Washington is playing tennis with crypto

Join the most important conversation in crypto and web3! Secure your place today

This week, Glenn Williams Jr. investigates. what politicians are saying about crypto regulation in Washington, DC

Next, Jodie Gunzberg, CEO of CoinDesk Indices, talks about the crypto sectors that continue to thrive despite the regulatory crackdown.

– Nick Baker

You read Crypto long and shortour weekly newsletter with insights, news and analysis for the professional investor. sign up here to get it in your inbox every Wednesday.

A descent into digital asset partisanship will benefit no one

I took the time last week to tune into the Senate hearing on cryptocurrencies titled “Crypto Crash: Why Financial System Safeguards are Needed for Digital Assets.” Co-chaired by Democrat Sherrod Brown and Republican Tim Scott, it focused on the need for increased regulation in the digital asset space, punctuated by recent industry collapses.

Sometimes I question the importance of monitoring these events. It’s getting to the point where if you’ve heard one, you’ve heard them all. One concern, however, is whether the regulation of digital assets is drifting more and more into partisan political waters, which I think is negative for everyone involved.

If the discussion around cryptocurrencies devolves into a scenario where one’s attitude can be predicted precisely by which side of the aisle they sit on, it will have sunk to the level of simplistic discourse; a new technology like crypto deserves better than that. For that reason, I often find political discussions around crypto to be more akin to political theater.

But if you’re going to operate within a sector, it makes sense to have an idea of which way the regulatory winds are blowing. It certainly makes sense to challenge your own ideas with those that may be contrary to your own. I would encourage everyone to watch it, even at 1.25x speed – which I may or may not have done.

Chairman Brown’s testimony seemed to take aim at cryptocurrencies in general. The overarching theme from my perspective is that the sector itself is not only vulnerable to fraud, but itself emblematic of it. My guess is that if I sat down with him and discussed cryptocurrencies, it would be largely about its use in criminal activity and “the greater fool theory” – the idea that the only value crypto has to its owner is to be able sell it to a bigger fool in the future at a higher price. However, it is worth noting that his testimony concluded with a list of existing financial regulatory methods. Examining where crypto fits into an already existing framework involves at least seeing a place for it.

Ranking Member Scott’s testimony appeared to center around the failure of current regulators, with Securities and Exchange Commission Chairman Gary Gensler specifically singled out. An acknowledgment that financial innovation is an engine for growth was stated, together with an emphasis on the need for existing regulation to be implemented in a timely and appropriate manner. My guess is that if I sat down with him and discussed cryptocurrencies, he would ask me if I knew where Gary Gensler was.

From there, testimony was given by Lee Reiners of the Duke Financial Economics Center, Professor Linda Jeng of the Georgetown Institute of International Economic Law and Professor Yesha Yadav of Vanderbilt University Law School. Each of them gave their views on cryptocurrencies, discussed harnessing innovation, developing a self-regulatory organization (SRO) and outright banning cryptocurrencies. I think some of their proposals deserve consideration, while other proposals seem blatantly hostile to the asset class itself.

For example, a focus on clear disclosures from crypto exchanges makes perfect sense to me. A well-informed investor is inclined to make decisions based on an underlying idea they believe to be true. It doesn’t guarantee that the idea is right, but at least it’s rooted in something.

The ban on the mixing of funds also makes sense. I cannot think of a good reason why customer funds and fixed assets should not be separated. This has been the case for years in traditional finance, and with good reason.

The creation of self-regulatory organizations (SROs) in crypto rang as a viable option to explore as well. What also stood out is that it was presented as a practical (but not perfect) way to improve the current regulations in a short time. SROs exist within traditional finance, so there is already a plan to implement them.

I take issue with the notion that bitcoin being 14 years old means it is not a “new” asset class. While bitcoin’s genesis block was mined in 2009, a significant amount of trading activity has occurred over the past three to four years.

Also, it strikes me as incongruous to state bitcoin’s existence since 2009, but only note its performance as an asset since 2021. The fall from $69,000 to $21,000 should certainly be stated. But the price rise from less than 10 cents to $21,000 since 2009 should also be mentioned if the measure is to be balanced.

However, what was most encouraging about the testimony is that, agree or disagree, I cannot automatically determine your political affiliation based on your recommendations. However, I don’t know if I can say the same to those who ask the questions.

It’s a tact that’s starting to present itself in these hearings that mirrors a tennis match — one where politicians switch back and forth between pro-crypto and anti-crypto statements, directing most of their questions to the witness they agree with the most the particular position of their political party.

