Non-fungible tokens (NFTs) have revolutionized how artists and content creators sell and monetize their works, especially in music, art and other creative content. One of the ways they make money is by earning NFT royalties, which help them receive ongoing compensation for their work.

But what are NFT royalties? How do NFT royalties work? And which marketplaces offer the opportunity to earn NFT royalties?

What is an NFT Royalty?

An NFT royalty is a percentage of the sale price of an NFT that is predefined and paid to the creator or original owner each time their work is resold. Essentially, this feature allows creators to continue earning from their NFTs even after the initial sale.

NFT royalties are intended to offer a sustainable source of income to creators of digital art, music and other digital assets. Additionally, they provide a means for creators to capitalize on the increasing value of their works as they are bought and resold on the secondary market, generating a fresh revenue stream for artists and other creators in the digital age.

How do NFT royalties work?

When an NFT is minted, the creator has the option to set a royalty percentage that they will receive whenever their NFT is sold in the future. The percentage usually ranges from 2.5% to 10%, but it can be adjusted according to the creator’s taste. When NFTs are resold on an NFT marketplace, the royalty percentage is automatically deducted from the sale price and paid to the original creator or owner. This feature allows creators to earn a passive income stream from their work even after it is sold.

To start earning NFT royalties, you must first create your NFT. This involves registering your digital asset on a blockchain network to create a unique and secure record of ownership. During the embossing process, you can specify the amount or percentage you want to receive from secondary sales of your work using smart contracts. As a result, when secondary sales occur, the smart contract will automatically assign the predetermined percentage to you as the original owner.

The royalty system associated with NFTs is intended to give creators an opportunity to capitalize on the increasing value of their work over time, even after the initial NFT sale. This creates a long-term income stream for artists, musicians and other creators, which can motivate them to continue producing high-quality work.

Suppose you create an NFT and someone buys it for 50 ETH. Even if this first sale only nets you 50 ETH, if you had included a 10% NFT royalty, you would still earn a percentage of each future sale. If the buyer then resells the NFT for 500 ETH, the smart contract will trigger and reserve 10% of the sale price for you, the original creator. If the new buyer decides to sell, you will receive an additional 10% royalty as the original owner, creating a potential long-term income stream for you.

The royalty percentage for an NFT remains fixed, while the sale price of the NFT may vary. This can cause variations in the amount of royalties the creator earns from each sale, depending on market demand, scarcity and other factors. Thus, the creator can earn different royalty amounts from different sales, even though the royalty percentage remains the same.

5 advantages and disadvantages of NFT Royalty

- Pro: NFT royalties give creators a way to earn ongoing income from their works even after they’ve sold them to someone else. That way, the reward for their work won’t be a one-time benefit.

- Pro: NFT royalties help ensure that creators are fairly compensated for their works as they increase in value. Therefore, it enables them to earn more as the value of their work increases.

- Pro: Royalties are automatically deducted from the sale price of an NFT, making it easier for creators to receive payment for their works. This is because the way of agreement is executed on a smart contract without any intermediary; when the NFT is sold, it is automatically triggered.

- Fool: Buyers may be less willing to pay high prices for NFTs if they know they will also have to pay royalties each time the NFT is resold. Some NFT marketplaces have made royalty payments optional; an example of such a platform is “Blur”, while platforms such as LooksRare have eliminated NFT royalty on their platform.

- Fool: Price volatility can also affect the frequency of NFT sales, which in turn affects the royalty income of the creator. NFT’s markets are very volatile. Therefore, potential buyers may hesitate to invest in the asset, which may lead to a reduction in sales volume and ultimately lower royalty income.

4 platforms offering NFT royalties

Although NFT royalties are still a relatively new technology, there are several NFT platforms where you can earn them.

