cumulatively. As LP controls the trading fees on the trading pool, several pools have a trading fee that is lower than the standard 2.5% royalty fee used in the regular marketplaces, making it more profitable to trade on Sudoswap.

NFT transactions, by collection, last 30 days – Source: Footprint Analytics

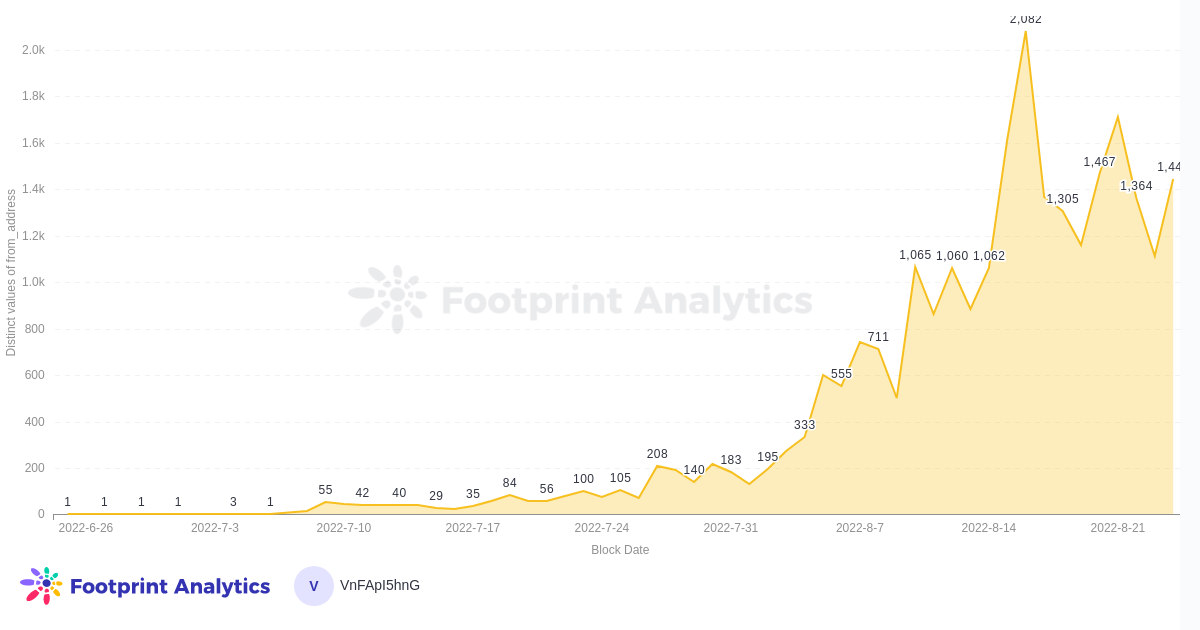

The number of daily users is growing as more people become aware of Sudoswap and its similarities to DeFi DEXs like Uniswap or Sushiswap (high liquidity and low fees).

Sudoswap daily users, last 60 days – Source: Footprint Analytics

Comparison with other marketplaces

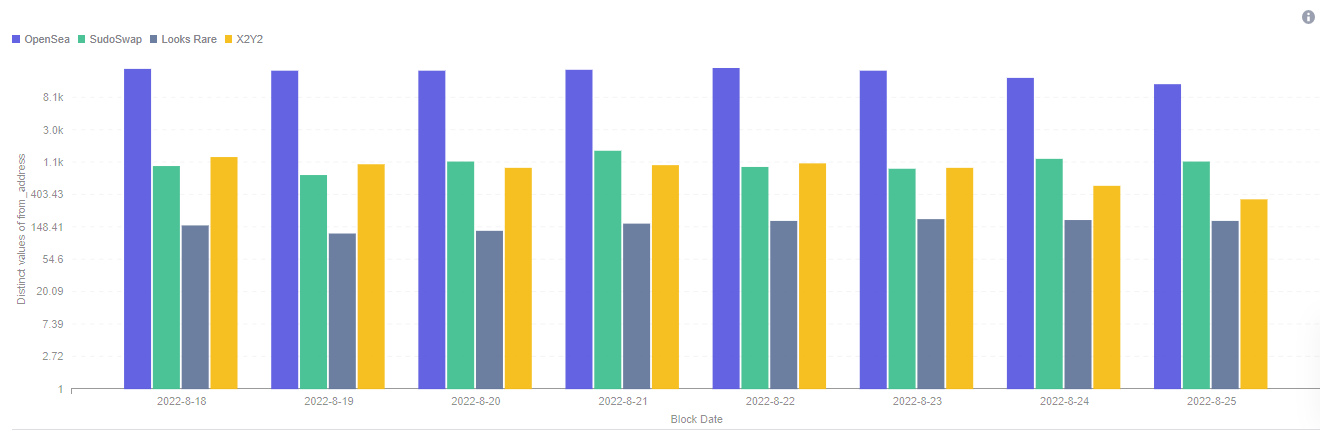

Daily users, comparison between Opensea, SudoSwap, Looks Rare and X2Y2 – Source: Footprint Analytics

At the beginning of August, Sudoswap started gaining traction and since mid-August has almost the same number of daily users as X2Y2 (around 1500 daily users).

Marketplaces Leaderboard – Source: NFTgo

Sudoswap shows 22 million of total volume in the last 30 days, which calculates in ~100,000 USD revenue, as the platform has a platform fee of 0.5%. We see all the signs (increasing number of users, daily transactions) that the NFT community is willing to try this different trading model to better understand its benefits and shortcomings. Although it will soon mean that the AMM approach will replace the traditional one, it has appealing features for NFT holders.

September 2022, Thiago Freitas

Data source: Sudoswap – AMM Marketplace for NFTs

This piece is contributed by Footprint Analytics society.

Footprint Community is a place where data and crypto enthusiasts around the world help each other to understand and gain insights about Web3, the metaverse, DeFi, GameFi or any other area of the new world of blockchain. Here you will find active, diverse voices that support each other and drive society forward.

Footprint website:

Disagreement:

Disclaimer: Views and opinions expressed by the author should not be considered financial advice. We do not provide advice on financial products.