What consumers think about the future of Bitcoin

Volatility in cryptocurrency markets is nothing new. This year alone has seen a massive hack, institutional investors are liquidating their positions, asset prices are plunging and more.

But will recent implosion of FTX, one of the largest crypto exchanges, finally signaling the end of the industry? News headlines may suggest so, but a closer look at the opinions of consumers and crypto owners tells a different story. What the FTX scandal has done is potentially shrink the pool of crypto believers, crippling the possibility that crypto will become mainstream in the US in the near term.

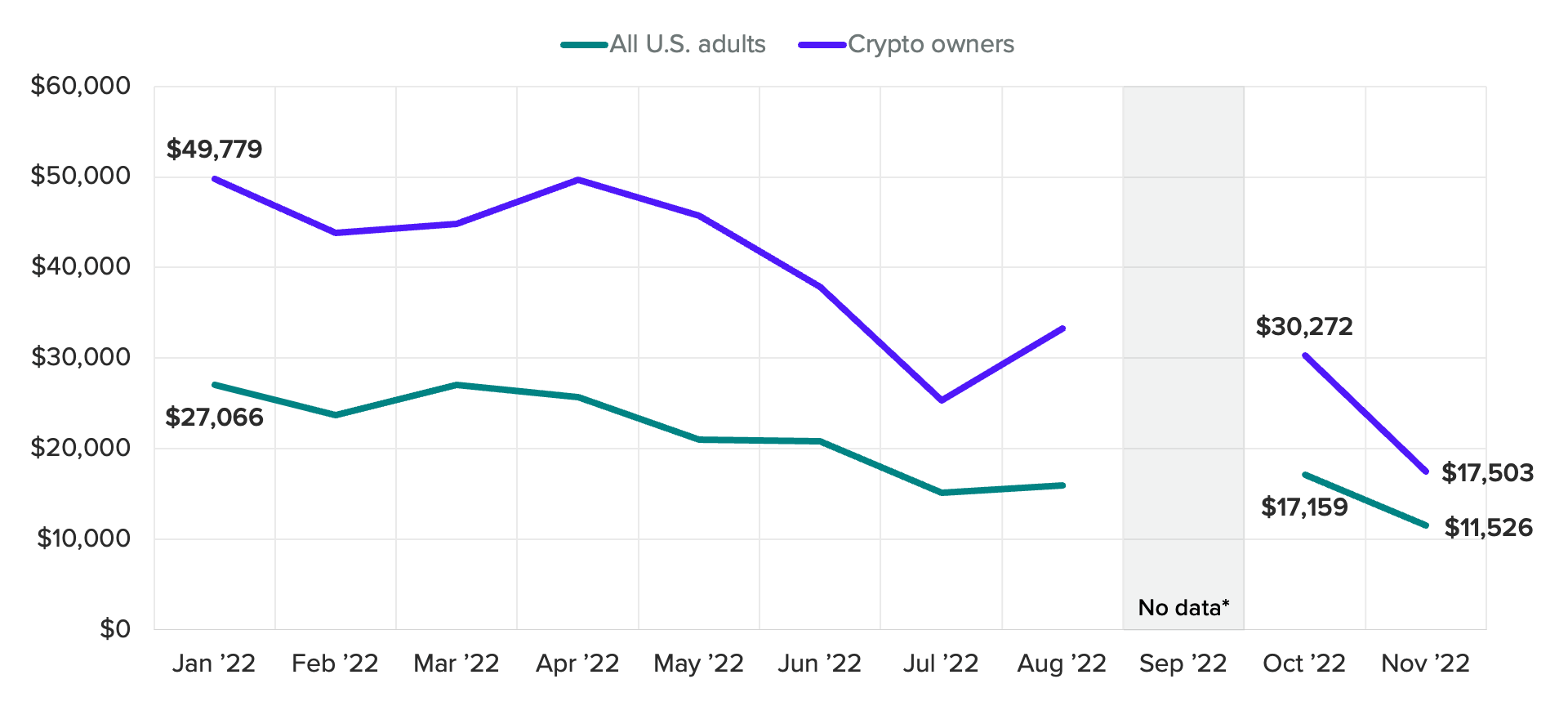

Consumers predict lowest bitcoin price ever, but many still believe in longevity

A Morning Consult survey conducted on 15-17 November, in the wake of the FTX fallout, shows that the public’s prediction of bitcoin’s future value is at a low level. US adults predict that bitcoin will be valued at just over $11,500 in six months — a drop of about $5,600 from October predictions and a decline of more than $15,500 from when we started tracking in January.

News has clearly shaken consumer faith in the most prominent cryptocurrency’s value, but crypto owners are a little more optimistic. They predict that bitcoin’s price will rise slightly from its current value (around $15,600 at press time) to around $17,500. This forecast is the lowest we’ve caught among crypto owners: almost $12,800 lower than in October and around $32,300 lower than their prediction at the beginning of the year.