1. OpenSea

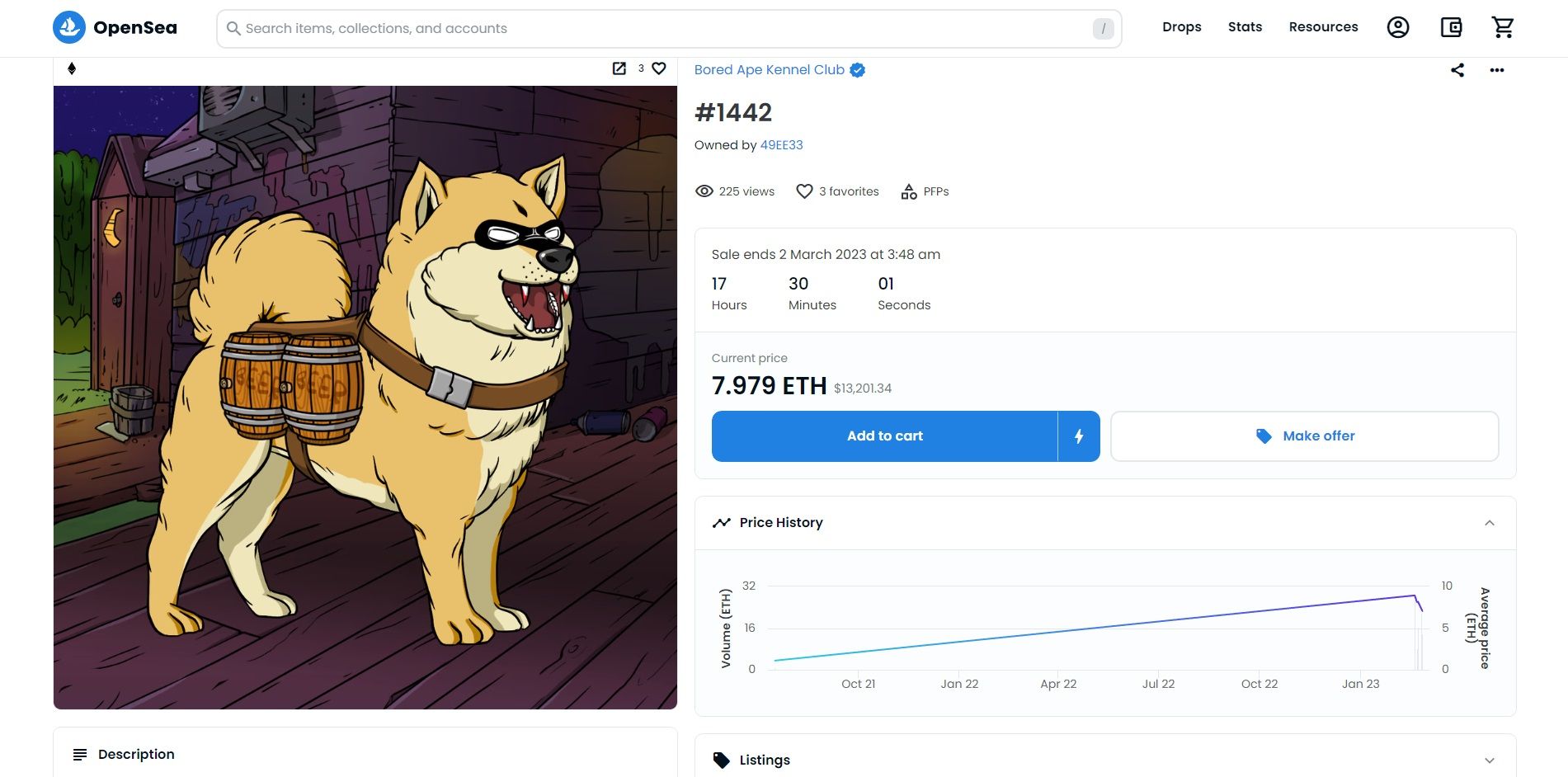

Founded in 2017, OpenSea is the largest marketplace for non-fungible tokens. In February 2023, OpenSea announced a change to its fee structure, reducing the transaction fee from 2.5% to 0% for a limited period.

OpenSea also stated that for NFT projects that lack on-chain enforcement measures, collectors will only be obligated to pay a nominal 0.5% royalty fee on old and new purchases. However, collectors can pay more if they believe the NFT is worth more. This change is likely to have a meaningful impact on the NFT market, positioning OpenSea as an increasingly accessible and cost-effective platform for collectors and creators alike.

