There are various strategies for trading cryptocurrencies. The most famous are those used to trade the crypto market, such as day traders. Other strategies do not require the high level of expertise that day trading requires.

Crypto arbitrage trading is one of those strategies that does not require very high trading skills. However, it is not “easy” and requires some knowledge of crypto markets. So how does crypto arbitrage trading work?

What is Crypto Arbitrage Trading?

If you have visited two or more exchanges around the same time, you may have noticed that the price of Bitcoin is not the same on all of these exchanges. Instead, the price on one exchange is higher or lower than the other.

This phenomenon is present in all markets, be it shares, raw materials or metals. It is also present in the crypto market, hence the rise of crypto arbitrage trading.

Crypto arbitrage trading is a crypto trading strategy that involves buying and selling crypto assets and taking advantage of the difference in prices on competing exchanges to make money.

Arbitrage is a strategy that anyone who is able to buy and sell crypto assets on exchanges can use to make money. It is also generally low-risk trading that requires little or no trading experience.

How Does Crypto Arbitrage Trading Work?

Arbitrage trading is about buying and selling crypto assets from one exchange to another. Basically, you buy Bitcoin on exchange A, where the price is lower, and sell on exchange B, where the price is slightly higher.

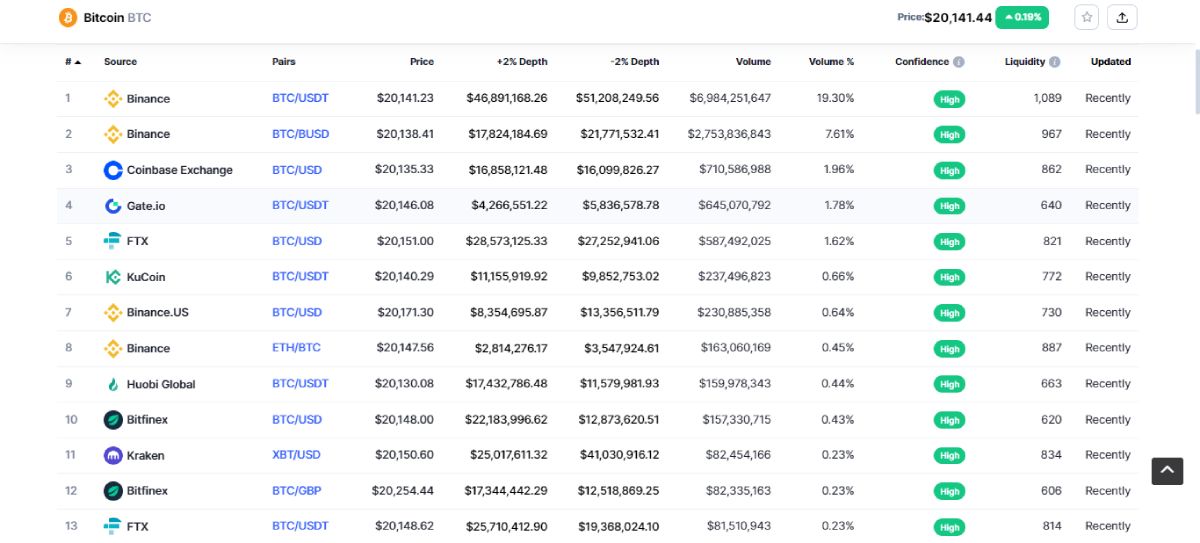

To get a better idea of what we are saying, visit CoinMarketCap and select Bitcoin to see the differences in price on different exchanges.

At the time of writing, the price of Bitcoin on Binance is $20,141, while on Huobi Global it is $20,130. So if you buy from Huobi Global and sell on Binance, you will earn about $11 on each Bitcoin.

However, be aware that since the cryptocurrency market is very volatile, the trade must be done very quickly, almost simultaneously, before the prices change again. This may not be a problem in some types of arbitrage trading, as we will see shortly.

