Weekly Waves: EUR/USD, Gold and Bitcoin

-

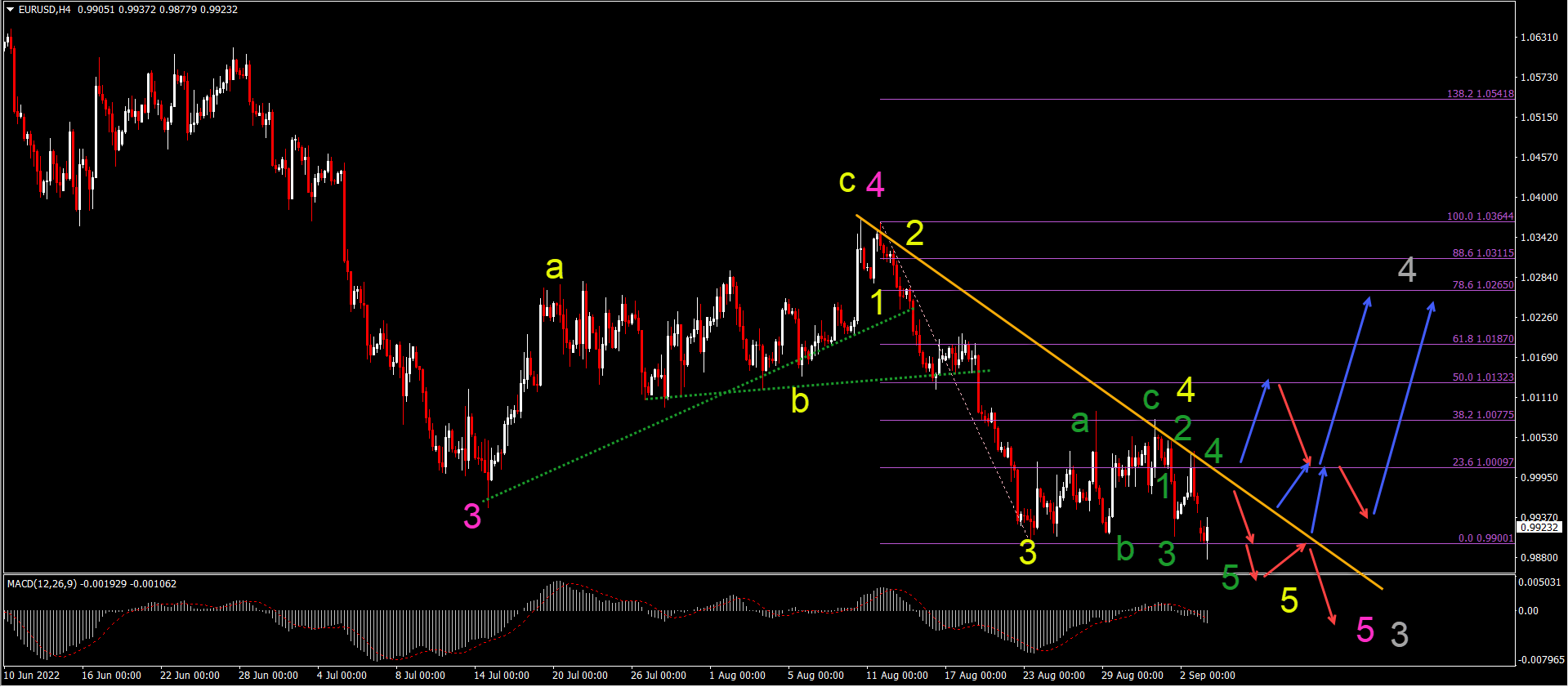

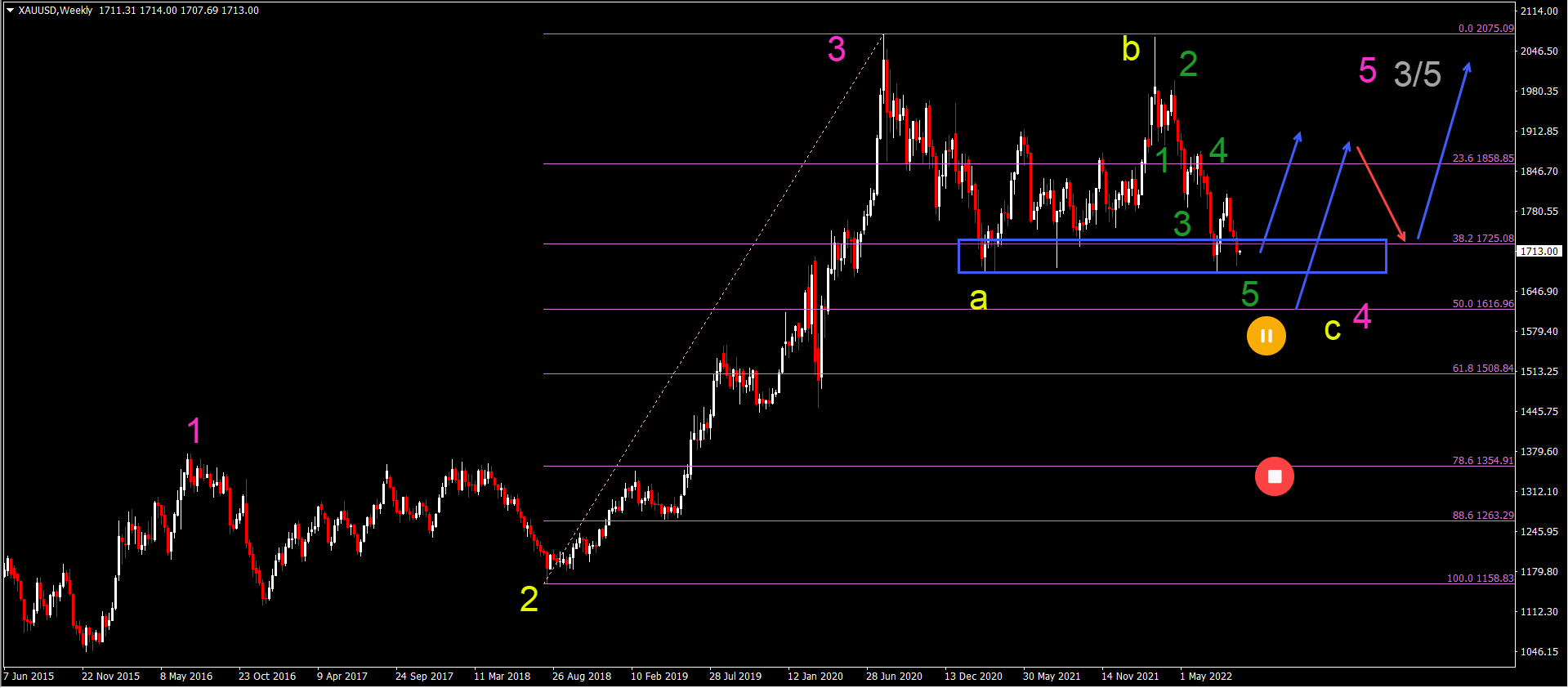

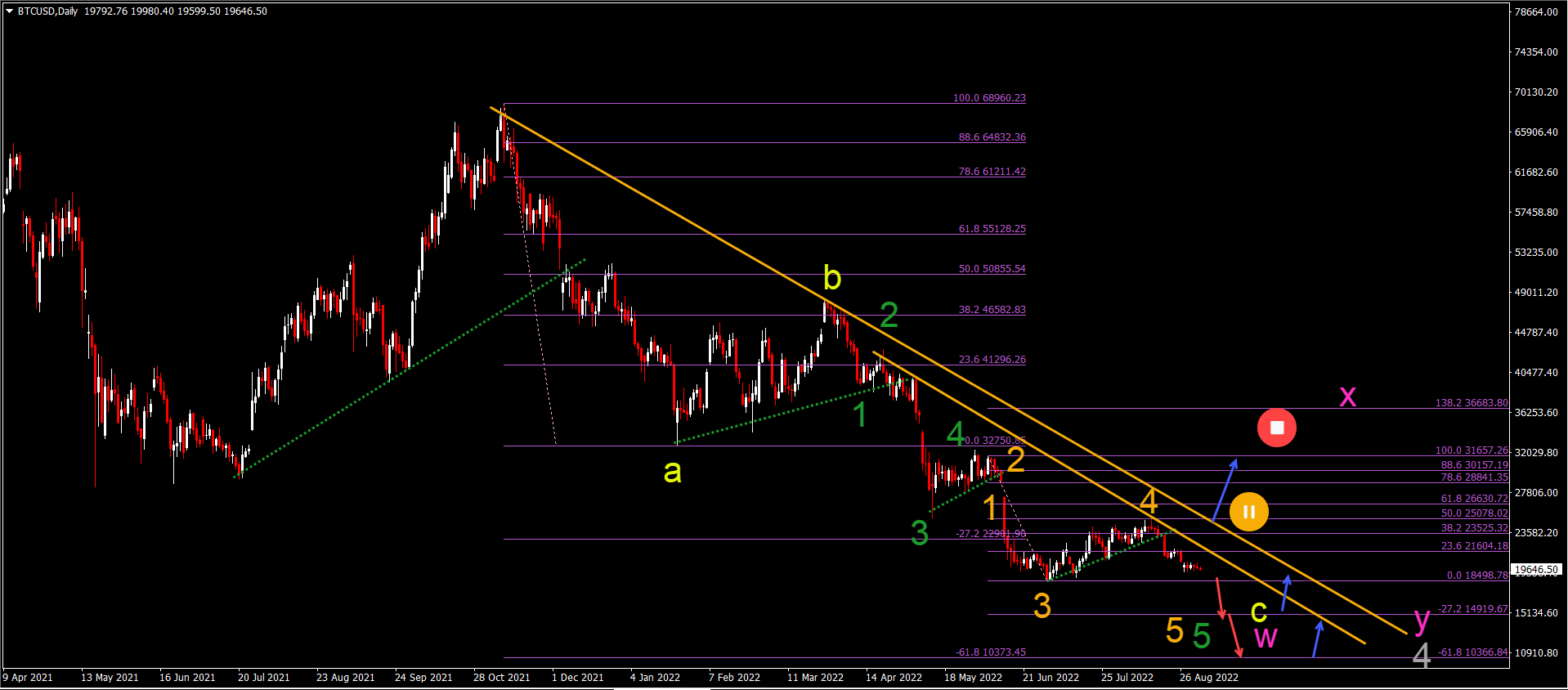

Our weekly Elliott Wave analysis reviews the EUR/USD 4-hour chart, the Gold Weekly chart and the Bitcoin cryptocurrency daily chart.

-

EUR/USD made a bearish retracement at the 38.2% Fibonacci retracement level. The break below the previous bottom may be part of a complex wave 4.

-

Although price action may provide a bullish bounce at the previous low, the price action is too bearish for some rally to succeed at the moment.

EUR/USD new low targets at 0.9750 target

EUR/USD made another low again after a shallow bullish correction:

-

EUR/USD made a bearish retracement at the 38.2% Fibonacci retracement level.

-

The break below the previous bottom can either be part of a complex wave 4 (yellow) or part of the downtrend within wave 5 (yellow). We prefer the wave 5 scenario and expect price action to produce a bearish bounce at the resistance trendline (orange) and/or break the bottom and a new lower low.

-

