Weekly Waves: EUR/USD, GBP/USD and Bitcoin

-

Our weekly Elliott Wave analysis reviews the EUR/USD 4-hour chart, the GBP/USD 4-hour chart and Bitcoin’s daily chart.

-

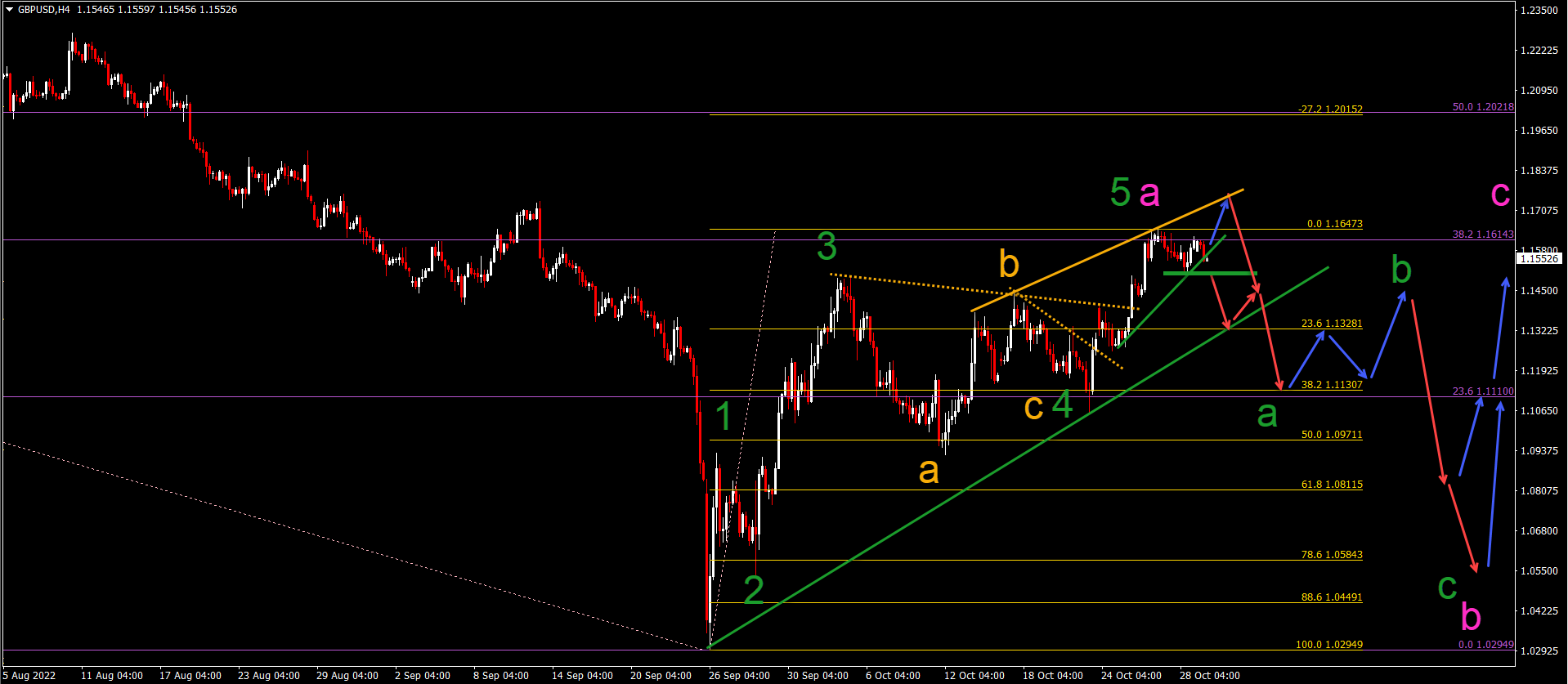

GBP/USD completes a bullish 5-wave pattern to the upside (green). It appears to be losing its bullish momentum at 38.2% Fib resistance (purple).

-

Bitcoin (BTC/USD) failed to break below the previous lows and support zone (green box). It made a bullish breakout above the resistance trend line (dotted orange).