However, volatility is not bad, as it makes arbitrage trading opportunities more numerous in the crypto market than in any other market.

4 types of crypto arbitrage trading

There are several types of crypto arbitration, depending on how the arbitration is done and the parties involved. The following are the four main types of crypto arbitrage.

1. Inter-Exchange Arbitrage

This is the type of arbitrage trade where you simply buy from one exchange and sell on another. It involves only two exchanges.

Since arbitrage trading of this type depends on the real-time prices of assets, it is impractical to buy assets on one exchange and transfer them to another exchange to sell.

You can avoid this and transaction fees by buying and selling the asset at the same time. This is possible if you have assets on both exchanges.

Let’s assume you have 20,000 USD worth of USDT on Binance and 1 BTC on Kraken.

If Bitcoin is worth $20,300 on Kraken but worth exactly $20,000 on Binance, you can take advantage of this opportunity by buying Bitcoin on Binance with your $20,000 USDT while selling Bitcoin on Kraken at $20,300.

Once this is done, the $300 spread becomes your profit and you don’t have to pay withdrawal and deposit fees to move the bitcoin from Binance to Kraken or vice versa.

2. Triangular Arbitration

This type of arbitrage trade is a little easier because it is done on a single exchange, even though it involves three different assets.

Suppose you have Bitcoin, Solana and Ethereum. If the last two assets are undervalued on the exchange, you can use this arbitrage opportunity to get more Bitcoin.

For example, you use your Bitcoin to buy Solana, and then you use your Solana to buy Ethereum. Finally, you use Ethereum to buy Bitcoin again and that’s it.

You will end up with more Bitcoin than when you first bought Solana, and without sending Ethereum to another exchange and paying their high gas fees.

Since it’s all done on the same exchange, there are no withdrawal, transfer or deposit fees involved.

3. Statistical Arbitration

This involves using mathematical models to trade assets and profit from price differences. Statistical arbitrage also uses arbitrage robots, which are capable of trading hundreds of assets simultaneously.

The bots use mathematical models to predict whether a trade will be a winning or losing trade and trade based on the prediction.

Since robots are involved, the process is mainly automated rather than manual, so there is not much for you to do. This makes it more convenient with less risk of making mistakes.

4. Spatial arbitrage

This type of arbitrage trading takes advantage of differences in the price of an asset based on differences in the geographic locations of each exchange. It is very similar to arbitrage between exchanges, except for the spatial aspect.

One factor that drives spatial arbitrage is differences in demand for an asset. For example, if you live in a country with a high demand for Bitcoin, you can buy from an exchange based in another country where demand for the asset is lower and sell on local exchanges in your own country.

This will give you an immediate profit as the higher demand means Bitcoin will be worth more. Although this sounds like arbitrage between exchanges, you don’t have to buy and sell based on real-time prices, so you can buy from one exchange and manually transfer to the other to sell for a profit.

Pros and Cons of Crypto Arbitrage Trading

Crypto arbitrage trading has its good and bad aspects, as you might expect.

Benefits

- Low risk trading strategy that requires little experience

- Can be done under both low and high volatility

- Not many fees are involved in most arbitrage trades

Cons

- Volatility causes rapid changes in price, which can be a challenge in arbitrage between exchanges

- Can claim assets on at least two exchanges

Is Crypto Arbitrage Trading Right For You?

Crypto arbitrage trading can be quite profitable if done correctly. It also involves very little or no risk, compared to, say, day trading, which involves trading with actual market movements.

If you have the assets to trade and meet the conditions for arbitrage trading methods listed above, it is definitely worth a try.

The information on this website does not constitute financial advice, investment advice or trading advice and should not be considered as such. MakeUseOf does not provide advice on any trading or investment matters and does not recommend that any particular cryptocurrency should be bought or sold. Always perform your own due diligence and consult a licensed financial advisor for investment advice.