Weekly Waves: EURUSD, Bitcoin and Gold

- EURUSD made a very strong bullish swing last week. Price made a bullish bounce at 0.9950 and gained 400 pips to reach 1.0350.

- Bitcoin (BTCUSD) broke below the support trendlines (dashed green) after moving sideways at the 78.6% Fibonacci support level for a couple of months.

- Gold (XAUUSD) is moving higher within a bullish trend channel after making a double bottom chart on the 4-hour and daily charts.

Dear Traders,

Our weekly Elliott Wave analysis reviews the EURUSD daily chart, the XAUUSD 1 hour chart and the Bitcoin weekly chart.

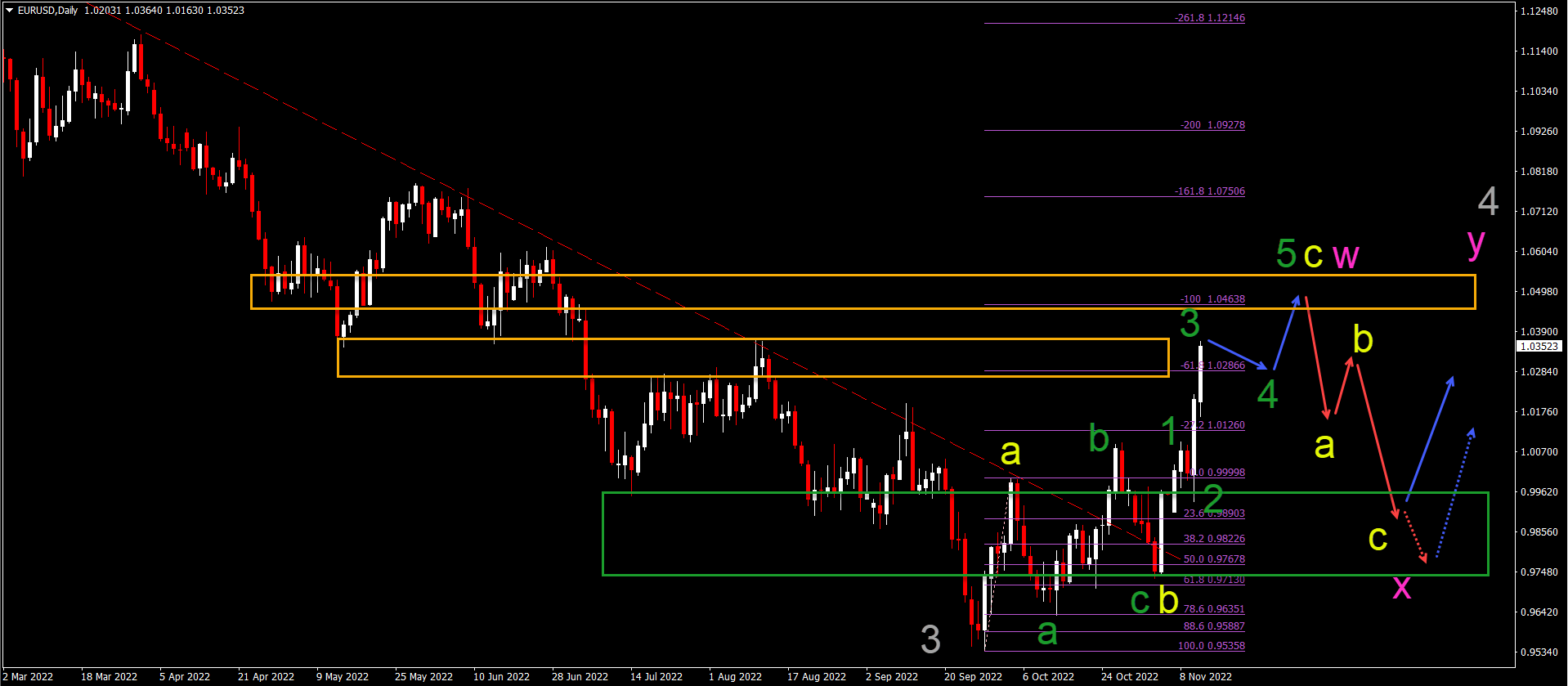

EUR/USD Bullish 400 Pips Price Rally

EURUSD made a very strong bullish swing last week. Price made a bullish bounce at 0.9950 and gained 400 pips to reach 1.0350:

- The EURUSD rally started after the price action completed a bearish ABC (yellow) pattern in wave B (green).

- The EURUSD was tested and bounced at the 61.8% Fibonacci retracement support level.

- A larger ABC (yellow) zigzag appears to be unfolding within a complex WXY (pink) correction of wave 4 (gray).

- Within wave C (yellow), price action moves in a 5-wave pattern (green).

- We expect wave 3 (green) to finish soon, which will then be followed by wave 4 (green) and wave 5 (green).

- The main target is the -100% Fibonacci level near 1.0450 and 1.05.

- A bearish ABC (red arrow) should appear at this target zone.

