Weekly Forex Forecast – NASDAQ 100 Index, Gold, Bitcoin, USD

Fears of bank contagion following the collapse of SVB, stronger than expected NFP data and hawkish rhetoric from Fed Chair Jerome Powell have combined to lower equity markets and short-term US Treasury yields.

The difference between success and failure in Forex / CFD trading is very likely most dependent on which assets you choose to trade each week and in which directionand not on the exact methods you can use to determine trade entries and exits.

So as you start the week, it is a good idea to look at the big picture of what is developing in the market as a whole, and how such development is affected by macro fundamentals, technical factors and market sentiment. There are only a few valid long-term trends in the market right now that can be profitably exploited. Read on for my weekly analysis below.

I wrote in my previous piece 12th March that the best trading opportunity for the week was probably less than the AUD/CHF currency cross. Unfortunately, the price increased during the week by 2.25%.

The news is dominated by three main issues:

- A persistent banking crisis. Credit Suisse shares fell to record lows as the bank neared collapse earlier this week, following the failures of Silicon Valley Bank and Signature Bank in the US. Credit Suisse secured a rescue package of 54 billion dollars from the Swiss National Bank and will now probably be taken over by the Swiss giant UBS, which is seeking a further 6 billion dollars in guarantees from the SNB. Bank shares have had a very tough week, with First Republic in the US now rumored to be in trouble.

- Fall in US inflation, PPI and retail sales. US CPI data released last week showed another drop in the annual rate from 6.4% to 6.0% as expected, and lower than expected PPI and retail sales data. This suggests a cooling US economy and significantly reduces pressure on the Federal Reserve ahead of their policy meeting this week on the 22nd.n.d March. US stock markets ended the week higher, with a technical golden cross seen in the NASDAQ 100 index, while 2-year US Treasury yields fell dramatically to end the week below 4%.

- ECB interest rate increase by 0.50 percent.

Markets will now turn their attention to the Federal Reserve’s policy meeting this Wednesday, having gone from expecting a rate hike of 0.25% or even 0.50% just a few days ago to a consensus expectation narrowly in favor for an interest rate increase of 0.25%, while almost half of the analysts do not expect any increase at all.

There were a few other important data releases last week:

- UK budget – There were no big surprises, but the government now predicts no recession in the UK, and a rapid decline in inflation. This helped strengthen the British pound.

- New Zealand’s GDP – this came in much worse than expected, showing a 0.6% decline compared to the previous quarter when only a 0.2% decline was expected.

The coming week in the markets is likely to see an even higher level of volatility than last week, due to ongoing fears of bank contagion and the US Federal Reserve’s policy meeting which could lead to another interest rate hike. This week’s key releases are, in order of importance:

- UK CPI (inflation) data

- Canadian CPI (inflation) data.

- US Federal Funds Rate, FOMC Statement & Projections

- SNB Policy Rate & Monetary policy assessment

- UK’s official Bank of England rate and monetary policy summary

- US unemployment claims

- Flash Services & Manufacturing PMI data for the US, UK, Germany and France

- It will be a public holiday in Japan on Tuesday.

The weekly price chart below shows The US Dollar Index printed a bearish candlestick continuing the rejection of key resistance level at 105.36.

The candlestick is a little small, but has a significantly higher wick, which suggests that bears have decisive control here. Another bearish sign is that The dollar is trading below the levels of both 3 and 6 months ago.

The US dollar is likely to face headwinds and high volatility in the coming weekdue to ongoing fears of US banking contagion, but also a cooling US economy and the Federal Reserve’s rate hike decision to be announced on Wednesday. For now, trades against the US dollar are most likely to be successful, but traders should follow the news closely and watch out for volatility events.

We saw a sharp increase The NASDAQ 100 Index during the week after a golden cross was made on the daily chart at the end of last week. Equity markets have been rocked by the ongoing banking crisis, but we see many tech stocks rallying as US inflation continues to fall, taking pressure off the Federal Reserve to continue raising interest rates as the US 2-year Treasury yield fell by more than 1 % in about a week. However, this is tempered by the recent sharp fall the S&P 500 has seen since it made a golden cross a few weeks ago, which historically has not seen similar gains in the last century.

