What is it and why is it important?

Crypto trading requires a critical approach to various metrics, and a key metric is crypto trading volume. This refers to the total amount of cryptocurrency traded in the market over a certain period of time.

Volume is a measure used to determine a cryptocurrency’s liquidity and overall market health. Therefore, understanding crypto trading volume is important for both traders and hodlers.

So let’s discuss the basics of trading volume and why it is a critical metric in the crypto world.

Crypto trading volume explained

Crypto trading volume is one of the most crucial metrics for basic crypto analysis. It helps determine the flow of a digital asset in the market and evaluate a crypto project, making it easier to predict the coin’s future price. This information can help you make better investment decisions.

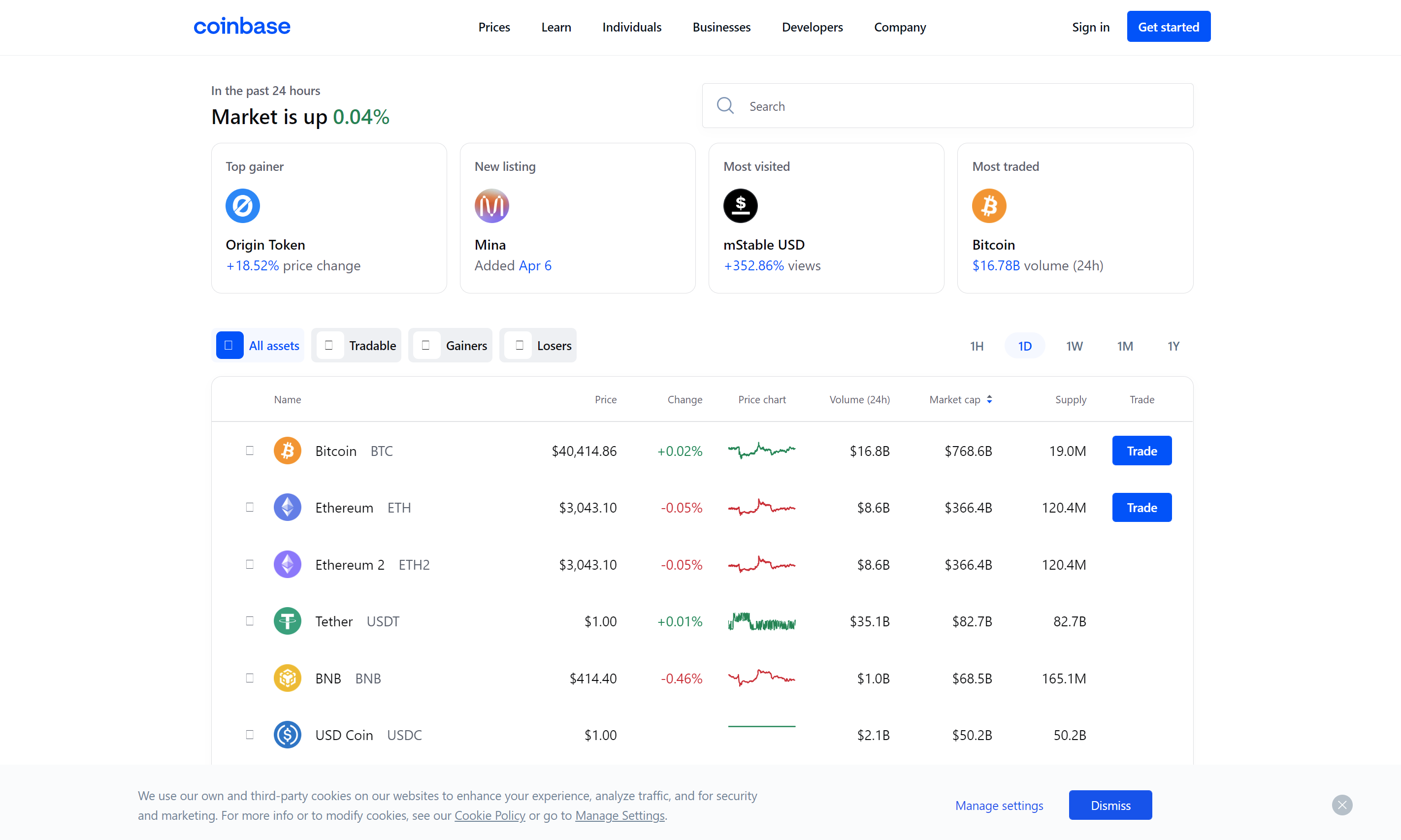

By definition, trading volume in crypto refers to the total amount of a digital asset traded over a certain period of time. This metric indicates the trading activity of a coin in the entire market or on an exchange. Typically, exchanges measure trading volume for the last 24 hours.

