What is crypto portfolio rebalancing and how do you do it?

As a crypto investor, you likely have various digital assets in your portfolio, including high-risk and low-risk cryptos. The general rule of thumb is to allocate a larger portion of your portfolio to low-risk assets and a smaller portion to high-risk assets. However, due to the fluid nature of the crypto market, your investment allocations will often change.

As a result, you need to rebalance your crypto portfolio frequently. But what does it mean to rebalance your portfolio, and how should you go about it?

What is crypto portfolio rebalancing?

Rebalancing your crypto portfolio involves reallocating – buying and selling – your assets to return them to their original weighting.

Let’s say you create a portfolio with 50% BTC and 10% ETH, ADA, DOGE, MATIC and DOT. Due to price fluctuations, DOGE may become more valuable than ADA, and the allocation will be 15% and 5%. With rebalancing you will sell out some DOGE and buy some ADA to keep the original allocations – 10% each.

You can only rebalance your crypto portfolio if you have multiple digital assets. Although each crypto is priced differently, you assign percentages to each asset calculated based on a fiat currency. For example, if you have $100 and want to create a portfolio using the allocations mentioned earlier, you would have BTC worth $50 and ETH, ADA, DOGE, MATIC and DOT worth $10 each.

As the crypto market fluctuates, these assets will be worth more or less in dollars. With rebalancing, you will sell off those that are worth more than they should, and buy more of those that are worth less until you get your original allocation back.

Remember that the value of your investment will change from the original $100. This means that you have to convert all of your assets into the base currency to get the new value, which could be $90, $150, or something else. Then you would rebalance based on this new value: If $150, you would have BTC worth $75 and other tokens worth $15 each.

With portfolio rebalancing, you can maintain your investment allocation and risk-to-reward ratio despite the volatile crypto market. This will help you reduce unplanned risks, such as investing more in high-risk crypto assets. However, rebalancing your crypto portfolio is a long-term crypto trading strategy, so you won’t reap the benefits immediately.

2 factors to consider before rebalancing your crypto portfolio

While rebalancing your crypto portfolio is a good idea, a few details affect how and when you should do it.

1. Market trends and conditions

Your decision to rebalance should be based on future expectations of the crypto market. Sometimes one asset will consistently outperform all others and you need to sell it to buy the underperformers at a reasonable price. Other times, low-risk assets can be retained, and selling a “risky” high-performing asset to buy them will result in huge losses.

Typically, traders stock cryptos with larger market capitalizations, such as BTC and ETH, to reduce volatility and minimize risk. However, you will need to rebalance your portfolio more often if you have several coins with medium and low market value. This is because their values are much more susceptible to change.

2. Investment goals and risk tolerance

You may not need to rebalance your crypto portfolio often if you take a long-term view. This is because the crypto market remains volatile, and buying and selling digital assets incurs fees and taxes, which can cancel out your gains.

Your investment objective and risk tolerance will also determine your rebalancing strategy. For example, you can rebalance if the allocation exceeds a certain threshold rather than at predetermined periods if you have a low risk tolerance.

How to rebalance your crypto portfolio

If you want to rebalance your crypto portfolio, follow these simple steps.

1. Determine the portfolio’s ongoing asset allocation

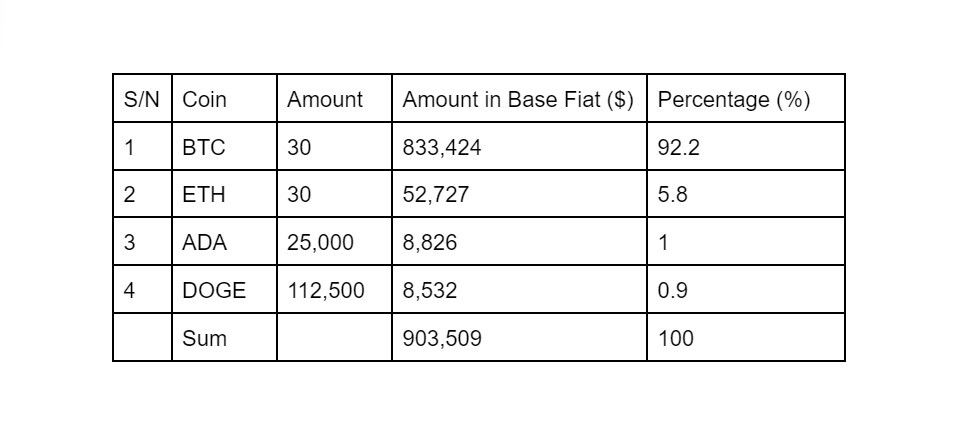

In addition to the ideal asset allocation (eg 25%, 25%, 25% and 25%), you need to know the current allocation of your digital assets before rebalancing your portfolio. This involves some mathematics; you must convert your holdings to a base currency (eg US dollars), total the value of your portfolio, and determine allocations and your total investment value.

