All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, do your own research before making any kind of investment.

all about cryptop referances

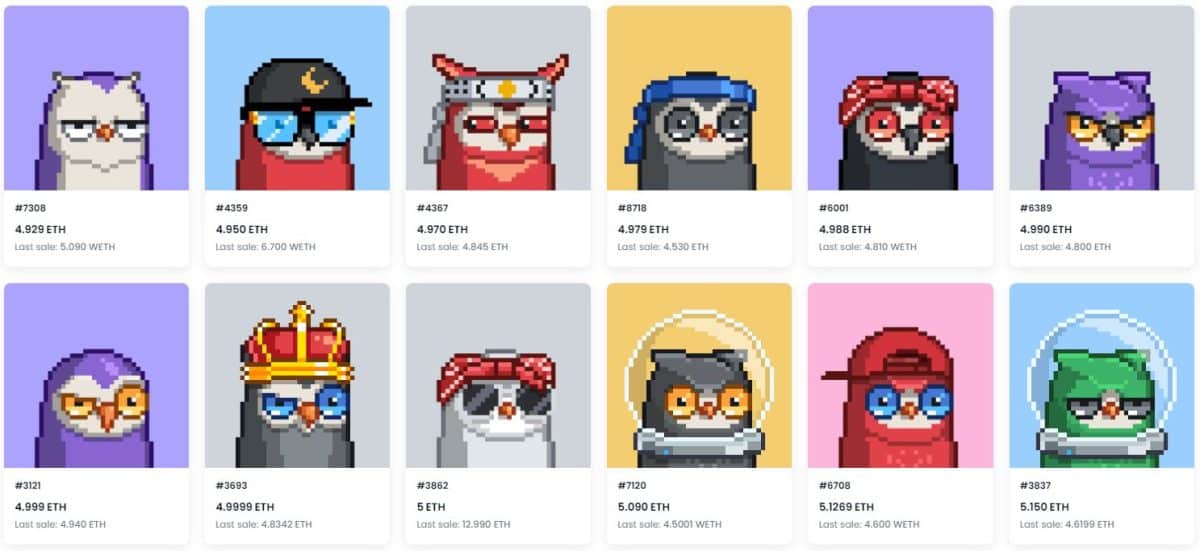

The Moonbirds NFT collection had a choppy weekend. Their floor continued its steady downtrend and hit a low right around 4eth on Saturday. So what happened to Moonbirds to cause this price action?

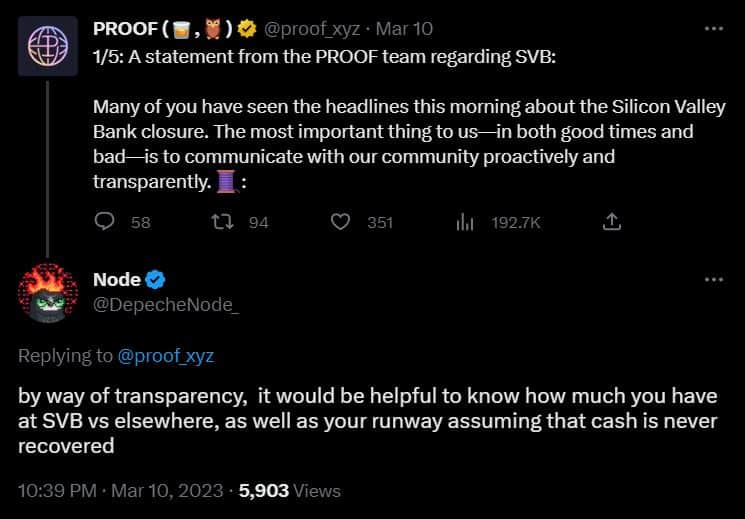

Proof, the parent collection of Moonbirds, tweeted that their ecosystem has a portion of their treasury at the now-defunct Silicon Valley Bank. They claimed to have diversified their funds in different places but did not disclose exact amounts at first. The Proof Twitter account said: “Proof has cash at SVB but… We’ve luckily diversified our assets across ETH, stablecoins, as well as fiat – so financially and operationally we’ll be fine.”

The reaction from the community was immediate and severe. Many prominent holders asked for more clarification on how much of the project’s treasury had potentially been lost. Given how much money the project had raised from the Moonbirds coin, royalties and VC funding, there was a real fear that the losses could be catastrophic.

Kevin Rose, CEO of Proof, even tweeted that he saw Moonbird buyers being bullied on his Twitter timeline. While possibly true, the idea of people being shamed into buying into the project didn’t exactly garner any positive attention in a market that operates primarily as an attention economy.

To make matters worse, the news came at an inauspicious time for Moonbirds thanks to unusual market activity caused by Blur breeding. A whale had bid big on Moonbirds last week to farm the upcoming Blur airdrop. This person artificially increased the price of the collection above 6 eth by collecting 499 Moonbirds.

After the SVB announcement, the trader started dumping his entire collection to bids as low as 3.94 wet on Saturday. By the end of the weekend, the Blur farmer had sold his last Moonbird and suffered around 700 eth in trading losses in the process.

Kevin Rose, CEO of Proof, revealed on Sunday that less than 50% of their treasury is held in SVB. This announcement came after the Department of the Treasury, the FDIC and the Federal Reserve issued a joint statement pledging to protect depositors’ assets. By guaranteeing these funds, the government ensured that the Moonbirds team will be able to execute their roadmap.

The community rallied behind the project and took advantage of the discounted floor price after the news. The floor price is currently at 4.80 eth, up approx. 20% of the lowest on Saturday.

Project managers Kevin Rose and Justin Mezzell held a Q1 update recently. They promised to focus on art on their “north star” going forward. To that end, they scrapped their metaverse art gallery project Highrise and announced the cancellation of nesting rewards, a longstanding feature of the project that rewards holders for not putting Moonbirds up for sale, after their next reward.

Will the Proof team be able to return the Moonbirds collection to its former position as a top-3 NFT collection? We will soon find out, but now that their funds held in Silicon Valley Bank are protected, at least they will have the means to take a chance on it.

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, do your own research before making any kind of investment.