What I Did to Fix My Bitcoin Loan – Bitcoin Magazine

This is an opinion editorial by Wilbrrr Wrong, a Bitcoin pleb and economic history enthusiast.

In this article, I describe my experience using bitcoin collateral loans, of the type offered by Holdhodl or Unchained Capital. I used these loans during 2020-2021, using some general rules of thumb, but recently I created a study that shows that they can be used with greater certainty if a more systematic approach is put in place.

I would first like to make a caveat that my practice may be criticized for not “staying humble.” Certainly, many pundits will discourage these ideas, such as in this “Once Bitten” episode with Andy Edstrom.

I have long had an interest in the use of modest amounts of leverage in financial strategies, and these ideas are presented solely to document my experience, and how it could be improved.

Motivations

The initial motivation for this strategy came from the excellent book “When Money Dies”, which describes the step-by-step process of how Germany entered hyperinflation in 1920-1923. A striking story from this period is that many Germans became rich, while the currency and the country went through hell. These investors took out deutschmark loans and used them to buy hard assets like real estate. Then, after one to two years, they would pay off their loans with deutschmarks that had become almost worthless, and they would still be in possession of the real thing – for example, a house.

The second motivation came from thinking about financial management strategies. Managing a bitcoin stack seems analogous to the problems faced by Saudi Arabia, with its oil resources. In particular – they have a valuable resource, and they have expenses. They want to use their resources to maximize their purchasing power, and build wealth for the future. Of course, Saudi Arabia also has other geopolitical considerations, but generally speaking, this is the problem for any family office or wealth manager.

Previous experience

I used the “deutschmark loan” strategy to good effect in the 2020-2021 bull market, but I was not systematic. I went with a subjective assessment for when I should take out a loan, and how the amount should be done. I had the general guiding principles:

- When starting a new loan, try to keep your total portfolio loan-to-value at 20%. In other words, try to keep the USD value of the loan book at 20% of the USD value of the bitcoin that I had allocated to this strategy. In this case, I would be able to withstand a 50% drawdown in the BTC price.

- Try not to sell. I had pretty well drunk the Kool-Aid that BTC would reach $200,000 plus and I didn’t want to be shaken out.

All loans were bitcoin collateral loans, of the type offered by Hodlhodl or Unchained Capital. A main feature of these loans is that they are liquidated if the bitcoin backing the loans falls in value – essentially a margin loan. For example: if you take out a loan of $50,000, you must oversubscribe collateral and put up $100,000 worth of bitcoin. If the value of the bitcoin falls to $70,000, you are required to deposit additional BTC or your security will be liquidated.

I did reasonably well with these ideas. I survived the Elon/dogecoin move, and held on for the Q4 2021 bull run. But then I hung on too long in the 2022 Federal Reserve-induced bear market. After this experience, I decided to investigate whether a more systematic approach would have improved downside protection while allowing my stack to grow over time.

The systematic strategy

With this modified strategy, I carried out a back-test over 2019-2021 which introduced strict guidelines for taking out new loans, and downsizing existing balances. I chose guidelines that are relatively similar to my 2020 strategy, but with more discipline. I started with a loan-to-value ratio (LTV) of 20%. For example, with a test BTC stack worth $100,000, the first loan would be $20,000, which would be used to buy more BTC.

Once the loan is established, my test monitors if the BTC price drops. In this case, the LTV rises. Continuing with the previous example, if the value of the bitcoin stack falls to $80,000, the LTV rises to 25%. (The $20k loan value is now divided by the updated $80k value of the stack.)

If the LTV rises too high, the test liquidates part of the loan. In my studies I chose 30% as this level. If the LTV reaches this level, it sells some BTC to pay off part of the loan. In this approach, I don’t want to overreact to momentary swings during a volatile bull market, so I want to sell enough bitcoin to bring the LTV back to 25%.

On the opposite side, if the BTC price rises, the LTV will fall. Using the previous example: If the bitcoin stack rises to $120,000, then the LTV is now 16.7% – the $20k loan is now divided by $120k. If the LTV falls to 15%, then the strategy decides that it is safe to take out another loan, bringing the LTV back to 20%.

It should be noted that the really difficult part of this strategy is having the discipline to sell when the LTV reaches 30%. We all suffer from hopium, so an iron will is needed to implement the recommendations spit out by a computer script.

Frictions in the real world

A personal pet peeve is quantitative strategies that look good on paper but fall apart when you factor in real-world issues like transaction costs, processing delays, and taxes. With this in mind, I wrote a python script to back-test the systematic loan portfolio, incorporating the following effects:

- Origination fee. This is usually 1%. For example, if you apply for a loan of $100,000, you will receive $99,000 in your bank account.

