What is Bitcoin Liquid Sidechain and how does it work?

One of the biggest issues facing Bitcoin is scalability and speed. Bitcoin’s underlying technology is not particularly fast and cannot process many transactions simultaneously. That’s a problem for the world’s most popular cryptocurrency.

One solution is Layer-2 blockchain protocols, which effectively add another processing layer to the original blockchain to increase capacity. The Bitcoin Liquid sidechain is a Layer-2 protocol that aims to solve Bitcoin’s scalability and speed issues, but how does it work and how can you use it?

What is a side chain?

A sidechain is a type of Layer-2 blockchain attached to the main blockchain to help process some of the data in the main blockchain. It enables the mainnet to grow its ecosystem by processing certain transactions securely and faster. In this case, the Bitcoin blockchain is Layer-1, and the Bitcoin Liquid sidechain is Layer-2. There are other differences between Layer-1 and Layer-2 blockchains as well.

It makes it safe to move digital assets like tokens between blockchains, and it improves the privacy and security of the main blockchain by reducing the trust needed to keep a network running.

Sidechains are more centralized than mainnets and are responsible for their security, a trade-off for the speeds they achieve. They also need their own validators or miners, but they can adopt any consensus mechanism, be it proof-of-work, proof-of-stake or proof-of-space-time. Sidechains do not have to use the same consensus mechanism as the main blockchain, which can help speed up processing.

For sidechains to work efficiently, i.e. transfer and receive digital assets from the mainnet without allowing any duplication, two things are required: a two-way link and smart contracts.

Two-way stick

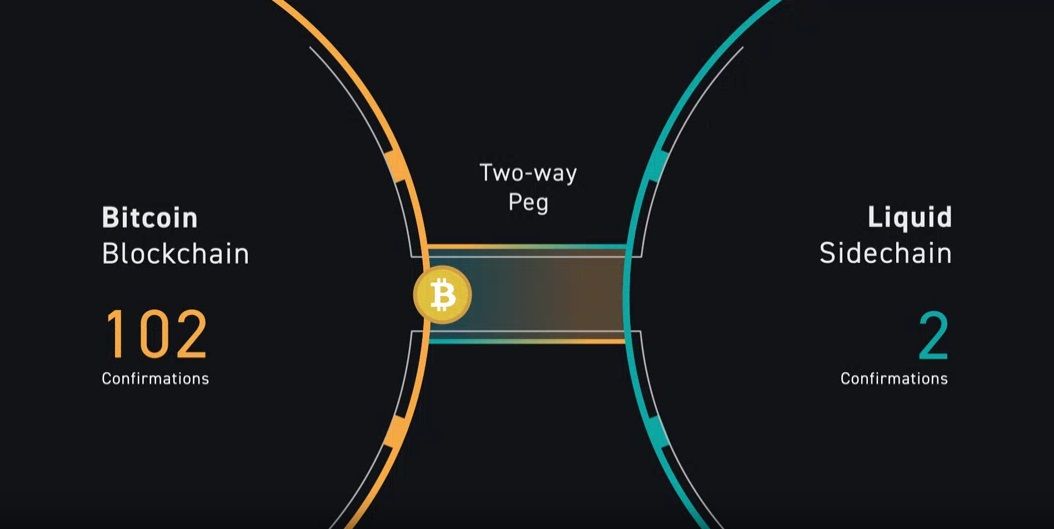

A two-way peg is a mechanism that enables the transfer of digital assets between two separate blockchains. It involves a two-way, counter-productive process: locking mainnet resources to the sidechains and releasing sidechain resources to the mainnet. So how does the two-way stick work?

The Liquid Sidechain two-way pin allows you to lock an asset on the mainnet and then add a corresponding amount of that asset to the sidechain. When the assets have to be transferred from the side chain back to the main chain, they are destroyed, and a corresponding amount of assets are minted in the main chain.

This creates a direct bridge between the two, enabling interoperability. Essentially, no “transfer” takes place. This means that the “validators” involved in the operation are assumed to act honestly.

Smart contract

The whole idea behind blockchain technology is to make it trustless. The validators in a two-way link transaction process cannot be human, and this is where smart contracts come in.

Smart contracts validate that the digital assets locked and released on each blockchain match each other in value. They do this by enforcing validators on the sidechain, and the mainnet acts honestly when verifying transactions across chains.

Essentially, when a transaction occurs on the sidechain, a smart contract notifies the mainnet of the event. The transaction information is then sent to another smart contract on the side chain to confirm the transaction.

Upon verification, the representative digital assets in the side chain are destroyed, and corresponding digital assets in the main chain are released to you. This process can take place in both directions.