Trading volume tracks how a cryptocurrency changes hands, allowing you to track whether investors are buying or selling the crypto and helping you determine market trends.

However, it is important to note that trading volume only accounts for public transactions and does not include OTC (over-the-counter) transactions. As a result, the calculation may not provide a complete picture of trading activities in the market.

Why is trading volume important in crypto?

The trading volume calculation is not unique to the crypto market; it has been a central part of the traditional financial system for over a century. Stock investors use it to decide whether to buy or sell stocks. Likewise, in the crypto space, volume records a coin’s trading activity, signaling the coin’s performance in the market.

Crypto trading volume is one of the most useful metrics to inform you about price movements, market trends and liquidity. This makes the importance of trading volume in the decision-making process of buying or selling a crypto-asset enormous. Here are some ways it can help you with your fundamental and technical analysis.

1. Measure a cryptocurrency’s liquidity

The primary factor that trading volume provides insight into is the overall liquidity of a digital asset in the market. Liquidity is an indicator of how easily a cryptocurrency can be traded at the current price.

In general, a consistently higher volume indicates stable liquidity, which leads to fewer price fluctuations. Cryptocurrencies with higher trading volume are usually traded faster and more frequently. However, it is important to note that a higher volume is not always a positive signal; it can also be an indicator of panic selling.

2. Determines market trends

The role of trading volume in the crypto market is huge as it helps determine market trends. When there is a fluctuation in the price of an asset along with a higher volume, it can be a sign of a strong trend. Conversely, when a price swing triggers a low trading volume, it is usually a sign of a weak trend.

Volume can also indicate buyer interest in the asset, which is usually high when trading volume is high and vice versa. Understanding market trends can be a good indicator to identify the ideal time to invest or opt out of a trade.

3. A crypto trend reversal indicator

The trading volume calculation also helps in measuring trend reversals in the crypto market. If there is a decrease in trading volume with a price movement in one direction, it may indicate a trend reversal. Generally, low selling pressure and volume can signal a decline in the asset’s prices. Therefore, trading volume calculations can help you track trend reversals in the market.

4. Validates cryptocurrency market strength

One way to validate the strength of the cryptocurrency market is to look at trading volume. This metric shows the level of interest among buyers and sellers and the buying or selling pressure for a particular cryptocurrency.

If there is a change in trading volume along with a corresponding change in price, it can help you determine whether the trend is strong or weak. An upward movement with high volume often indicates a strong trend. Therefore, tracking the trading volume can help you assess the overall strength of the cryptocurrency market.

5. Allows you to measure accumulation in the market

Accumulation trends in the cryptocurrency market are crucial indicators for analysis as they reveal when high net worth investors are buying the asset. Usually, the flow of funds from large wallets inspires a positive price action. So insight into accumulation can help traders find the right time to buy assets.

What is the effect of trading volume on cryptocurrency prices?

The correlation between trading volume and price movements in the crypto market is significant. The level of buyers’ interest in a particular token, which is reflected in the trading volume, creates a balance between supply and demand.

The token’s price usually rises as volume increases and more liquidity enters the market. Conversely, when volume decreases and liquidity is low, the token may experience a drop in value.

Furthermore, trading volume can indicate both short-term and long-term market trends. Fluctuations in demand and supply can shape either bullish or bearish trends in the crypto market.

What is a good trading volume in crypto?

Assessing the trading volume of a cryptocurrency can be challenging as there are no set rules for what constitutes a “good” volume. That’s because the decision to trade a particular crypto project involves considering several factors unique to that project. Furthermore, cryptocurrencies often experience short-term trends driven by hype in the community, making it risky to base trading decisions solely on volume trends.

It is also important to note that increasing trading volume does not always indicate an upward price movement. High volume can sometimes be due to market exhaustion or indicate a bear run. It can also signal selling pressure, not just buying pressure.

For this reason, it is advisable to consider several other crypto technical analysis indicators in addition to volume when assessing the potential of a crypto token.

Trading volume: an important metric for market trends

Trading volume is a critical metric for assessing the strength and potential of a cryptocurrency. It can help you determine liquidity, market trends, reversals and overall market strength. With this critical insight, you can make informed decisions as a trader.

However, it is important to keep in mind that crypto trading is very risky, and relying solely on one metric can lead to significant financial losses. In order to minimize risk and maximize gains, it is crucial to consider a number of other indicators for both fundamental and technical analysis of a token.