A crypto-liquidity pool allows you to lock your tokens in a pool of cryptocurrencies where they are used, and you in turn receive passive income. It also has many benefits for crypto- and decentralized financial networks (DeFi) as they shift away from how centralized crypto exchanges work.

In this article, we will look at what a crypto liquidity pool is and its role in DeFi networks.

What is a crypto-liquidity pool?

A liquidity pool is a pool of crypto tokens secured under a smart contract. These tokens provide decentralized exchanges with the essential liquidity they need. The term “liquidity” refers to how easily one can exchange one cryptocurrency for another. Such ease is crucial to the DeFi ecosystem due to the many economic activities carried out in it.

Although the decentralized trading sector contains a large number of liquidity pools, only a select few of them have established themselves as investors’ first choice. They include Uniswap, Balancer, Bancor, Curve Finance, PancakeSwap and SushiSwap.

How a liquidity pool works versus an order book

A liquidity pool is like a pot that contains cryptocurrencies locked into a smart contract that allows people to trade easily. The importance of liquidity pools is better understood when we compare them with traditional order books.

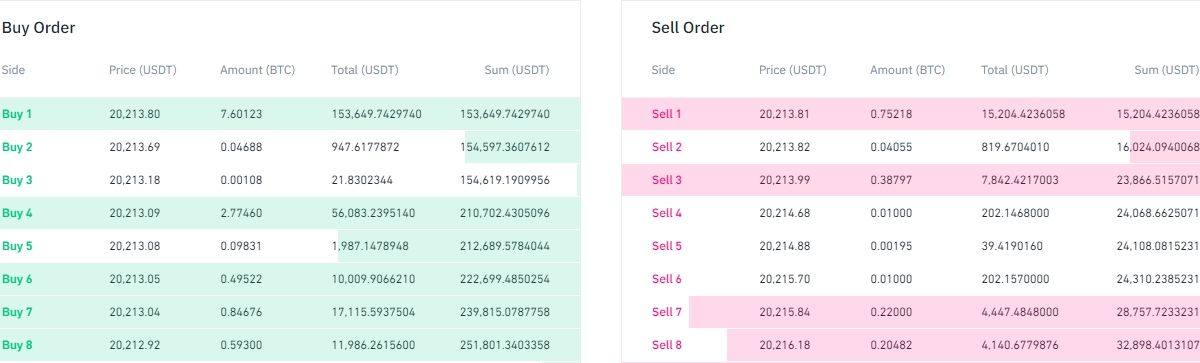

The order book is a digital list of crypto buy and sell orders arranged by price level and updated continuously in real time. Simply put, buyers and sellers submit orders for the number of tokens they want to trade and at what price. The method requires that someone else is willing to accommodate the order. Otherwise, traders will trade at an unfavorable price or wait a long time to see someone meet the desired price.

Liquidity pools ensure that buy and sell orders are executed at any time of the day and at what price you want to trade without looking for any direct counterparty. The system uses an Automated Market Maker (AMM) to ensure this. You do not have to find a seller to buy a token. All that is needed is sufficient liquidity in the pool.

When a token swap occurs, AMM ensures that the price is adjusted based on the algorithm. The algorithm ensures that there is always liquidity in the pool, regardless of trade size.

A liquidity pool is by default a 50:50 ratio of 2 coins. Let’s say 50% bitcoin (BTC) and 50% ether (ETH). When you buy BTC with ETH, the pools will start to lose BTC and get more ETH. The algorithm increases the price of bitcoin and lowers the price of ether to keep the ratio regulated. The process is a self-regulated automated response to market needs.

Advantages and disadvantages of order books

The order book system also has its advantages. The system, which has been used for many years, allows buyers and sellers to make more informed decisions. The order book reveals imbalances in the market, which traders can use to gain insight into short-term market trends. For example, when there is an increase in the number of purchase orders, there will probably be an increase in the price because an increased number of traders is bullish.

The order books can also be used to identify the areas in the market that create support and resistance. For example, strong support can be found in an area with multiple purchase orders, while you can find resistance support in an area with multiple sales orders.

The order book also offers some challenges, one of the most important of which is the lack of transparency. Stock exchanges have been taken to engage in price manipulation, insider trading, laundry trading, as well as manipulating their trading orders. As a result, the order book gives traders false information, which causes them to make trades they should not.

As more centralized exchanges store the information and documents of their customers, there is a greater possibility that the information to the customers may be disclosed in the event of a data breach.

Order books are used by many centralized exchanges, including Binance and Coinbase. The order book is also used to trade shares on traditional stock markets. However, order books do not work well when the market is not very liquid. This is because it will not be easy to find a match, and you may have to wait a long time to complete your trades.

3 advantages of liquidity pool over order books

Below are three advantages that liquidity pools have over traditional market-creating systems.

There is liquidity at all price levels

You do not need to connect to other traders to trade because there is always liquidity as long as the client’s assets remain in the pool.

You do not have to worry about finding a partner who wants to shop at the same price as you. Instead, the algorithm adjusts the value of the crypto based on the platform’s exchange rate.

2. Better price balance

With liquidity pools, no seller can demand high market prices. Similarly, buyers cannot devalue the market price below the average price. As a result, transactions are smoother and the market is more balanced.

As soon as a liquidity provider deposits money in the pool, smart contracts take full control of pricing.

3. Everyone can offer and benefit from it

The supply of liquidity is not limited to market participants, and anyone can provide liquidity. Listing fees, KYC requirements and other barriers related to centralized exchanges are not required for liquidity pools. To provide liquidity to the pool, you only need to make a deposit equal to the value of the assets.

Liquidity providers are usually rewarded with fees, which can be a form of passive income.

3 Risks at liquidity pools

There are also some disadvantages to liquidity pools. Three of these issues are explained below.

1. Permanent loss

The value of one cryptocurrency can change compared to another due to demand and supply activities, leading to a permanent loss of value. This problem occurs when the ratio of two assets held ends up being different due to a sudden price increase on one of the assets.

A permanent loss means that liquidity providers lose on the profit from one of the assets they have. It can become permanent if a liquidity provider takes its funds out of the pool before the price recovers.

2. Vulnerabilities in smart contracts

Smart contracts manage the assets added to a pool; there is no central authority or trustee for these assets. Therefore, you can lose the coins permanently if a vulnerability is detected.

Performing smart contract audits is a good way to ensure that smart contracts are safe from security breaches. However, the process requires a closer look at the source code to look for potential errors.

Developers who hijack pools

There is a possibility of fraud in a very centralized liquidity pool. For example, one of the developers in the pool can hijack the pool’s resources. As a result, you need to choose your liquidity pool carefully and perform adequate due diligence before depositing crypto.

Be wary of projects where developers can change the rules of the pool. For example, developers can sometimes have a private key or other way to gain special access to the smart contract code. Without a smart contract audit, they could use this to do something bad, such as take control of the total funds.

Liquidity pools are crucial for the operation of DeFi technology

A liquidity pool is an important component of DeFi. Although it has its drawbacks, it helps to perform many DeFi activities such as trading, crypto yield farming, lending, arbitrage trading and profit sharing. In addition, you can also get passive income by being a liquidity provider.

With liquidity pools, you can trade without fear of market makers’ price manipulation, which increases the confidence that traders and liquidity providers have in cryptocurrencies and DeFi in general.