There is a clear resistance level shown in the price chart below at 12820. A daily close above this level would be a further bullish sign.

It looks like we have some bullish signs, but overall we’re seeing a split stock market with select tech stocks doing well while other sectors are not.

Much will now likely depend on whether the US Treasury can restore faith that banking contagion will not spread, and what approach the Fed takes to interest rates on Wednesday. It’s important to keep in mind that the NASDAQ 100 has a good track record of producing external returns, so the bullish signal here is worth considering.

Last week, the strongest price rose Gold seen since last November. The price chart below shows an extremely strong and large bullish candlestick was pressed, which closed right at its high, ending at an 11-month high price, which is usually a bullish sign.

The price ended the week below $2,000, but within sight of the March 2022 high.

Trend and breakout traders should seriously consider buying gold even just on these technical indications. The deeper reason for it Gold is rising probably due to the decline in the US dollar as a safe haven due to the banking crisis, and due to the banking crisis itself. Bitcoin also seems to be playing a similar rose to Gold now.

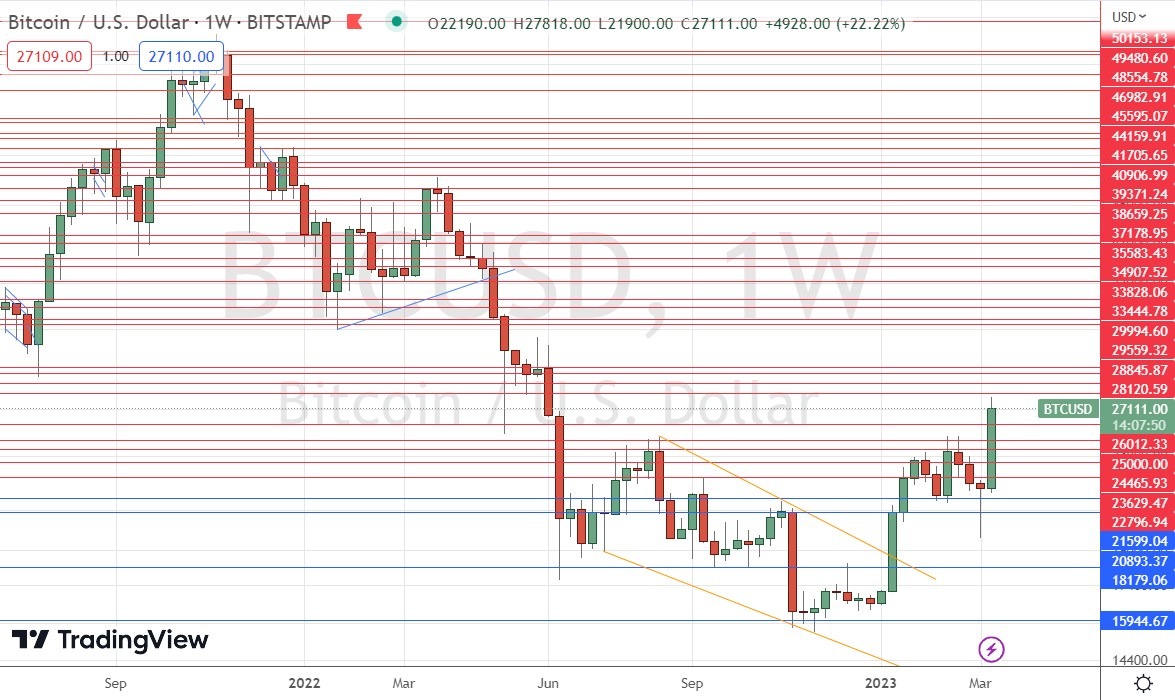

Last week, the strongest price rose Bitcoin seen since January this year. The price chart below shows a strong and large bullish candlestick that was pressed, which closed not far from the high, and ended at a 9-month high price, which is usually a bullish sign.