Respondents’ predictions about the price of bitcoin in six months

Survey conducted monthly among a representative sample of 2,200 to 4,400 US adults, with an unweighted margin of error of up to +/-2 percentage points.

As bitcoin’s value has fallen more than 60% this year, crypto owners’ price predictions have consistently been higher than those of the general population and more in touch with current value. Still, their prediction that bitcoin’s value will increase over the next six months is not the most expected reaction.

While consumers are clearly concerned about the fallout from the FTX collapse, they are more likely than not to say that cryptocurrencies will still be around in 10 years, 38% to 32%. Naturally, crypto owners are more confident, with 74% saying it’s likely crypto will survive into the next decade and 16% saying it’s not likely.

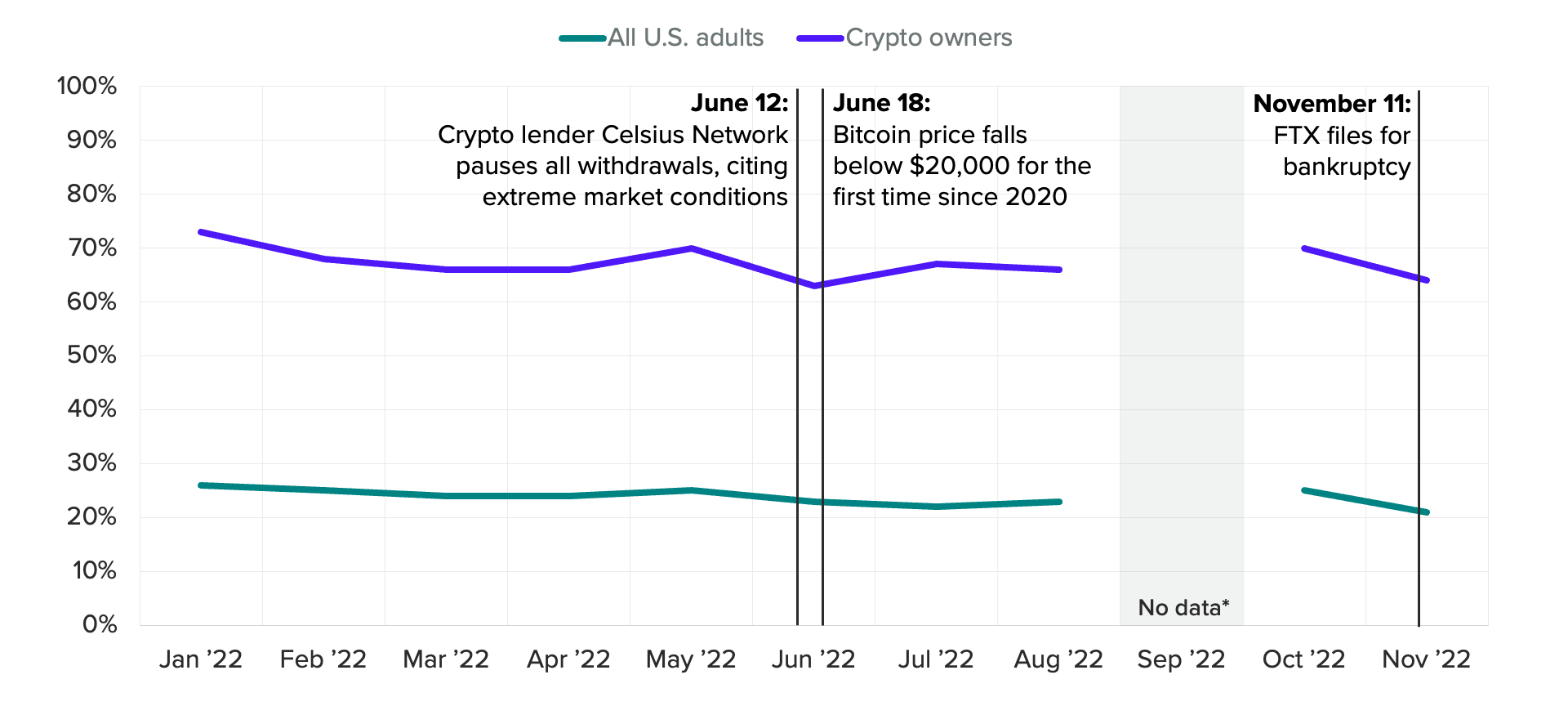

The purchase price for crypto is stable for now

In general, US consumers are only slightly less likely to buy crypto now than they were before the FTX news broke. Just over a fifth (21%) of US adults said they are likely to buy cryptocurrency in the next month, compared to 25% in October (right before the FTX collapse) and 26% in January.