I sincerely hope this does not become the norm. Extreme partisanship would be harmful to all parties involved, because it would likely remove the nuance necessary to allow technical innovation while protecting individual investors from bad actors.

Ultimately, investor protection, financial inclusion and innovation are all necessary elements for healthy growth within the digital asset space. As members of the United States Congress work to achieve these goals, I hope they see them more as individuals than as members of a political party.

– Glenn C. Williams Jr., CMT

Bitcoin, DeFi and computing are thriving amid crypto

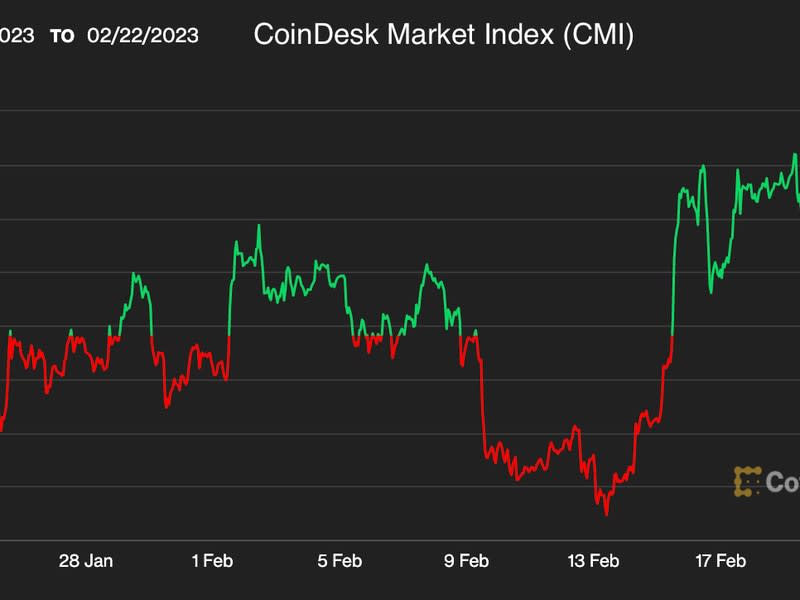

After bitcoin’s (BTC) best January since 2015, it has retreated as the US Securities and Exchange Commission cracks down on crypto, and inflation was slightly hotter than expected. Despite these challenges, crypto continues to dramatically outperform traditional asset classes.

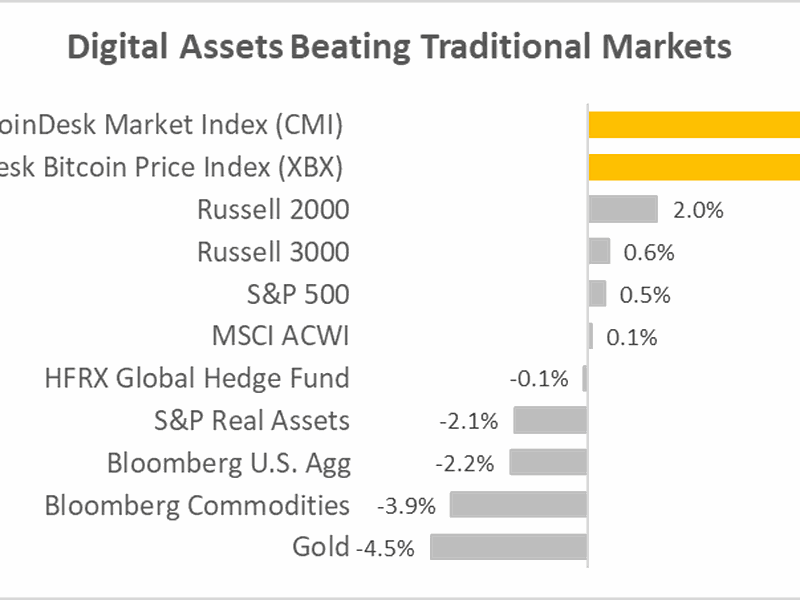

The CoinDesk Market Index (CMI), the broad measure of crypto returns, rose 6.5% in February through February 16. Stocks haven’t done nearly as well, with the S&P 500 up just 0.5%. The Bloomberg US Aggregate Bond Index fell 2.2%, while the Bloomberg Commodity Index lost 3.9%.

A key reason crypto is doing so well: Bitcoin is broken because the Ordinals protocol essentially brings non-fungible tokens (NFTs) to that blockchain. “This has demonstrated a new, valuable use case for the longest-running cryptocurrency chain,” CoinDesk chief content officer Michael J. Casey wrote recently.