The main target zone is the support area around 0.9750-0.98.

-

However, a break above the resistance trendline (orange) will change the perspective and indicate the end of the downtrend.

-

A stronger bullish retracement may emerge within wave 4 (gray) after price action completes wave 5 (yellow) of wave 5 (pink) of wave 3 (gray).

Gold test key 38.2% Fibonacci support

Gold (XAU/USD) is testing the support zone (blue box) and Fibonacci retracement levels:

-

XAU/USD appears to be completing a wave 5 (green) of a larger ABC (yellow) correction in wave 4 (pink).

-

The 38.2% and 50% Fibonacci support levels should remain unbroken if this Elliott Wave analysis is indeed correct and the price action is within a wave 4 (pink).

-

A break below the 50% Fibonacci is a first warning that the current bullish Elliott Wave analysis is wrong, while a move towards the 78.6% Fib invalidates it.

-

However, a bullish recovery may develop slowly with an upward momentum (blue arrow) followed by a deep bearish retracement (red arrow).

-

Price action may only break for a new higher high in 2023. The first price action must test the double top, and then after a bearish bounce, price action may push above it.

BTC/USD price action is too bearish for any reversal

Bitcoin (BTC/USD) analysis from last week seems unlikely at the moment due to bearish momentum and prolonged and shallow bullish price movement:

-

BTC/USD needs a break above (blue arrow) the resistance trend lines (orange) and 50% Fibonacci level before the bulls can be optimistic about any kind of rally.

-

Therefore, we decided to change the Elliott Wave analysis this week to provide a fresh and new perspective.

-

The bullish correction was likely a wave 4 (orange) within a downtrend, rather than a wave A (or a larger ABC up).

-

The current bearish swing is expected to be a wave 5 (orange).

-

A break below (red arrows) the previous low would confirm wave 5 (orange).

-

The main bearish targets are $15k and $10k.

-

A bullish return (blue arrows) is expected at one of these targets.

The analysis is done with the indicators and template from the SWAT method simple wave analysis and trading. For more daily technical and wave analysis and updates, sign up to our newsletter