Trend and breakout traders should seriously consider buying Bitcoin even just on these technical indications. The deeper reason why Bitcoin is rising is probably due to the decline in the US dollar as a safety net due to the banking crisis, and due to the banking crisis itself. Gold also seems to be playing a similar rose to Bitcoin now.

Traders should keep in mind that Bitcoin is riskier than gold and has a poor record as a safe haven, while Gold’s record is better. Buying gold is probably the best deal here.

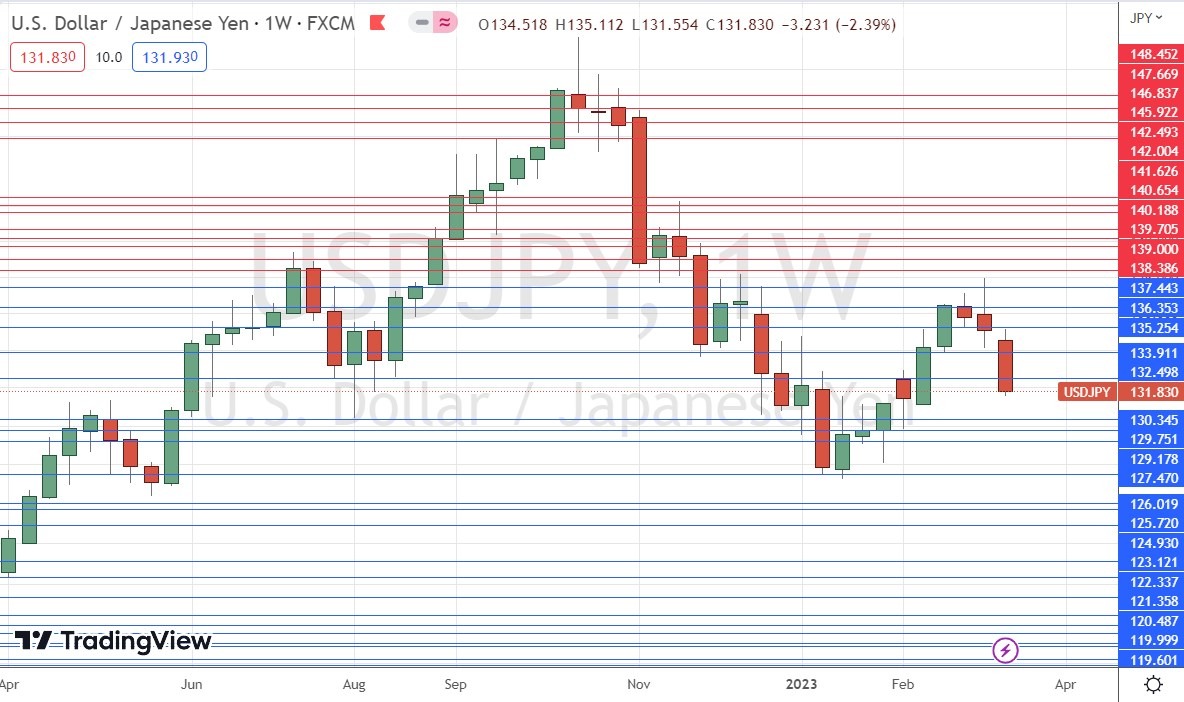

The Japanese yen has strengthened very strongly in the past week, not because of any significant change in policy by the Bank of Japan or any fundamental factor, but simply because of the attractiveness of the Japanese yen as a safe-haven currency at a time of banking crisis in the United States.

The yen rose more than 2% against a basket of currencies, with the US dollar one of the biggest losers as the greenback is generally weak and in a long-term downtrend.

The price chart below shows that the weekly candlestick is a good size, looking very bearish as the industry is very close to the low.

If the perception of a banking crisis persists, we will likely see the currency pair USD/JPY continue to decline.

I see the best trading opportunities this week as:

- Long Gold against USD

- Long Bitcoin against USD

- Long Japanese yen vs. USD (potentially as short-term day trades due to support near ¥130.

- Long the NASDAQ 100 index after a daily close above 12820

Ready to trade our weekly Forex analysis? We have made a list of the best brokers to trade Forex worth using.