What is CC0 and why will it change the NFT market?

As the NFT industry becomes more formalized, with major artists, studios and brands involved, the space has struggled with how best to protect intellectual property.

For example, Bored Ape Yacht Club maintains strict IP usage and has taken people to court while CryptoKitties uses the NFT license. Until recently, it seemed that NFT projects would try to follow IP precedent from Web2.0, but a different approach has started to gain more adoption.

- What is CC0

- Why new collections use it

- How different licenses can affect performance

- Examples of derivative products under CC0

What is the CC0 license?

Copyright issues are a constant source of friction between brands, creators and the community that uses the product. Especially with NFTs, several lawsuits had already been filed in court to settle differences between the parties involved.

An example is “Roc-A-Fella Records Inc. v. Damon Dash”, where there is a dispute over the copyright owner of Reasonable Doubt, Jay-Z’s debut album, as there was an intention to sell it as a NFT.

CC0 is Creative Commons 0, where “0” corresponds to “no rights reserved” on the project’s intellectual property. It is a type of copyright that allows creators to relinquish legal interest in their work and take it into the public domain almost immediately. When thinking about NFTs, the owners can take the art on their NFT and use it for any purpose – marketing, modifying it, creating a brand with it, anything. In fact, this license means you don’t even need to own an NFT from the collection – anyone can use any NFT in the collection, even as the logo of a company, if desired.

Which collections use CC0 and why?

One of the first projects to use the CC0 license was Nouns. The idea behind the project was to build a community, and later a DAO, that would promote innovation by using the Noun characters to create derivatives (new projects based on it). They’ve already launched a sunglasses collection, a LilNoun’s NFT collection, and have other initiatives that you can follow on the proposal page.

Moonbirds followed a different path. It started with a “regular” license, but in August 2022moved it to CC0.

As of August 22, the top collections using CC0 as the distribution license model were:

- Noun

- Lil Noun

- Mfers

- Goblintownwtf

- CrypToadz

- XCOPYART

- cryptodickbutts

- thief project

- Moonbirds

- oddities_xyz

- terraforms

You will find a more comprehensive list here.

And why do they do it?

The idea is to promote the project to a wider audience so that they can add value to it. With more interaction opportunities through derivative collections, original art-related goods and a larger community, interest in the collection grows, benefiting creators and NFT holders.

So giving away the rights over their collection can actually be beneficial to the creators and holders:

- The creators/DAO usually still receive the royalties on the secondary market

- It stimulates the creation of derivatives, which brings more attention to the original collection

- Derivatives usually provide an airdrop (or Whitelist spots) for the holders of the original collection

- The creators/DAO can fund new projects to increase the collection’s popularity, creating a flywheel movement

Market comparison: CC0 x other licenses (trade volume and transactions)