On the other hand, users who implement the enforcement tools on the chain are entitled to full royalty payment of up to 10%.

2. Rare

Established in 2020, Rarible offers a user-friendly platform for creators to showcase their artwork. The process of listing an artwork on Rarible is simple, requiring you to create an account and connect a wallet. After that you can start uploading works and setting prices. Rarible charges a fee of 1% on each transaction carried out on the platform, which applies to both the buyer and the seller. Furthermore, the platform allows creators to set a royalty rate of up to 50%.

3. SuperRare

Launched in 2018, SuperRare is a prominent NFT marketplace that has distinguished itself from other NFT marketplaces by emphasizing the uniqueness of its digital artworks. Potential creators who wish to publish NFTs on the platform must apply for approval from SuperRare Labs. Additionally, on SuperRare, when a secondary sale occurs, the original owner receives 10% as royalties, while the collector receives 90% of the sale. A fee of 3% is charged for each sale, which the buyer pays.

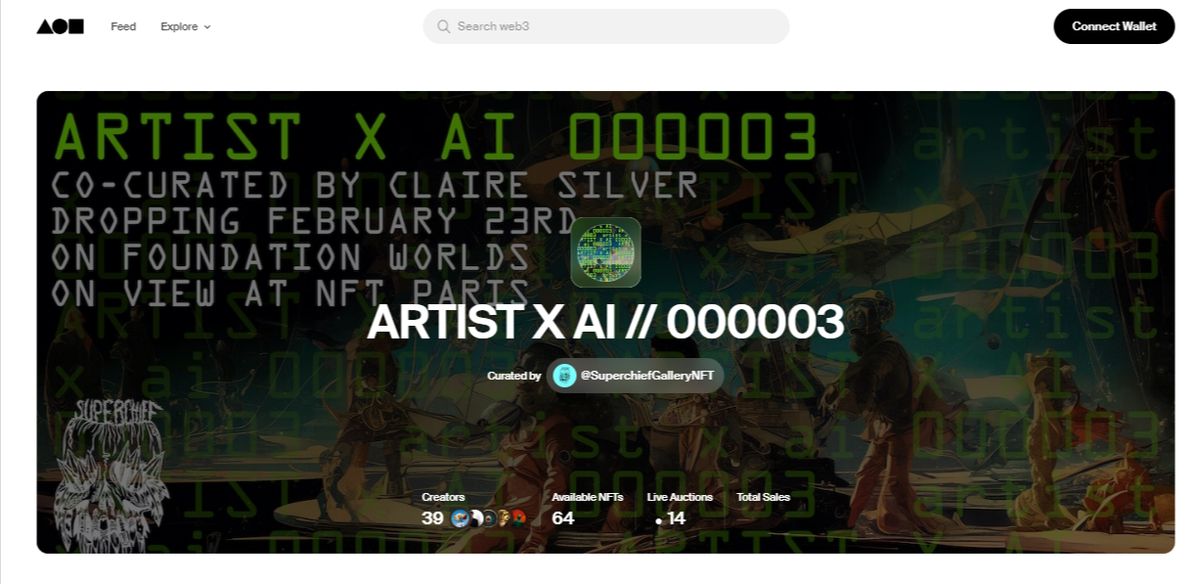

4. Foundation

Foundation, one of the largest NFT marketplaces, launched in 2022. To list your digital art or collectibles on Foundation, you must wait for an invitation from an established community member who has sold at least 1 NFT. The Foundation charges a 5% fee for each secondary sale, while a 10% royalty is given to the original creator, with the seller receiving the remaining 85%.

NFT royalties are the future of creative expression

In conclusion, despite being a relatively new concept, NFT royalties have significantly changed the art world. The advent of NFTs has given creators a reliable source of income, allowing them to continue their craft. Furthermore, it has opened up a new market for digital assets that were previously undervalued or ignored.

As the use of NFTs increases, we can foresee further transformations in art creation, sales and valuation. Therefore, NFTs have not only revolutionized the art industry, but also have the potential to shape the future of creative expression.