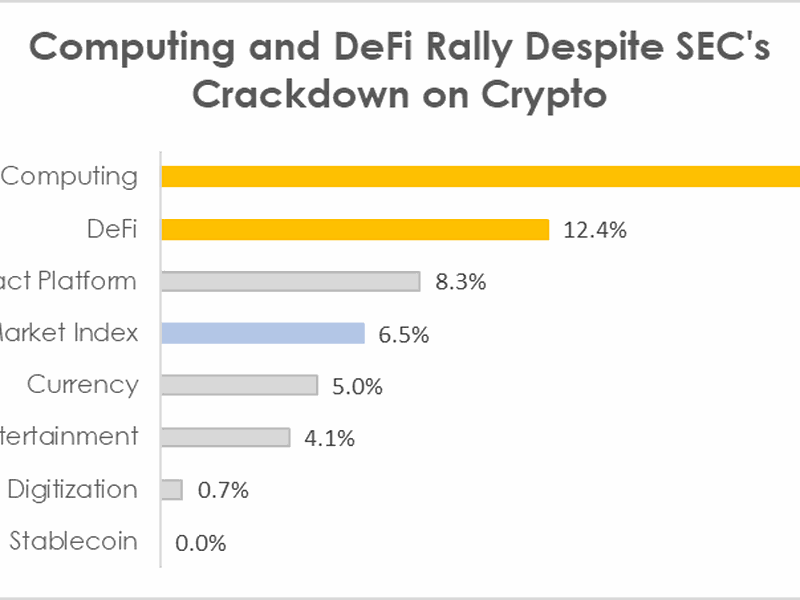

The big gain in the CoinDesk Bitcoin Price Index (XBX) shows the enthusiasm. But many other digital assets performed even better. There are 158 total digital assets in the CMI, and 109 of them outperformed bitcoin. These outperforming assets were concentrated in the CoinDesk Digital Asset Classification Standards (DACS) DeFi and computing sectors.

Although they make up only 2% and 1.4% of CMI’s weight respectively, they stand out. So far this month, Computing is up 23.5%, giving it a 91.5% gain so far this year. DeFi is up 12.4% in February and almost 66% in 2023. Computing has been driven by excitement over artificial intelligence (AI), with ChatGPT and Bing dominating the conversation. DeFi is the sector many are looking to for greater security and infrastructure.

Although Computing and DeFi are relatively small by market cap, there are many constituents in each sector: Computing has 23 assets and DeFi has 39. So opportunities for big gains (alpha, for you pros) are plentiful.

However, bitcoin remains in high demand as the most established, largest, most liquid asset with the longest track record and the deepest derivatives market. So, to mix bitcoin with some of these potentially high performers, some market participants prefer the CoinDesk Large Cap Select Index (DLCS), which is similar in concept to other market cap-weighted flagship indices to measure various asset classes.

Still, the digital asset market is in its early days, so concentration is currently high with five assets (which are in two sectors) accounting for 70% of the index’s market capitalization. Therefore, some prefer a broader sector exposure through the CoinDesk Market Select Index (CMIS) which spans five sectors with at least five market cap-weighted assets from each sector.

– Jodie Gunzberg, CFACEO of CoinDesk Indices

Takeaways

From CoinDesk’s Nick Baker, here’s some recent news worth reading:

-

MT. GOX: Once upon a time, in the early days of crypto, there was an exchange called Mt. Gox (which stood for Magic: The Gathering Online eXchange, just to get you into the mood). The business collapsed spectacularly due to a 2014 hack. The subsequent bankruptcy process has dragged on and on, but there was important news last week that may signal the end is in sight: The two biggest creditors chose the repayment option that could allay fears that the restructuring will take out the price of bitcoin (BTC).

-

CANADIAN CRACKDOWN: Canada is close to increasing its requirements for crypto exchanges, putting it ahead of the pack in terms of concrete action in the wake of FTX’s collapse. Of course, it won’t be the last to do something.

-

SHANGHAI VOLATILITY: The Ethereum merger didn’t stir up ETH prices much back in September. But there is reason to believe that Shanghai, the Ethereum upgrade that makes ETH unstakeable, could generate volatility.

-

JUMP CRYPTO: Last week, the Securities and Exchange Commission did not identify the company that made more than $1 billion from the terraUSD/luna ecosystem before it collapsed. (The unnamed company was not accused of wrongdoing.) But sources told CoinDesk it is Jump Crypto, which declined to comment.

-

BRAG: CoinDesk journalists won one of the biggest prizes in journalism, a George Polk Award, for the scoop that led to FTX’s collapse and two explosive follow-ups.

To hear more analysis, click here or here for CoinDesk’s “Markets Daily Crypto Roundup” podcast.