What is Bitcoin Liquid Sidechain?

Bitcoin Liquid, also known as the Liquid Network, is a sidechain designed to provide solutions to the privacy and scalability limitations of the Bitcoin blockchain.

Unlike in Bitcoin, where blocks are mined with the proof-of-work mechanism, Bitcoin Liquid assigns each block to specialized hardware units known as “function nodes”, which sign transactions, generate new blocks and secure bitcoins connected to the main network.

To achieve better privacy, Liquid Network uses tokens with transaction amounts, and asset types hidden using cryptographic techniques. These assets allow the network to support confidential transactions, resulting in more privacy.

Meanwhile, the Liquid Network achieves scalability through its support for two-minute block times, significantly faster than Bitcoin’s ten-minute block time. This allows for faster trading and settlement of assets on the network.

Who Controls the Bitcoin Liquid Sidechain?

Bitcoin Liquid was created by Blockstream, a company founded in 2014 by Adam Black, to develop products and services for the storage of digital assets.

It is currently managed by a federation of 63 trusted entities known as “Liquid Functionaries”, which include financial institutions, cryptocurrency exchanges and other bitcoin-based businesses. These officials provide the validation and management infrastructure for the network.

How does the Bitcoin Liquid Sidechain work?

Bitcoin Liquid works through a unified pin mechanism that allows bitcoins to be unlocked in the mainnet and a corresponding value of the asset released in the sidechain in a 1:1 ratio.

How Liquid Network works:

- To initiate a “connection”, you first send Bitcoin to a specific address on the main chain owned by Liquid Federation.

- Once the Bitcoin is verified, an equal amount of Liquid Bitcoin (L-BTC) is sent to your Liquid Bitcoin address on the Liquid sidechain.

- You can use your L-BTC to make transactions on the Liquid sidechain, which is faster and more private than the main chain.

- To “delink” your L-BTC back to the main chain, you send the L-BTC to a specific burn address on the Liquid sidechain, and the main chain will release the same amount of Bitcoin when the transaction reaches two confirmations.

This system allows you to make faster and more private Bitcoin transactions without compromising the security and reliability of the Bitcoin blockchain.

Advantages of Bitcoin Liquid Sidechain

There are several benefits that the Bitcoin Liquid sidechain offers to both the Bitcoin blockchain and its users. They include

- Faster transactions: Based on block times, the sidechain can process transactions at least five times faster than the mainnet, reducing transactions to two minutes instead of ten. This takes some of the transaction load off the Bitcoin blockchain. In addition, it makes it an ideal choice for arbitrage trading and retail investments, which need faster transaction processing.

- Cheaper transactions: Normally, fees on the Bitcoin blockchain skyrocket when it gets congested with transactions, and miners have to charge more for prioritization. On Bitcoin Liquid, since the transactions are processed faster, the fees are lower and ideal for heavy users and institutional investors.

- Greater privacy: Liquid Network uses confidential transactions that allow users to keep transaction amounts and other information from public view. Therefore, if you need a way to move Bitcoin that is more privatized, the sidechain is a good option.

- Increased functionality: Bitcoin’s blockchain is very limited because its programming language, Script, is not Turing-complete, which means that the issuance of digital assets is limited. However, with the Liquid Network, users can manage assets such as tokens, stablecoins and NFTs.

Overall, Bitcoin Liquid works well as a load reliever for the Bitcoin blockchain. Nevertheless, despite its effectiveness, it also has a number of disadvantages.

Disadvantages of Bitcoin Liquid Sidechain

The structural design of the Bitcoin floating sidechain presents several problems.

- Centralization: The Liquid sidechain is run by a federation of 63 officials who are responsible for maintaining the ledger and adding new transactions. Of the group of 63 members, only 15 clerks are active at all times. As such, a centralized system is subject to the control of a few parties and is not ideal for people who value decentralization.

- Risk of error: Bitcoin liquid has only 15 nodes from the officials who maintain the network compared to Bitcoin blockchain’s thousands of nodes. This means that there is a high risk of malicious attacks, which will result in errors.

In particular, Liquid Network’s design creates the same challenges blockchain technology was designed to solve: centralization risk.

Sidechains and Layer-2 networks will help build crypto

If we are going to have a Bitcoin ecosystem that billions of people can use, the idea of using sidechains to expand the scope, scale and dynamics is great. That means more people can make transactions without having to suffer slow speeds.

The sidechains built to support the mainnet, whether they have different consensus mechanisms and governance rules or the same, must have a common vision while remaining independent.

Sidechains have a big role to play in improving the use and adoption of cryptocurrency.