What is a crypto insurance fund and how does it work?

The cryptocurrency market is volatile and unpredictable, so exchanges must have measures to protect users from unexpected losses. A crypto exchange insurance fund is one of these measures, and it is important for leveraged traders to understand how insurance funds work in order to know what measures are in place if they are liquidated.

What is a Crypto Exchange Insurance Fund?

A crypto insurance fund provides a safety net to cover unexpected losses that exceed the initial margin. This safeguard helps traders reduce risk and provides an extra layer of security against incurring negative balances when engaging in high-risk derivatives trading. At the same time, insurance funds also ensure that profitable traders get the full profit.

How Crypto Exchange Insurance Funds Work

Any losses you incur are compounded when you engage in leveraged crypto trading. If the price of an asset declines and the value of your position falls below a specific threshold referred to as the “liquidation price”, the trading platform will sell your position to reclaim the borrowed funds you have received.

Assuming you have $5,000 to trade and use a 10x leverage, your trading results, both profit and loss, will be magnified by a factor of 10. For example, if you predict that the price of a cryptocurrency such as BTCUSD will increase and initiate a trade, but the price starts to drop instead, without the use of a stop loss, the price can plunge to the liquidation price, causing you to be liquidated. With leverage, a 10% drop will cause you to lose your original margin.

Liquidation ensures that you do not lose more than your initial margin or deposit amount. However, during market volatility, there can be price drift, leading to a price gap in cryptocurrency trading. This price gap is a visible discontinuity on the price chart caused by sudden sharp movements in cryptocurrency prices. Such gaps occur due to the absence of trading activity within a certain price range, due to factors such as low trading volume or increased market volatility. Price gaps can lead to losses that exceed the initial margin, leading to bankruptcy.

Cryptocurrency exchange insurance funds are designed to protect against liquidation autodeleverage, which occurs when a person goes bankrupt and the insurance fund is insufficient to cover their losses. Despite brokers’ efforts to prevent this from happening, it can be challenging to do so, especially in volatile and unpredictable markets, such as those characterized by the price gaps discussed earlier. Also, given the high leverage typically used by cryptocurrency derivatives traders, the possibility of auto-deleverage liquidation remains a real risk.

In the event of a trader’s bankruptcy, auto-deleverage liquidation occurs, causing the platform to automatically sell the positions to counterparty traders to compensate for losses. This measure helps preserve the platform’s liquidity levels during extreme market volatility.

Insurance funds can be financed through exchange fees and liquidation fees. If a trader’s position is liquidated, and the closing price exceeds the bankruptcy price, any remaining margin will be added to the insurance fund. However, if the closing price is lower than the bankruptcy price, the trader’s loss will have exceeded his initial margin, resulting in the insurance fund compensating for the loss.

The size of a trading platform’s insurance fund can vary based on various factors that affect the platform’s risk level. For example, higher trading volume and greater market volatility can increase risk exposure, and increase the size of the exchange’s insurance fund to provide more comprehensive protection for its traders.

Alternatively, if trading volumes decrease or market volatility stabilizes, the platform may consider reducing the size of the insurance fund to optimize resources and costs. In addition, some exchanges may change the size of their insurance fund depending on the assets traded or the degree of leverage offered.

How much does a crypto insurance fund cover? Who can use it?

Many exchanges that offer hedge funds make them available to retail traders with no limit based on margin size. However, some exchanges have specific limits on how much their insurance funds will absorb in the event of liquidation. For example, Delta Exchange’s insurance fund covers up to 5% of losses for Bitcoin and Ethereum contracts and 2% for other contracts. If the loss exceeds the limits, autodeleverage liquidation will be triggered.

On the other hand, some exchanges, such as BitMEX, do not specify how much loss their insurance fund will cover, as it varies depending on factors including the trade’s leverage size, position size and market condition, among others.

3 popular crypto exchanges that offer crypto insurance funds

Below are three platforms that offer crypto insurance funds for derivatives trading.