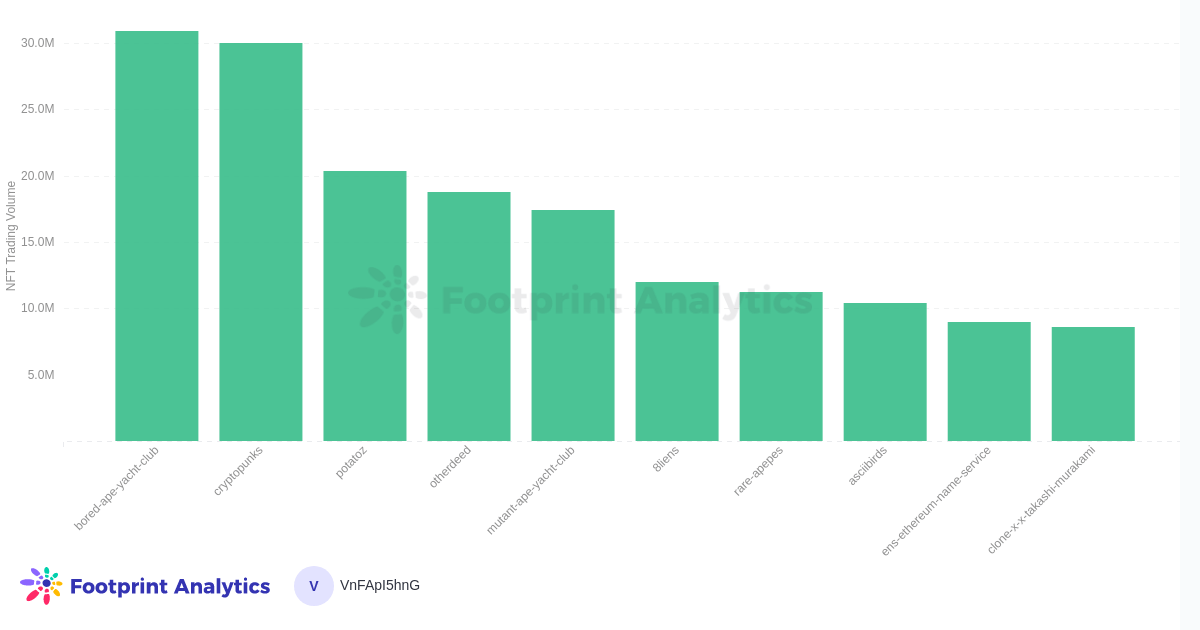

The top 10 NFT collections in non-CC0 license trading volume for the past 30 days totaled $168 million, as shown in the chart below.

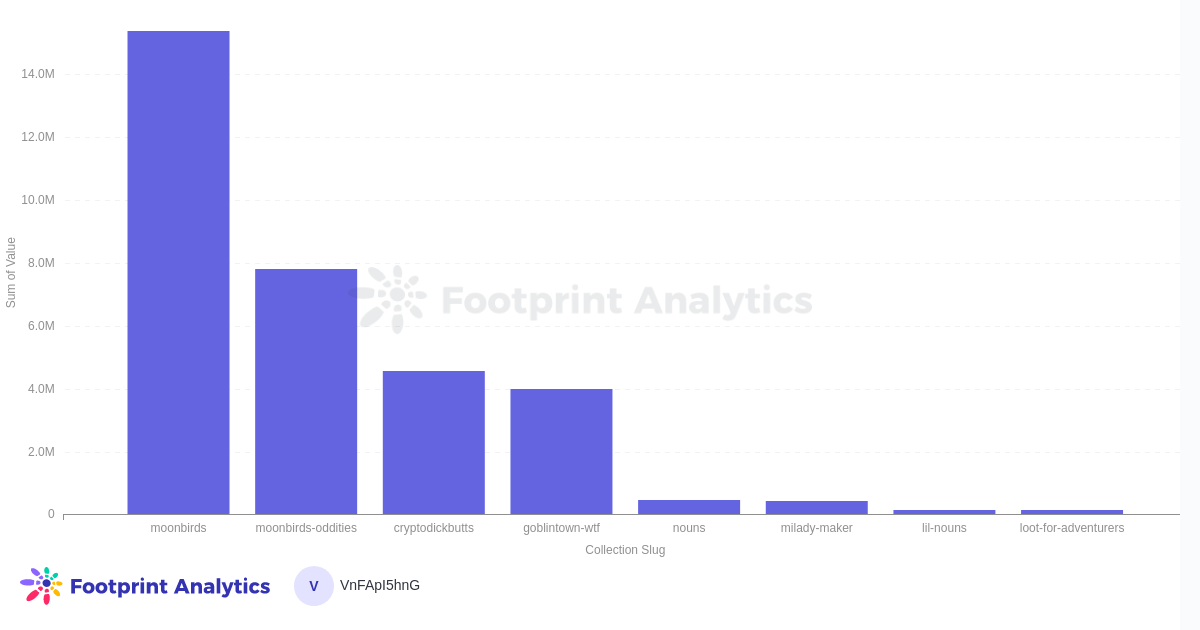

The trading volume for the top 5 CC0 license pools in the last 30 days (see chart below) was USD 32 million. This represents around 27% of the trade volume for the top 10 non-CC0 licenses.