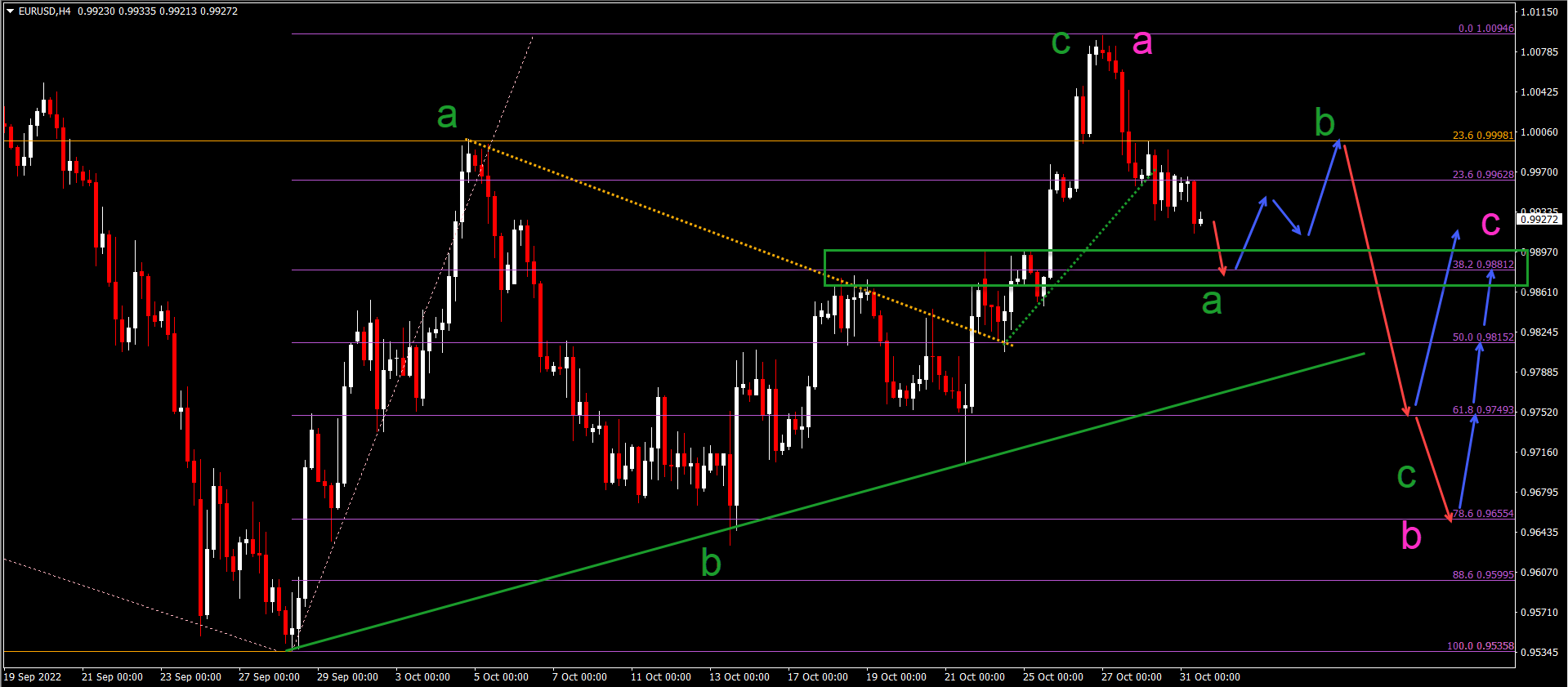

EUR/USD bearish ABC after bullish rally

EUR/USD made a bullish breakout instead of reaching the previous bottom last week, as our analysis expected:

-

EUR/USD bullish breakout above the resistance trend line (dotted orange) triggered a bullish rally.

-

This indicated the end of wave B (green) and the start of wave C (green).

-

The bullish ABC (green) has likely completed a wave A (pink) with a larger ABC correction (pink) in wave 4.

-

Wave A (pink) appears to be complete and the current bearish price swing is expected to initiate wave A (green) within wave B (pink).

-

The main target for wave A (green) is the 38.2% Fibonacci level.

-

Later, price action may drop down to the deeper Fibonacci levels.