1. Binance

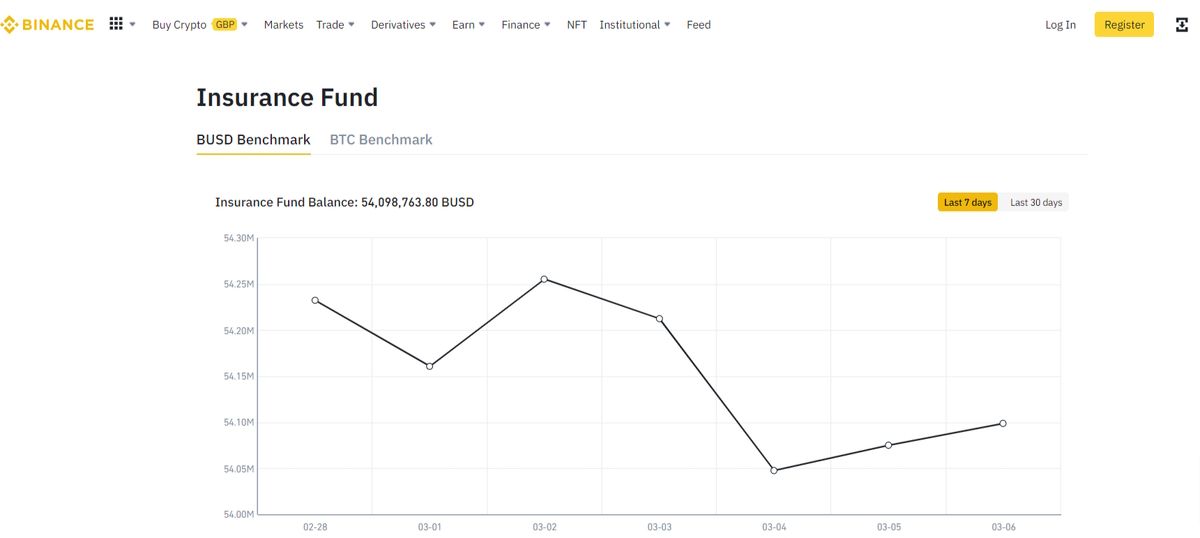

Binance is among the leading crypto platforms with one of the most extensive insurance funds globally. Specifically, for trading pairs such as BTCUSD, ETHUSD and BNBUSDT, the insurance fund is over 900 million USDT and BUSD, and Binance has insurance funds for several pairs across various categories, all held in USDT and BUSD.

2. City piece

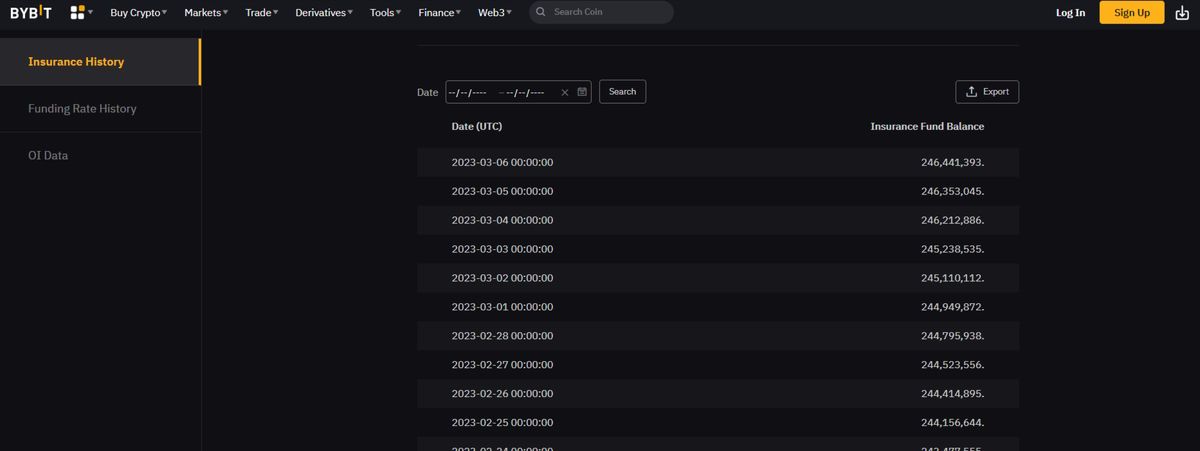

Bybit is a well-known crypto exchange that offers trading services for futures, perpetual futures and options contracts. To protect its traders from negative balances resulting from positions being closed below the bankruptcy price, the platform maintains an insurance fund of more than 246 million USDT.