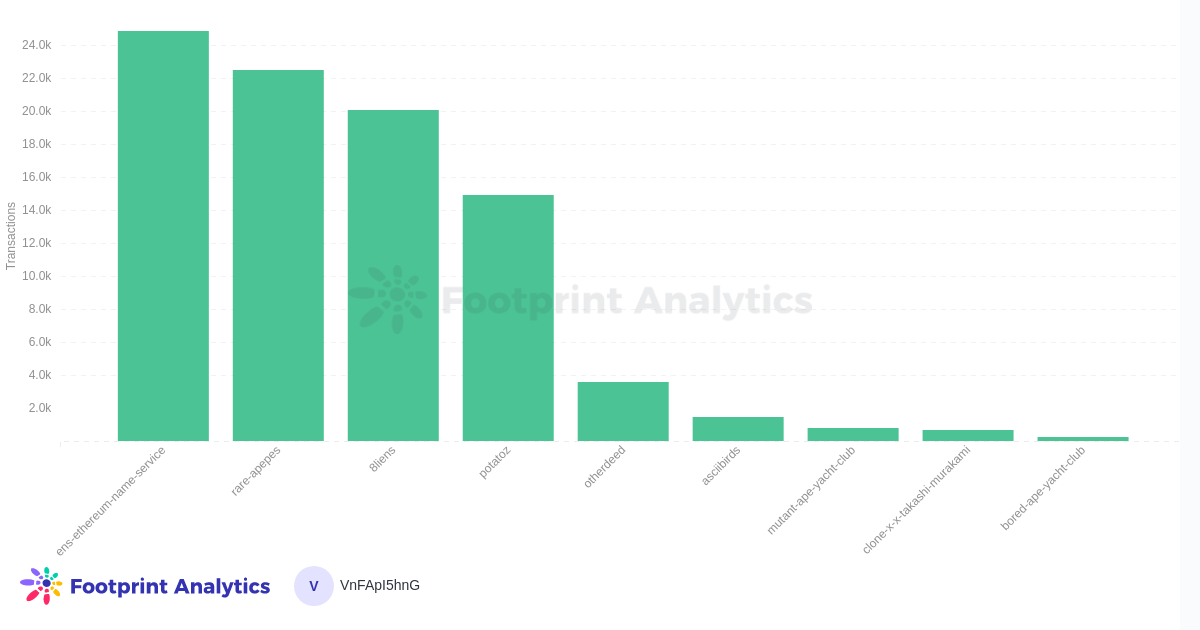

We have a total of transactions in the last 30 days for these Top 10 NFT collections without the CC0 license, we have a total of 89,177 transactions.

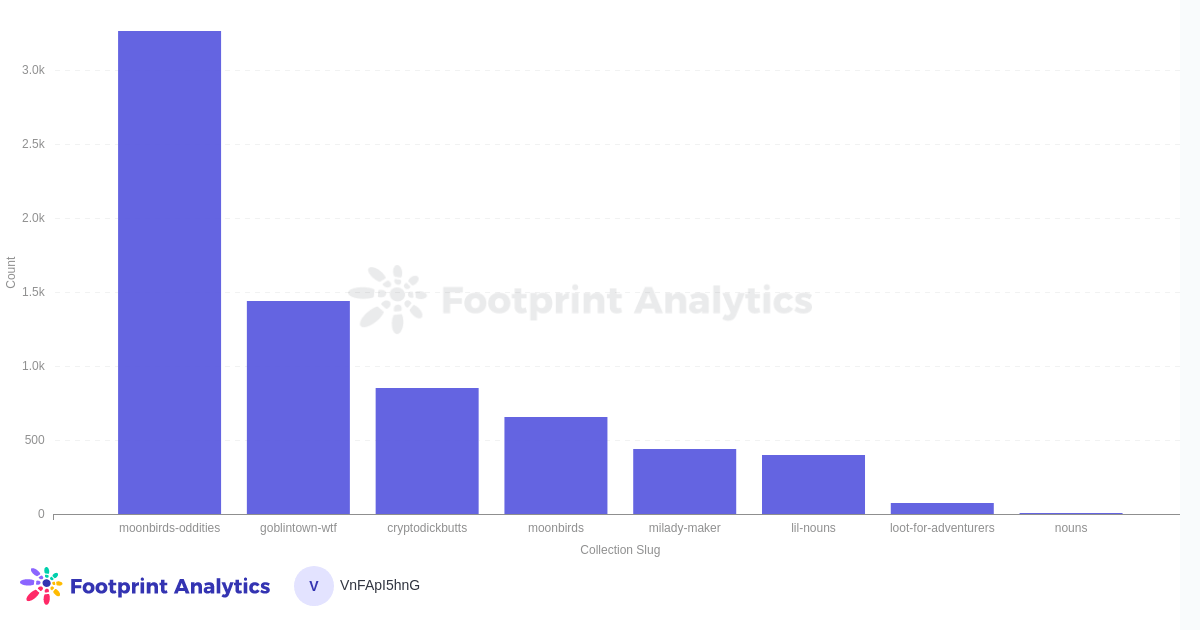

Likewise, when we look at the top CC0 collections (chart below), we have a total of 7,140 transactions, 8% by comparison.

