Weekly Crypto Price Analysis October 23: BTC, ETH, XRP, ADA and SOL

Our weekly crypto price analysis covers the trending cryptocurrencies; Bitcoin, Ethereum, Cardano, Polkadot, Ripple and Binance coin BNB. Cryptocurrency markets corrected as the U.S. 10-year Treasury yield rose to its highest level since 2008. U.S. stock markets rallied after the Wall Street Journal reported that some Federal Reserve officials were concerned about the pace of rate hikes and the risk of overtightening, although this type of rallies often are bad for risky assets.

Market leaders Bitcoin and Ethereum are currently trading in a consolidation phase, with the latter managing to regain some lost ground. Meanwhile, Bitcoin climbed to the $19,100 level, but a minor pullback was seen over the weekend after a short-lived selloff. Ethereum also hit a weekly high of $1,340, but has pulled back to $1,304.11, where it is currently trading.

Looking at the cryptocurrency price heatmap, most altcoins are trading in the green, and today’s worst performers are Chiliz and eCash XEC, which have fallen by 12.17% and 6.23% respectively. Ripple and Stellar are the week’s top winners among altcoins, increasing by over 6%. At the end of the week, there is a sharp pullback to the downside across the market, resulting in a significant pullback in the medium term, after which we will likely see markets push lower over the following weeks if prices do not recover.

Weekly Crypto Price Analysis: Bullish trend cutting across the crypto market, will it last in the coming week?

Looking at our weekly crypto price analysis, most of the cryptocurrencies are trading around near support levels and near resistance levels. A breakout in any direction is likely since most cryptocurrencies have not made significant price changes to set a clear market trend. The majority of cryptocurrencies are expected to continue following their respective price trends in the near future. However, some correction cannot be ruled out as the market is heavily overbought at the moment and prices may witness a minor decline in the near term.

In the coming week, most cryptocurrencies are likely to continue with the bullish sentiment if market sentiment remains favorable.

BTC/USD

BTC/USD fell sharply below $19,000 after reaching the weekly high and has hovered around the $18,900 to 19,100 level in recent days. The current market structure is neutral and a further decline towards $18,800 cannot be ruled out in the short term.

Bitcoin’s relief rally faces strong resistance in the zone between the 50-day simple moving average (SMA) ($20,019) and the downtrend line. This shows that bears are selling on the rally and will try to pull the price to $18,626.

The repeated retesting of a support level tends to weaken it. If bears drop below the strong $18,850 support, the BTC/USDT pair may experience panic selling. That could open the door to a possible retest of the June low at $17,622.

If the price falls and stays below $18,843, the BTC/USDT pair could fall to $18,125. The bulls are expected to strongly defend the zone between $18,125 and $17,622, because if they fail to do so, the pair could resume its downtrend. The next stop on the downside could be $15,750.

BTC/USD entered a bullish sentiment during yesterday’s market close and the bulls have held above $19,187.88 in the last 4 hours. To invalidate this bearish view, the bulls will need to push and sustain the price above the downtrend line. If that happens, the bullish momentum could pick up and the pair could rise to $22,799. The Bears can pose a strong challenge at this level.

The long tail of the October 22 candlestick shows that buyers bought the dip below $18,843. They will try to drive the price above the moving averages. A break above the 50-day SMA ($19,616) could clear the way for a possible rally to $20,500. This is an important level to watch because a break above it could signal the start of a strong recovery to $22,800 and then $25,211.