3. BitMEX

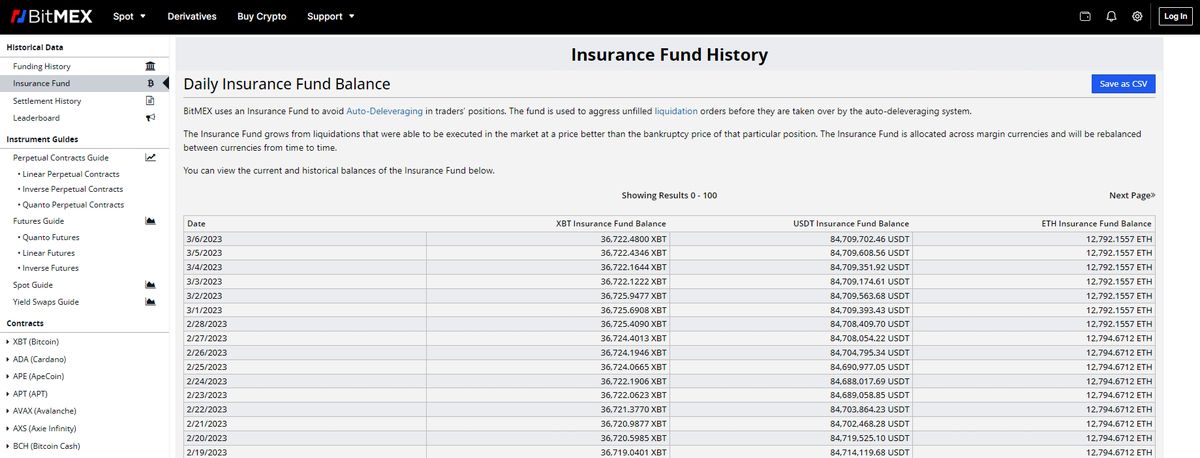

BitMEX is a widely used crypto derivatives exchange that maintains an insurance fund consisting of over 84 million USDT, 12,000 ETH and 36,000 XBT. It is financed by completed liquidations which are better than the bankruptcy price. The fund is spread over various margin currencies and rebalanced at regular intervals

Advantages and disadvantages of insurance funds

Insurance funds protect traders against potential losses from liquidation events in leveraged trading. It reduces the likelihood of a trader incurring negative balances and promotes trader confidence in a crypto exchange. The fund also helps exchanges maintain trading platform stability and reduces the possibility of a platform failing due to unforeseen losses.

However, severe market volatility can trigger a wave of liquidations, rapidly depleting insurance funds and leading to a lack of funds to cover losses. In addition, there are extreme market conditions when insurance funds may not be sufficient to cover all losses, leading to negative balances for some traders. Finally, insurance funds may also be funded by a portion of the trading fees charged by the platform, which may increase trading costs for traders

Prioritize risk management; Don’t rely on insurance

It is important to note that while a large insurance fund may provide some degree of protection for traders against negative balances, it is not a guarantee against such losses. In extreme market conditions, the size of an exchange’s insurance fund may not be enough to cover all the losses incurred by traders, resulting in a shortfall. As such, traders should always exercise caution and use risk management strategies when engaging in derivatives trading.

Some of these strategies may include setting stop-loss orders, diversifying their portfolio and using leverage wisely. It is also advisable to research and choose reputable exchanges with robust frameworks for risk management and insurance funds.

![Bitcoin [BTC] losing grip on $28k as interest rate hikes continue, unabated Bitcoin [BTC] losing grip on $28k as interest rate hikes continue, unabated](https://www.cryptoproductivity.org/wp-content/uploads/2023/03/po-2023-03-23T073741.604-1000x600-520x245.png)