The top CC0 license pools already had almost 30% of the top 10 non-CC0 trading volume in the last 30 days, even with 8% of the number of transactions. These numbers will increase as more collections switch to this licensing model.

This is not a trend that will go away, especially with a huge success story like the Noun Collection. As Moonbirds also announced their plans to move to a DAO to monitor and incentivize their logo/brand usage, this process of releasing the copyright to the collection and sharing its direction with the NFT holders (DAO) is an interesting development for investors: Own a piece of the brand by owning a piece of their collection.

Examples of derivative products under CC0

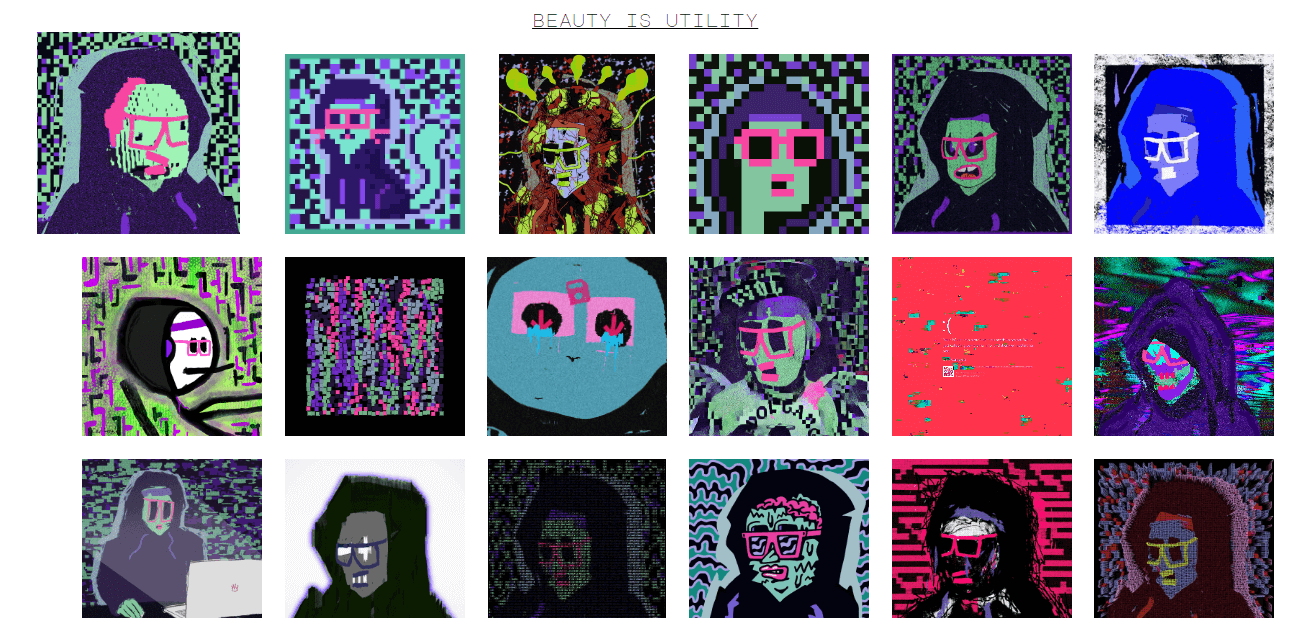

XCOPY, an iconic NFT creator, put his “Right Click and Save as Guy” artwork under the CC0 license in January 2021. This CC0 license has already resulted in many derivatives.

And they are available for trade, giving more visibility to the original artwork.

After their CC0 announcement, there was also an explosion of derivatives of Moonbirds. An example is Mournbirds, where the creator explicitly mentioned that the new collection was made possible because of the license.

After their CC0 announcement, there was also an explosion of derivatives of Moonbirds. An example is Mournbirds, where the creator explicitly mentioned that the new collection was made possible because of the license.

This is not a trend that will go away, especially with a huge success story like the Noun Collection. As Moonbirds also announced their plans to move to a DAO to monitor and incentivize their logo/brand usage, this process of releasing the copyright to the collection and sharing direction with the NFT holders (DAO) is an interesting development for investors: Own a share of the brand by owning part of their collection.

This piece was contributed by the Footprint Analytics community on August 30, 2022 Thiago Freitas

Data source: CC0 dashboard

Footprint Community is a place where data and crypto enthusiasts around the world help each other to understand and gain insights about Web3, the metaverse, DeFi, GameFi or any other area of the new world of blockchain. Here you will find active, diverse voices that support each other and drive society forward.