- Processing time. I set this to 14 days. The time from the loan application until you receive USD or USDT. 14 days may be too conservative, but it sets a floor for strategy performance – you usually take out new loans when the price pumps.

- Taxes. This is the part that really makes selling bitcoin when LTV rises painful. However, BTC tax processing allows HIFO processing – Highest In, First Out. This can minimize taxes paid – you count the sale against the highest price you paid.

- Interest. I set this high at 11%, which I have found to be typical for these loans.

- Sale time. I had an estimate of a day’s sales time. For example, if the LTV goes higher than 30%, I will be able to sell some bitcoin and bring the LTV back down within one day. My experience has been that the process of selling BTC and getting USD with a bank transfer can be done within a day.

- Rollovers. All loans are assumed to have a 12-month term. If a loan reaches the end, it will be rolled over. The USD size of the loan will increase to add the origination fee for the new loan.

- Interest costs. When taking out a new loan, I withhold all necessary interest expenses for the current and following quarter, for all loans. BTC is purchased with the remaining amount.

Data

Daily data came from Coinmetrics. They have thought a lot about their figures, and have done research to eliminate laundry trade. Their daily reference rate also takes a time-weighted average over the hour until the New York market closes. This time, weighting is a good proxy for slippage – when you buy or sell, you never realize exactly the price listed right at the close. Their methodology is described here, specifically from the bottom of page seven, “Calculation Algorithm.”

The only problem with Coinmetrics was that their low price for bitcoin in March 2020 was $4,993. I remembered a lower price during the crash. Because of this, I also took some Yahoo! data, which showed $4,106 intraday, as a further stress test for the strategy. With both sets of data, the strategy survived the stress and performed well.

Results

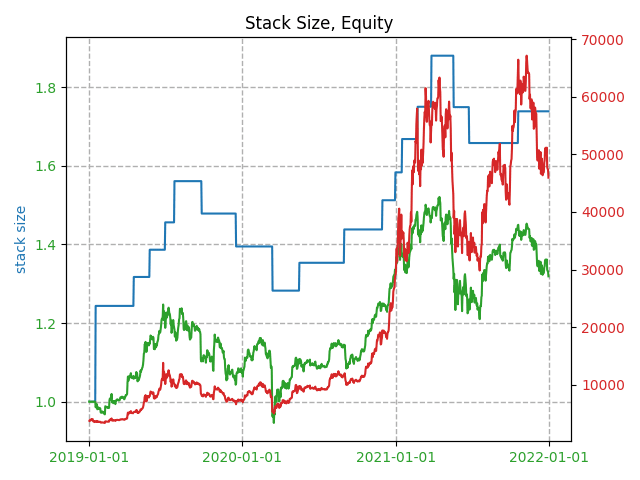

With all the preceding preambles, the results came out well, as shown in the graph:

An explanation of the results:

- The blue line is the size of the stack. It starts at 1, growing to about 1.75 by the end of 2021.

- The red line is the bitcoin price, plotted with linear coordinates instead of the usual log plot.

- The green line shows the equity position – the value of the BTC stack minus the loan balance. This is shown in BTC terms, against the left axis.

This is a promising result, as it shows that during 2019-2021, this systematic strategy could be used to increase a BTC stack by approximately 32%, with conservative downside protection.

The other positive result is that the strategy handled market stress well, in March 2020 and May 2021. In both cases, it maintained good safety coverage, and did not come close to forced liquidation. Even with Yahoo! data showing the lower intraday level never went below 240% during the extreme March 20, 2020 event. Typical terms for winding up loans are around 130-150%.

A negative result saw the stock position temporarily fall below one in March 2020, to 0.96 BTC before recovering. So the backtest showed that this strategy, while conservative, carries risk and does not present a “free lunch.”

Conclusions and further work

This article describes my previous use of bitcoin collateral and how it could have been improved with a more disciplined approach. Going forward, I will experiment with different parameters in the strategy, while protecting myself against over-adaptation to a specific time period. I have also done initial work on adding cost of living into the back-test, to complete the overall wealth management picture. The final result is very sensitive to cost of living, so caution is required. No Lamborghinis.

From a 30,000-foot point of view, the bottom line is that the coming years will hold enormous volatility, as well as opportunities for those who can balance optimism with discipline and conservatism. Nothing in this article is investment advice! Do your own research, and take personal responsibility to heart. My personal goal will be to continue and improve these lending strategies, and to take calculated risks to get past the big debt reset with as many bets as possible.

This is a guest post by Wilbrrr Wrong. Opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.