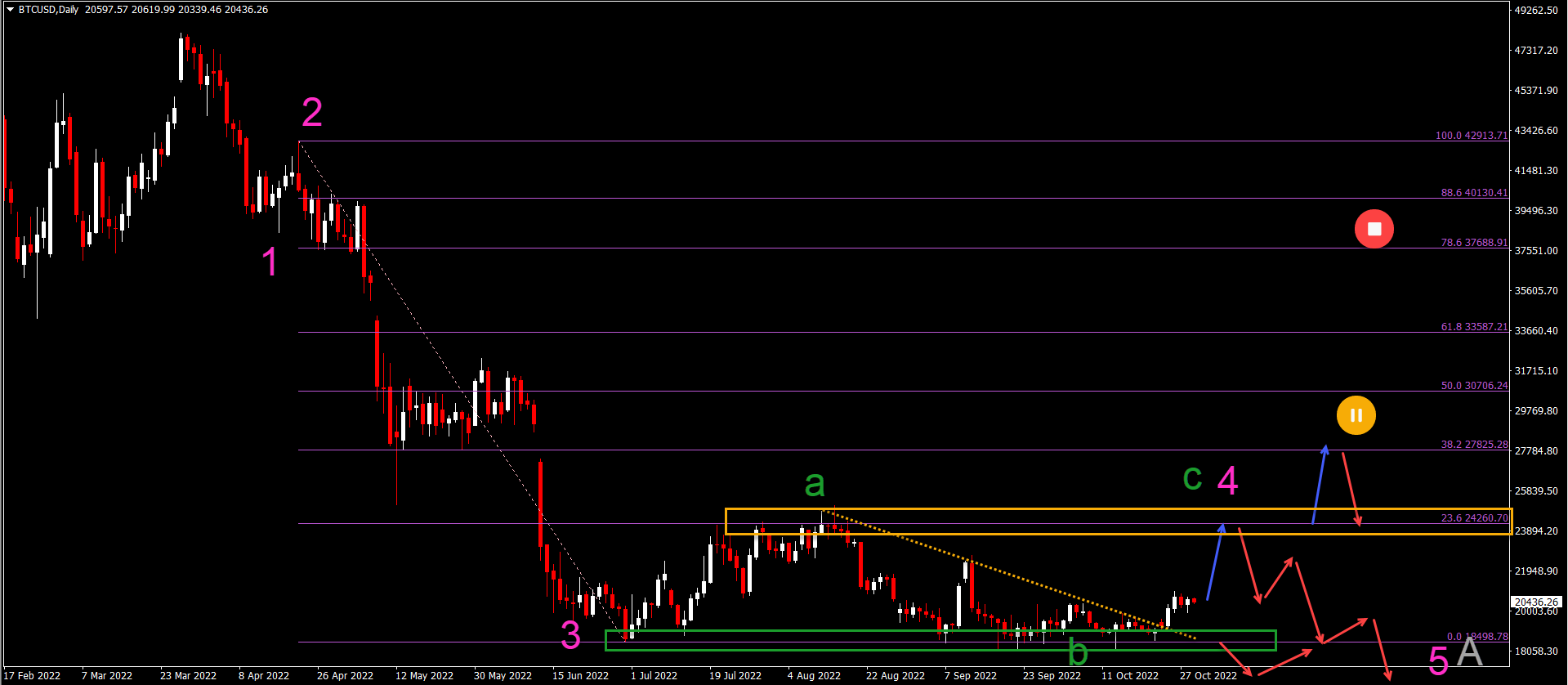

Bitcoin breaks north of key resistance trendline

-

BTC/USD made a bullish breakout above the resistance trend line (dotted orange).

-

This breakout confirms the continuation of wave 4 (pink).

-

A bullish ABC (green) pattern unfolds within the wave 4 (pink).

-

The breakout marks the end of wave B (green) and the start of wave C (green).

-

Wave C (green) could test the previous peak and 23.6% Fibonacci level.

-

Price action could go as high as the 38.2% Fibonacci level within wave 4 (pink).

-

However, a larger bullish retracement would make the bearish Elliott Wave analysis unlikely.

GBP/USD faces strong resistance at 38.2% Fib

-

GBP/USD appears to be losing its bullish momentum at 38.2% Fib resistance (purple).

-

A final upward push (blue arrow) can complete the ascending wedge chart.

-

A bearish breakout (red arrow) below the support line (green) marks the end of wave 5 (green) of wave A (pink) and the start of bearish ABC (green) of wave B (pink).

-

The bearish wave A (green) will reach the 38.2% Fibonacci level.

-

The bearish wave C (green) should reach the 50-61.8% Fibonacci level on the lower.

-

Once ABC (green) is completed in wave B (pink), a bullish wave C (pink) should take price action higher again in a larger wave 4.

The analysis is done with the indicators and template from the SWAT method simple wave analysis and trading. For more daily technical and wave analysis and updates, sign up to our newsletter