What happened to Russian fintech after the global “cancellation”

This is seriously fascinating in a business case sense. I don’t think any country in recent history has faced such a rapid change in the way the fintech and banking system works. Global sanctions against Russia were and still are unprecedented in terms of scale, sheer numbers and implications for the immediate global “exclusion”.

Let’s talk about what the world thinks happened versus what actually happened.

Visa, MasterCard ban

Tagline: Visa and MasterCard stopped working in Russia.

Reality: Visa and MasterCard effectively stopped global support for the cards issued by Russian banks. This means that Visa and MasterCard issued in Russia will not work outside of Russia in shops and ATMs. Inside the country, existing Visa and MasterCard continue to work fine. No new ones are issued.

How is this possible?

The Russian central bank has isolated domestic operations of Visa and MasterCard back in 2015 following the Crimea sanctions. Visa and MasterCard agreed to work through the local switch called the National Payment Card System, using the Russian central bank as a clearinghouse for domestic operations.

This worked exactly as designed when 2022 happened. Local banks can no longer issue new Visa and MasterCard bank cards, but can extend existing ones indefinitely. They did just that.

Those who needed to make purchases abroad had to physically travel to nearby countries and open bank accounts and cards. They call it ‘debit card tourism’. One by one, countries that experienced the biggest waves of such tourism began to refuse to issue cards to Russians. However, this is still a very viable option here and there.

There was a lot of hope on UnionPay’s shoulders, many banks believed that the Chinese scheme will take over the lost dominance of Visa and MC. However, UnionPay decided not to rush after the obvious commercial gain, and stopped all negotiations with the Russian banks.

So far, no other global or foreign bank card scheme has taken the vacant seat. The local did. MIR, the local bank card scheme is now a monopoly. All new bank cards issued in the country are MIR cards. MIR has been issued for years since 2015. It held approximately 15% of bank card payment share domestically by the end of 2021, reaching 25% by the end of 2022. Overseas MIR card adoption and co-branding initiatives faced several obstacles, leaving the hope of anti -The Visa/MC alliances high and dry.

SWIFT Prohibition

Tagline: Russian banks were cut off from SWIFT.

Reality: It is true that many banks have lost access to SWIFT. But not all. Those that still have it either keep it under the radar or strictly censor access to international wire transfers for their customers.

The SWIFT ban itself was not a defining event. A real crushing force came with the closing of the Russian banks and central bank accounts in the US/EU banks, followed by the freezing/seizure of their client funds. This has happened both formally due to sanctions, and informally. Way out of the banking business into any Russian corporate business with foreign bank accounts.

Why does it matter more than SWIFT?

It cut off the entire banking system from the vital USD, EUR. There are very few top Russian banks that have directly corresponding accounts in the foreign banks. Most of the smaller banks got their USD and EUR from the bigger RU banks. Closing accounts meant loss of access to funds, money transfers for the entire Russian banking system.

It cuts off Russian businesses from international payments and money transfers. Suppliers, contract payments, revenue. As for the general public, it meant they lost access to easy, cheap international money transfers in USD or EUR. However, there are still ways through certain banks, just more expensive and complex.

It hugely damaged the international movement of funds in/out of Russia. To the point of collapse.

To date, no new routes have been found. Only temporary solutions via nearby land banks, other currencies or crypto. Neither of them work well. The only viable solution now appears to be the ancient system of hawala. Or a two-pocket system, where money goes into one pocket and out of the other.

Crypto was strongly expected to fill the void, and it kind of did in person-to-person money transfers. However, it is not sustainable when it comes to large quantities and companies. At least not yet.

ApplePay, GooglePay ban

Tagline: Apple and Google stopped support for contactless payment technology in Russia.

Reality: Yes they did.

Immediately after this, the national faster payment system skyrocketed. It was developed by the central bank a few years back after the success of the Chinese fintech. It wasn’t perfect and had little to offer people used to contactless payments via Apple from Google. Until 2022 happened.

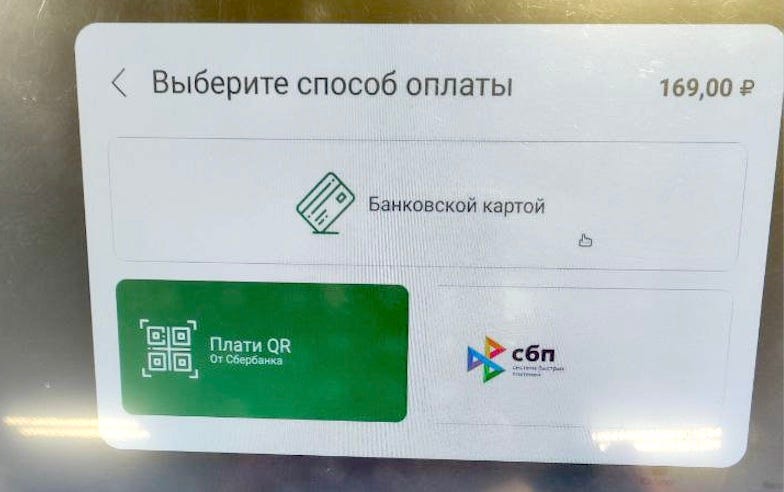

Now there is a boom in contactless payments to companies or authorities via QR codes – national QR code system (SBP) or local system from the preferred bank. For those paying from a mobile device: deep link directly to the online banking application. There are different Pays now from the banks and internet giants: TinkoffPay, SberPay, YandexPay, MIRPay. Major banks have even introduced stickers and wearables that ring.

Offline payments go quickly from Visa/MC through ApplePay/GooglePay to direct and immediate bank transfers. Naturally, the intermediary fee was cut, which is not necessarily reflected in the downsizing of payment fees yet.

Total

There is no doubt that the impact of sanctions against banking and fintech in Russia is colossal. They performed well on the global isolation scale. But domestically, they seem to have done the opposite, allowing the fintech and banking system to reshape itself using the latest technologies and new consumer habits. Russian fintech has been reborn and will continue to develop in a unique and innovative way unlike any other. Unless the following recession and government monopoly kills it with its own hands.

—–

“What kind of money?” is a lifestyle + fintech blog by Anna Kuzmina about innovations and payments landscape, e-commerce and doing business worldwide. WTM publishes monthly summaries, regular reports and articles on hot topics in these industries.

Follow Anna on Telegram, read on Finextra, or connect via LinkedIn.