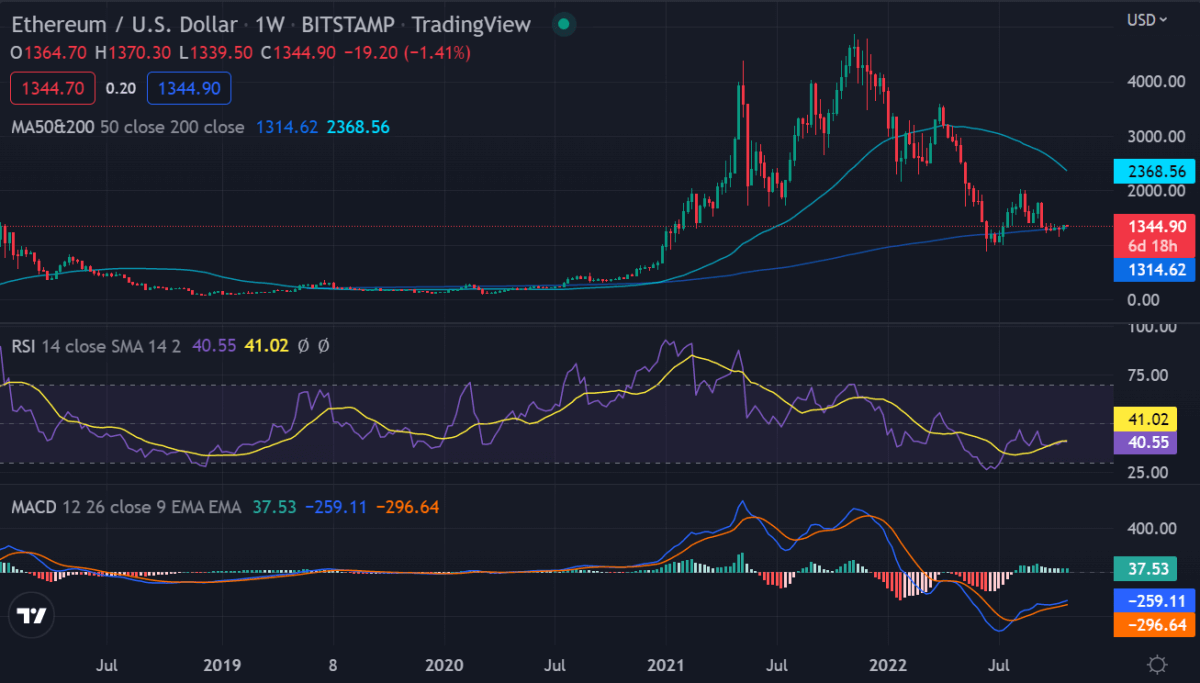

ETH/USD

Ethereum climbed above $1,335 on 10/18/2022 and the bulls have been able to hold above $1,309.96 in the last 24 hours. Ethereum is struggling to rise above the 20-day EMA ($1,313), but a minor positive is that the bulls have not allowed the price to stay below the immediate support at $1,263.

If the price swings up from today’s level and breaks above the 20-day EMA, the ETH/USDT pair may rally to the downtrend line of the descending channel. Buyers need to push the price above this resistance to indicate the start of another up move.

On the contrary, if the price continues lower and breaks below the support zone $1220 to $1190, selling may intensify and the pair may fall to the psychological level of $1000 and then to the support line of the channel.

ETH is up 0.73 percent after a small bear-bull battle. The bulls have struggled to push prices above the key resistance level at $1,317.10.

XRP/USD

Our weekly ripple crypto price analysis indicates a slight pullback from the recent price decline of around $. Swing lows that formed saw XRP fall to weekly lows around $0.466, which currently serves as the key support level for the current price. Ripple is currently trading at $0.4587 after retracement from recent lows. Ripple plunged below the developing symmetrical triangle pattern on October 20, but the long tail on the candlestick shows that the bulls are buying the dips to the 50-day SMA ($0.43). Buyers again defended the 50-day SMA on October 21.

The 20-day EMA ($0.46) has started to decline and the RSI has slipped into negative territory, indicating that the bears have a slight edge. If the price breaks down from the current or 20-day EMA level, the bears will try to pull the XRP/USDT pair to the $0.41 breakout level. This level is likely to attract strong buying.

On the upside, a break and close above the 20-day EMA would be the first indication of strength. The pair may then rise to $0.51 and later to the resistance line. A break and close above the triangle could improve the prospects for a resumption of the uptrend.

Currently, the bulls are defending the key support area at $0.50 and they are likely to make another attempt to push prices above the $0.455 resistance area. If they succeed, there could be a sharp increase in buying pressure and prices could even regain the $0.5500 level. The main support is now near the $0.440 level, below which Ripple’s price could extend losses towards the recent low of $0.4013.

ADA/USD

According to our weekly crypto price analysis, Cardano followed a downtrend line before the bulls came in on 10/21/2022 to push prices to the current $0.3493. After a two-day relief rally, selling resumed on October 18, and bears pulled the price to the support line of the wedge.

The last few days’ heavy selling has caused the RSI to fall deep into oversold territory. This suggests that the selling may have been overdone in the short term and that a relief rally or consolidation may be around the corner.

If the price retraces from the support line, the ADA/USDT pair will try to rise to $0.36 and then to the 20-day EMA ($0.38). A break above this level will be the first indication that the bears may be losing their grip.

On the downside, if the price breaks below the support line, the sell-off could pick up further and the pair could plunge to $0.30.