However, you can skip this step if you use an automatic rebalancing tool (more on this later).

2. Identify crypto assets to be rebalanced

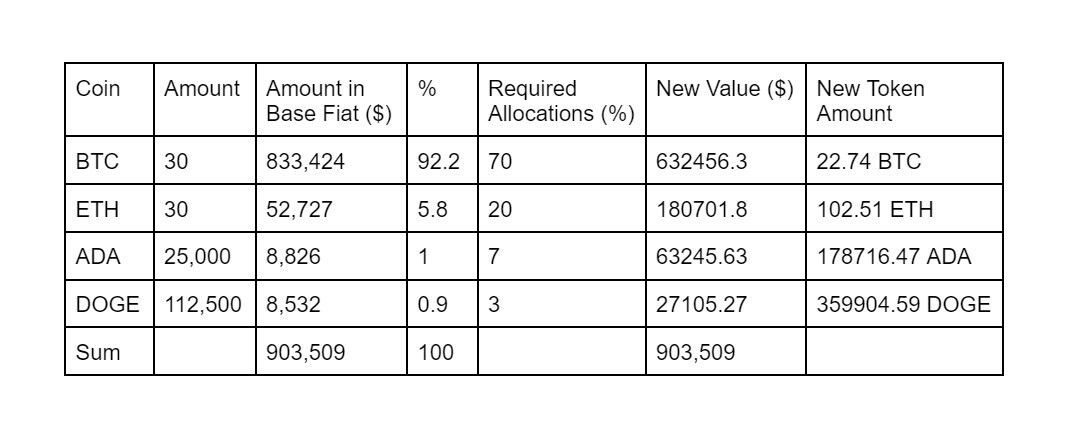

Let’s assume you want a crypto portfolio with 70% BTC, 20% ETH, 7% ADA and 3% DOGE. All four assets need to be rebalanced based on the current allocations above (92.2% BTC, 5.8% ETH, 1% ADA and 0.9 DOGE). You need to sell BTC until it is 70% of your new total investment value and buy more ETH, ADA and DOGE until they recover your intended allocations.

As in step 1, you can waive this part with an automatic crypto portfolio rebalancing tool.

3. Choose a rebalancing strategy

In general, there are three rebalancing strategies you can use.

First, you can use a threshold rebalancing strategy, where your assets are adjusted after they cross a certain point. For example, you can limit allocation changes to 15%. When an asset’s allocation goes beyond this point, either in the negative or positive, you rebalance. This method is best if you have a long-term view and don’t want to spend a lot on transaction fees.

Another strategy you can implement is periodic or calendar crypto rebalancing. With this method, you will set a regular rebalancing schedule. If you rebalance weekly, you will adjust your holdings to your original allocations at a predetermined time each week. This strategy will help you maintain a firmer grip on your crypto portfolio, ensuring lower portfolio drift and a well-adjusted risk investment.

Alternatively, you can use a hybrid rebalancing strategy, a mixture of calendar and threshold. With this method, you will adjust your portfolio every time an asset crosses a certain point and on a schedule.

4. Implement your strategy

After choosing a portfolio rebalancing strategy, you can implement it manually or automatically.

A manual approach means calculating allocations and executing the necessary trades yourself. You need to perform all the steps quickly because the crypto market is very fluid. You must also carefully log each transaction to monitor the performance of your portfolio and determine your capital gains for tax purposes.

5. Optional: Use a crypto portfolio rebalancing tool

Alternatively, you can use a crypto portfolio rebalancing tool, such as Shrimpy, to do the calculations, identify the assets to rebalance, implement your strategy and record all the transactions. You can connect to secure crypto exchanges like Coinbase, Binance and Kraken and some of the best cryptocurrency wallets like MetaMask and LedgerLive. Before using this rebalancing tool, try a demo account to find out if it is best for you.

Don’t leave your crypto portfolio unbalanced

Adjusting your cryptocurrency portfolio can help you reduce risk in this volatile market. Review your investment goals and risk tolerance and find the best crypto portfolio rebalancing strategy to follow. So stick to it.

And you’ll be on your way to better managing your digital assets!

The information on this website does not constitute financial advice, investment advice or trading advice and should not be considered as such. MakeUseOf does not provide advice on any trading or investment matters and does not recommend that any particular cryptocurrency should be bought or sold. Always perform your own due diligence and consult a licensed financial advisor for investment advice.