Crypto owners have been equally steadfast in their intentions to buy cryptocurrency. They weren’t scared off at the beginning of the “crypto winter” and they are not afraid now.

The fall in purchase consideration among crypto owners has not been as severe as expected: down only 6 percentage points from last month and 9 points from January, with 64% saying they are “very” or “somewhat” likely to buy crypto in the next month. While this is a significant change when tested, the majority of crypto owners still plan to buy soon and the market remains competitive.

Reported likelihood of buying cryptocurrency in the next month

Survey conducted monthly among a representative sample of 2,200 to 4,400 US adults, with an unweighted margin of error of up to +/-2 percentage points.

Crypto owners are signaling that they are investing for the long term. They see crypto as a continuous investment and are not ready to give up so early in the movement towards crypto’s acceptance.

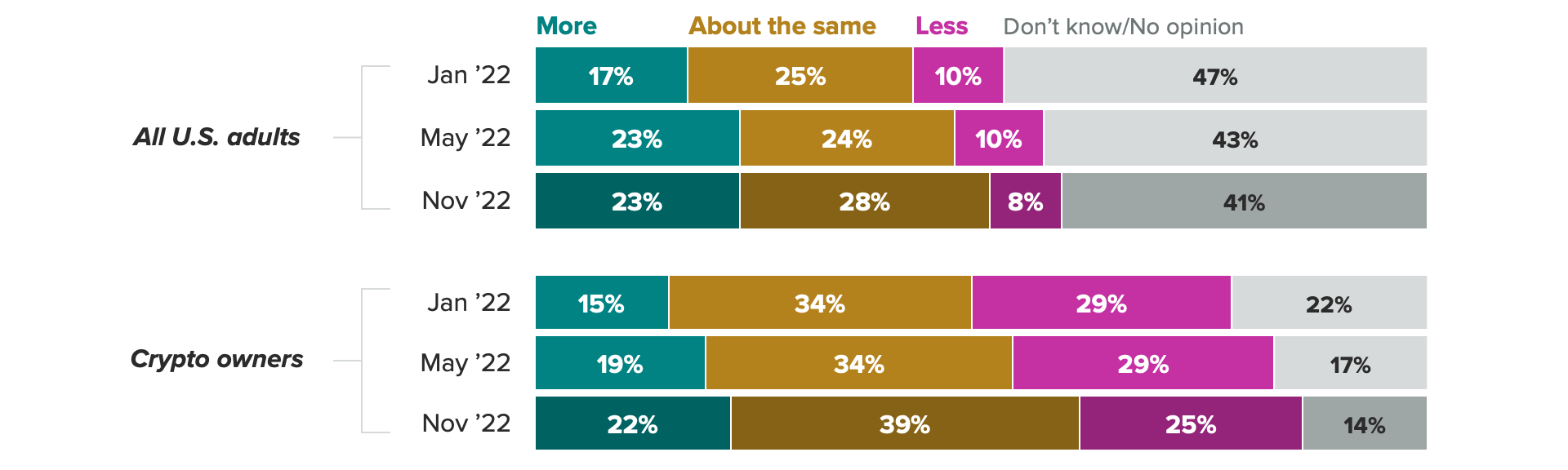

Crypto owners and the public agree that the industry needs more regulation

Although many crypto owners hold on to their coins, they want them regulated. After the bank run on FTX and similar runs on other exchanges, many are eager for the authorities to get involved and ensure that the exchanges have enough cash on hand to handle withdrawals.

Nearly 3 in 10 US adults (28%) said cryptocurrency should be regulated the same as other financial assets, and 23% said it should be regulated even more; A number of adults do not have an opinion. This desire for heavier regulation of cryptocurrency has remained stable since May, but has increased from January’s 17%.

Most crypto owners agree that regulation is necessary, but they take a middle ground on how much. In November, nearly 2 in 5 (39%) said crypto should be regulated in the same way as other financial assets, compared to 34% in January. Despite this, 1 in 4 still say crypto should be less regulated than other financial assets, a figure that has fallen from a peak of 33% in February.

Respondents were asked whether cryptocurrency should be regulated more, less or about the same as other financial assets

It looks like consumers may finally be getting what they want, as the FTX fiasco and subsequent fallout has caught the attention of politicians. Financial Secretary Janet Yellen admitted The crypto world needed more oversight, and the House Financial Services Committee is holding one hearing next month to discuss FTX’s bankruptcy and talk to responsible company managers.

Despite a whirlwind couple of weeks in the crypto markets, many crypto owners are optimistic and do not immediately plan to load their coins. US consumers who do not own crypto reacted more strongly to the FTX bankruptcy and aftershocks than crypto owners have; for them, the debacle appears to be just another bump in the road to regulation. For now, it looks like this November will only mark the collapse of FTX, not the entire crypto world.