The price has again fallen below the uptrend line on 30 September. The downward moving averages and RSI in the negative territory suggest that the path of least resistance is going down. If the price breaks below $0.42, the ADA/USDT pair may decline to the crucial support at $0.40. The bulls are expected to defend this level vigorously.

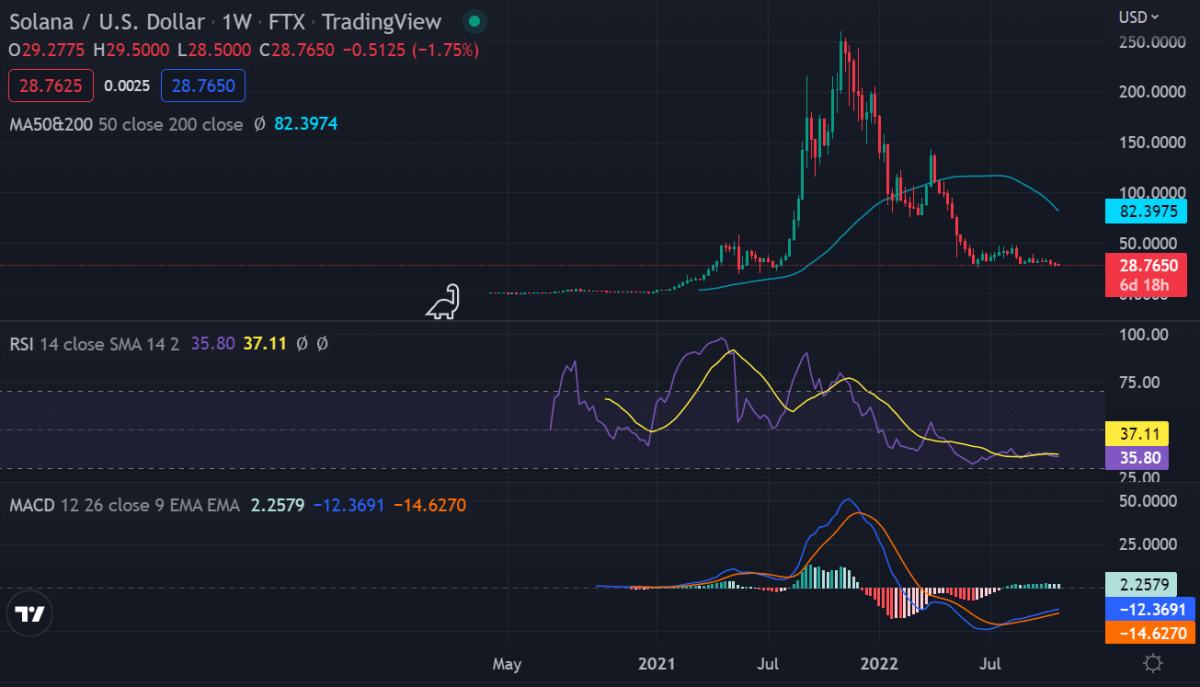

SOL/USD

Our weekly crypto price analysis indicates that the Solana cryptocurrency has performed well over the past week, moving from a low of around $27.73 to a recent high of around 28.48. Solana fell below the $29.42 support on October 19, indicating increased selling pressure from the bears. The sell-off continued and the $27.87 support was taken out on October 21. This opens the way for a retest of the crucial $26 support.

The downward moving averages and RSI in the negative territory indicate that the bears are in control. If the SOL/USDT pair does not rebound strongly from $26, the possibility of a break below it increases. The pair can then reject to the next support at $22.

Contrary to this assumption, if the price goes up from the current level or $26 and breaks above $30, it will signal accumulation at lower levels. The bullish momentum may pick up in the near term after the pair breaks above the 50-day SMA ($32.28).

The 20-day EMA ($33.30) is trying to rally, and the RSI is just above the midpoint, suggesting that the bulls are trying to make a comeback. If the price breaks and holds above the 50-day SMA, the bullish momentum could pick up and the SOL/USDT pair could rise to $39. The bears are expected to mount a strong resistance at this level.

Alternatively, if the price breaks down from the 50-day SMA, the pair could fall to $31.65. A break below this support could lower the pair to $30.

Weekly Crypto Price Analysis Conclusion

Overall, our weekly crypto price analysis indicates that we will see consolidation in the week before an uptrend is set for the week. As several higher highs and lows have been established across the major altcoins, crypto price action remains bearish.