Bitcoin Bearish Drop Bounces to $15k

Bitcoin (BTCUSD) broke below the support trendlines (dashed green) after moving sideways at the 78.6% Fibonacci support level for a couple of months:

- The BTCUSD bearish breakout below the 78.6% Fibonacci level confirms a continuation of bearish wave C (yellow).

- The target for the bearish wave C (yellow) is now at the 88.6% Fibonacci level of $11.2k. Other rounds levels like $15k and $12.5k will also act as support.

- Price action has already made a pullback at the $15k level, but a further decline is possible after the bullish correction is complete.

- A falling wedge pattern (red arrows) may develop as price action inches closer to the $11k mark.

- Price action can complete a wave C (yellow) of wave 2 (pink) or a wave C of wave W (orange) of a larger wave 2′ (pink).

- A bullish bounce (blue arrows) could appear at the 88.6% Fibonacci level.

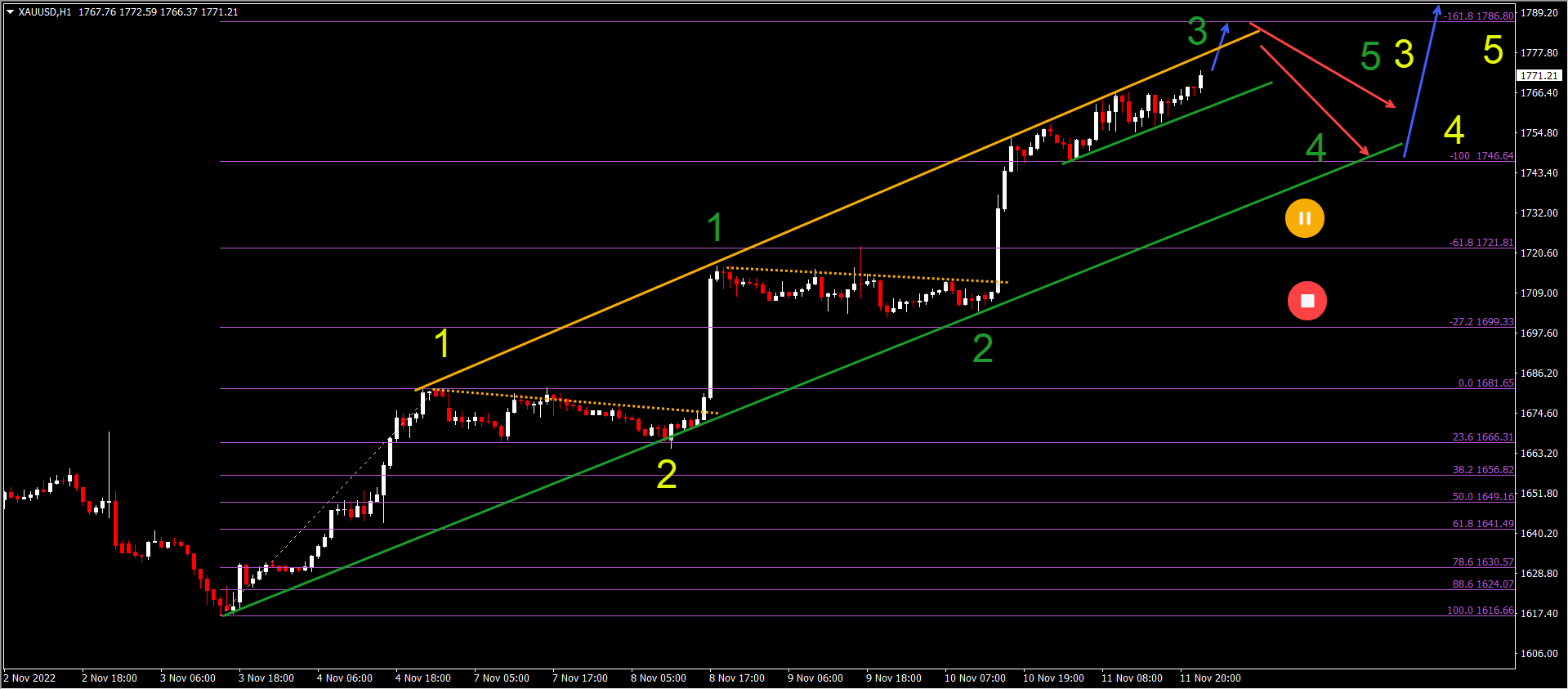

Gold Bull flag patterns tip for more upside

Gold (XAUUSD) is moving higher within a bullish trend channel after making a double bottom chart on the 4-hour and daily charts:

- The gold chart made several bullish breakouts above the resistance trendline (dotted orange).

- Gold looks set to develop an impulsive price swing with a 5-wave pattern (green) in wave 3 (yellow).

- Price action is expected to continue higher (blue arrow) towards the -161.8% Fibonacci target.

- Once wave 3 (green) is completed, a bearish retracement (red arrows) within wave 4 (green) is expected.

- Wave 4 (green) remains valid as long as the price action remains in the bullish channel.

- A bullish bounce should take place within wave 5 (green) of wave 5 (yellow).