Warren Buffett Has Exposure To Bitcoin And So Should You (BTC-USD)

Paul Morigi

Summary of the assignment

While Warren Buffett has openly criticized Bitcoin (BTC-USD), he has actually built significant exposure to the asset through his stake in a Brazilian “cryptobank”. This has become increasingly relevant now that Brazil has actually legalized it cryptocurrency as a payment method.

Banking on crypto

From February this year, it is known that Warren Buffett invested 1 billion dollars in Nubank (NU), which was labeled as a crypto-friendly bank. After recent events, calling Nubank crypto-friendly might be an understatement.

First, in May, Nubank announced that it would offer Bitcoin to its customers and that it would also commit 1% of its portfolio to Bitcoin. That means Warren Buffett is exposed to Bitcoin, albeit indirectly. Interestingly, Buffett initiated a position in Nubank just as he was exiting positions in traditional financial stocks such as Visa, Inc. (V) and Mastercard Corporation (MA)

But there is more. In early November, NU introduced Nucoin, its own digital currency. Currently, Nucoin is being developed with the help of 2,000 customers, with the intention of officially launching by 2023. Initially, Nucoin will be a way for customers to receive rewards, but it will also act like any other cryptocurrency.

Nubank is clearly committed to the idea of crypto, and this is something an investor like Buffett must have been aware of at the time of investment. But is that all he knew?

Yesterday, Brazil, the country where Nubank is based, passed a law making cryptocurrencies a legal method of payment. This was approved by the Chamber of Deputies in Brazil, but still requires the signature of the president. It is important to understand that this does not mean that crypto is legal tender, as in El Salvador, but it is a step in that direction.

Whether by luck or, more likely, foresight, Buffett has a significant interest in an up-and-coming fintech with crypto exposure located in a country of 214 million people that just legalized crypto.

Do as I say, not as I do

Warren Buffett and Charlie Munger have made a name for themselves as value investors guided by fundamentals and cash flow. This is the foundation of their publicly traded company Berkshire Hathaway (BRK.A) (BRK.B).

It is difficult to justify Bitcoin as a value investment, and this is something Buffett himself has talked about:

“Whether it goes up or down in the next year, or five or 10 years, I don’t know. But the one thing I’m pretty sure of is that it’s not producing anything,” Buffett said. “It has a magic about it, and people have attached magic to a lot of things.”

Source: Warren Buffett

However, Buffett must see some potential in at least some new financial technologies since he sold “traditional” financial companies in favor of Nubank.

This is also not the first time Buffett has invested in Brazilian fintech. In 2018, he bought 14 million shares, 8% of StoneCo Ltd.’s (STNE) IPO. This is a company that offers similar services to Square (SQ).

While Munger has also positioned himself as an anti-cryptocurrency critic, he didn’t speak well of fiat currencies in this interview with Yahoo Finance.

“The safe assumption for an investor is that in the next hundred years the (fiat) currency will go to zero.”

If fiat is also not to be trusted, then what is the solution?

Buy when there is blood on the streets

There is definitely wisdom in Buffett’s words, and I am particularly fond of this quote.

“I’ll tell you how to get rich. Close the doors. Be afraid when others are greedy. Be greedy when others are afraid.”

Source: Warren Buffett

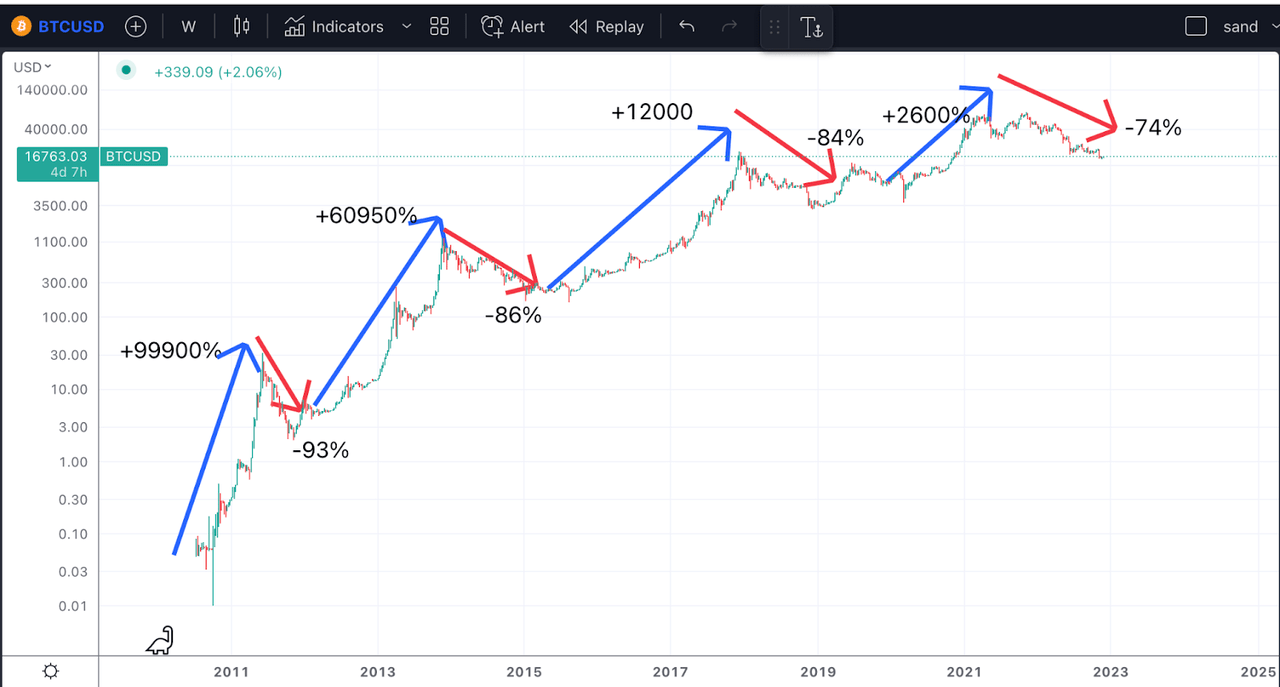

The best time to buy stocks is when everyone is too scared to do so. Great panic leads to generational buying opportunities, and this can also be applied to Bitcoin. In the 13 years since its inception, Bitcoin has given investors plenty of reasons to panic, but so far has never failed to recover.

BTC chart (Author’s work)

Bitcoin has suffered through three episodes of +80% moves and that is where we sit now, about 74% below the recent peak. The next rally could be very close, and if history is any indication, we should easily be looking at triple digit returns.

Final thoughts

Bitcoin has died many times before and this time is no different in my opinion. All in all, today’s prices offer a great opportunity to buy. Of course, there are always other things to consider, which is why I provide regular analysis on Bitcoin and the crypto markets for my subscribers. With the right approach, you can enjoy the huge gains of Bitcoin while limiting your risk exposure.